—The Mortgage Report: Nov. 23—

- Bond yields stopped falling three months ago but that hasn’t stopped Tangerine from launching one sweet 10-year special.

- If you:

- think the economy will turn around in 2021, and

- think rates are near a medium-term (or longer) bottom, and

- want maximum protection from future rate increase, then

Tangerine’s new 10-year fixed rate might just check your boxes.

- It’s far and away the lowest 10-year fixed rate that Canada has ever seen — a full 19 basis points below the prior all-time low 10-year fixed rate and 60 bps under the next closest nationally advertised 10-year. There is simply no cheaper long-term rate protection available at this point in time.

- As most mortgage advisors will tell you, 10-year terms have historically performed poorly. But that’s not exactly telling. Much of the reason they’ve cost more is because rates have been downtrending for almost four decades.

- Mathematically, the breakeven between a 10-year fixed and two consecutive 5-year fixeds is now just 95 bps.

- In other words, if your rate at renewal following the first 5-year fixed term was more than 95 bps higher, you would have been better off in a 10-year fixed. (That’s assuming you don’t break your mortgage early, which is not the case with most 10-year borrowers.)

- Decade-long mortgages are typically the least flexible products you can get if you have prime credit. That’s specifically true during the first five years of the term. Reason being: the penalties for breaking the contract in the first 60 months of a 10-year term can be brutal, especially at most of Canada’s top-10 lenders.

- But in Tangerine’s case, its mortgages are among the most flexible in the nation with:

- fair penalties

- a long 120-day porting privilege (many lenders allow just 30-60 days…the longer the better)

- large 25% lump-sum prepayments with no silly once-a-year prepayment restriction like some lenders

- no restrictive refinance limitations

- no restrictive bona fide sales clauses

- the ability to increase the mortgage without a penalty

- the ability to early renew any time without penalty

- the ability to add a (non-automatically readvanceable) HELOC

- pre-approvals as the same low rate.

- And, as with all lenders, you can break Tangerine’s 10-year fixed after just five years with only a three-months’ interest charge.

Virtual Closings: Hopefully Here to Stay

- First Canadian Title (FCT), a leader in closing mortgage switches and refinances, is increasingly performing virtual closings in COVID hot spots across Canada, including Toronto. Its goal: to protect borrowers and staff from infection.

- One key benefit: Virtual closings can significantly speed up the closing process versus in-person signings, FCT says. (FCT’s service is typically referred to borrowers by lenders or mortgage brokers. In essence, FCT is an alternative to a traditional lawyer.)

- “Most provincial regulators/law societies have amended guidelines to facilitate a virtual commissioning process and identity verification, but not all have adapted such processes,” says FCT Marketing Head, Phillip Notley.

- He adds: “If provincial regulations do not allow for virtual signings or a lawyer or lender prefers in-person signings, we support those requests through our national network of remote signors, lawyers, notaries and commissioners.”

- We asked the company if virtual signings will stick around post-COVID. Notley answered, “Yes, we will continue to offer virtual signing options both during and following the pandemic. We will continue to work with lenders, brokers, lawyers and notaries to make necessary adjustments to our offering.” That’s welcome news for consumers who want a faster, simpler closing experience.

Many Deferred Mortgages Because They Could

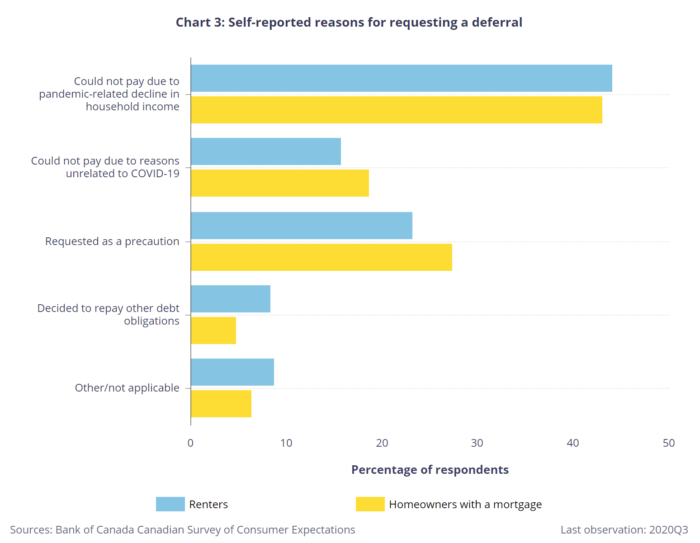

- 1-in-3 mortgagors who requested a mortgage deferral did so not because they couldn’t pay, but because they wanted to delay payments as a precaution or to pay other debts. So finds a new Bank of Canada study.

- That said, as much as officials seem to downplay it, the two-thirds who needed deferrals to avoid insolvency is still a heck of a lot of people—over 600,000 households by our math.

- Despite worries that deferring borrowers would default in high numbers, the Bank says “arrears rates of expired deferrals [0.20%] are below rates that prevailed before the COVID‑19 pandemic [0.50%].” And “over 99%—of households with expired deferrals on any kind of debt have resumed repayment.”

- Although, Bank of Canada Deputy Governor Toni Gravelle cautioned that, “We may not have a full picture of how many homeowners have fallen behind on those payments until the end of the year or early 2021.”

A Precursor to HELOC Defaults

