If there’s one thing the major banks wish would go away, it’s talk about their fixed-rate mortgage penalties. Competitors constantly use accounts of huge bank penalties to sell against the banks, and the media picks up on it.

If there’s one thing the major banks wish would go away, it’s talk about their fixed-rate mortgage penalties. Competitors constantly use accounts of huge bank penalties to sell against the banks, and the media picks up on it.

Expect more of this as mortgage penalties approach record highs.

In the last few months, we’ve seen non-bank lenders increasingly market their penalty advantage. One of them is Equitable Bank (EQB). “According to OBSI’s (Ombudsman for Banking Services and Investments) 2018 Annual Report, mortgage prepayment penalties continue to be a leading consumer complaint,” the bank said this month.

“Considering most borrowers take a 5-year fixed mortgage and break early, the structural differences in prepayment charge calculations between [non-banks like Equitable Bank] and Big Banks should not be overlooked when making a mortgage financing decision,” says Equitable Bank’s Manager, Residential Lending Strategy and Analytics, Osman Aziz.

Early mortgage termination is more common than most realize. That’s because people’s lives change unexpectedly. In a few years, you could find yourself needing to upgrade your home, refinance to consolidate debt, refinance to take advantage of lower rates, undergo separation, relocation, etc. Any of these things could warrant mortgage breakage.

The Exorbitant Penalty Formula

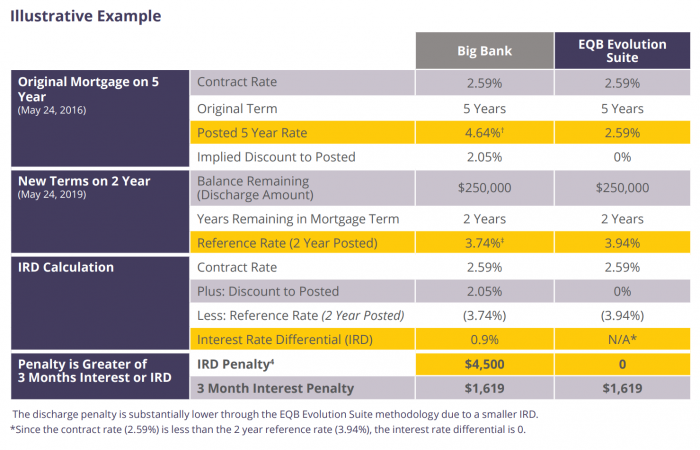

Here’s what a typical big-bank interest rate differential (IRD) penalty looks like:

IRD = ( Contract rate – ( Comparison rate – Discount at Origination ) ) x Balance x Years Remaining on the Term

The problem with big-bank IRD penalties is that “Discount at Origination” part.

It means the bank essentially penalizes you for getting a discount on your mortgage. If the bank’s 5-year posted rate is 4.64% and your actual rate is 2.59%, your discount at origination is 2.05 percentage points.

Here’s a quick look at how that discount can bite a hypothetical borrower:

The takeaway: The very same borrower with the very same term could pay almost three times more to get out of his/her mortgage at a Big 6 bank. Or worse.

And it’s going to be worse. That’s because major banks are keeping their 5-year posted rates purposely inflated, despite plunging market rates. Today, some 5-year posted rates are as high as 5.34%. If your actual rate is 2.59%, your discount at origination is therefore 2.75 percentage points instead of the 2.05 in the example above. That magnifies the penalty another 77% in this example, to $8,000.

Equitable cites one example of a recent borrower with a $250,000 mortgage that was being discharged with three years to go on their 5-year fixed term. The person’s prepayment charge was $10,875, whereas their 3-month interest charge at a lender like Equitable would have been just $1,600.

It’s not just about the cost difference. It’s about realizing mortgage freedom sooner. “…Instead of incurring [an additional] prepayment charge of $9,000 to break the mortgage,” says Equitable Bank’s Osman Aziz, “…if the client utilizes those same funds as a lump-sum prepayment they can shave about one year and two months off their amortization period.”

Are Mortgage Penalties Over-hyped?

Some bankers claim penalties are over-hyped because customers overwhelmingly refinance with their existing bank instead of breaking the mortgage. That helps borrowers avoid a penalty altogether.

Some lenders, like Scotiabank, allow refinances and ports and increases before maturity with zero penalty whatsoever. The bank simply adds another portion to your existing mortgage for whatever amount of new money you qualify for.

Other lenders sneakily build the penalty into their new rate when borrowers want to add more money.

Aziz says, “Even if your current prepayment charge is waived for a refinance, if the client breaks their mortgage in the future by selling their property or refinancing/switching to another lender they still have the same disadvantageous prepayment charge structure. Waiving prepayment charges for refinancing with the current lender doesn’t eliminate the costs the client can experience down the road.”

That’s not to mention the fact that your existing bank likely won’t have the lowest rates and best terms. A penalty beyond three months’ interest could make it uneconomical to switch lenders and take advantage of lower costs elsewhere.

What Can You Do About It?

Three things:

1) Avoid ugly penalties in the first place. Is it worth saving 10 basis points (0.10 percentage point) on your rate if you incur serious penalty risk?

Consider that 10 bps of rate savings is $1,175 interest savings on a $250,000 mortgage over five years. To see if the rate savings is worth it:

- Guesstimate the additional penalty you’ll incur at the cheaper lender (any mortgage advisor worth their salt can help with this)

- Estimate the probability of breaking your mortgage early (let’s call it 25%, for example)

- Multiply that probability by the additional penalty (0.25 x $8,000)

- Compare that number ($2,000) to the interest savings ($1,175).

2) If appropriate, choose variable rates and shorter fixed terms instead of fixed rates over three years. Massive IRD penalties generally aren’t a concern with those terms.

3) If you have to break a mortgage early, one option is to make a big prepayment first. That money can come from a line of credit, or even a cash advance from your credit card if the borrowing period is short enough. Just be sure to make that prepayment far enough ahead of when your lawyer or closing agent requests a discharge statement from the lender. Some lenders don’t count prepayments made within 30 days of discharge.

It’ll Get Worse

Here’s one thing we can count on. The closer interest rates get to zero, the more expensive mortgage penalties will get.

Why? Because zero (0%) is the lower bound for deposit rates. It’s highly unlikely banks will charge borrowers to park their money in bank accounts.

Therefore, as rates fall the spread between banks’ cost of funds and lending rates shrinks. So does their net interest income.

One way to recapture some of that lost profit is through mortgage penalties. As a bank, you do that by leaving your 5-year posted rates high as contract rates fall, widening the spread (IRD) between the two. That’s exactly what we’re seeing today.

Given the wide interest rate differentials we’re seeing, it’s possible that Canadians could bear record-high mortgage penalties in years to come. In turn, the number of irate, financially-harmed mortgage breakers may soar. Don’t be one of them.

log in

log in

Some bankers claim penalties are over-hyped because customers overwhelmingly refinance with their existing bank instead of breaking the mortgage. That helps borrowers avoid a penalty altogether.

Some bankers claim penalties are over-hyped because customers overwhelmingly refinance with their existing bank instead of breaking the mortgage. That helps borrowers avoid a penalty altogether. Three things:

Three things:

7 Comments

Well written article and it’s articles like these that need to get more attention to have any chance for change.

The Big 6 banks sorta act like cartel by artificially keeping these posted rates when no one ever pays these rates. Sorta like price fixing. It means nothing if you don’t have to break your mortgage.

It’s like when Sears and The Bay got busted years ago from the competition bureau over flimsy mattress pricing. Both would continuously market sleepsets with significant discounts when it never would sell a mattress at regular price. While the leap from mattresses to mortgage penalties are two different things, the parallels are similar, but have huge benefit to the Bank if when a client breaks the mortgage. The Banks have zero intention of ever charging their posted rate, therefore, the posted rate is all about a penalty calculation. OSFI should be monitoring this.

It’s very interesting that all the Banks posted rates are still above 5% when bond yields have been averaging 1.20% over the last 30 days.

OSFI won’t do anything. They cradle banks because they’re so afraid of bank instability. Regulators jobs depend on strong banks so they sacrifice the greater consumer good to ensure banks make more money. In my opinion it’s almost a corrupt system. Hopefully Andrew Scheer has enough gumption to do something about it when he wins this October.

Hi Joe,

You do realize that Andrew Sheer is a former Insurance Salesman and is owned outright by the Milk Marketing Board. He has a BA in history, and no work experience.

He will not do anything to help you or curtail the banks.

It will take competition and sites like ratespy.com to make a difference.

This election really is a choice of OMG they are all terrible.

I must be missing something: there is tons of competition, so the real question is, why do consumers continue to prefer to take out mortgages with the big banks given that their products appear to be less desirable and may have features that are punitive for the borrower. nobody is forcing new homeowners to take a loan with a bank vs a non bank.

“why do consumers continue to prefer to take out mortgages with the big banks”

Financial illiteracy?

Bank branding/brainwashing?

Convenience?

Equitable bank has the exact same IRD calculations as other banks. Look at your mortgage documents and learn what it will cost to break a mortgage.

@Mortgage

You don’t know what you’re talking about if you’re talking about Equitable’s “A” mortgages. It doesn’t incorporate a made up discount from posted rates in its prepayment charge calculations. Re-read the comparison above and inform yourself before posting.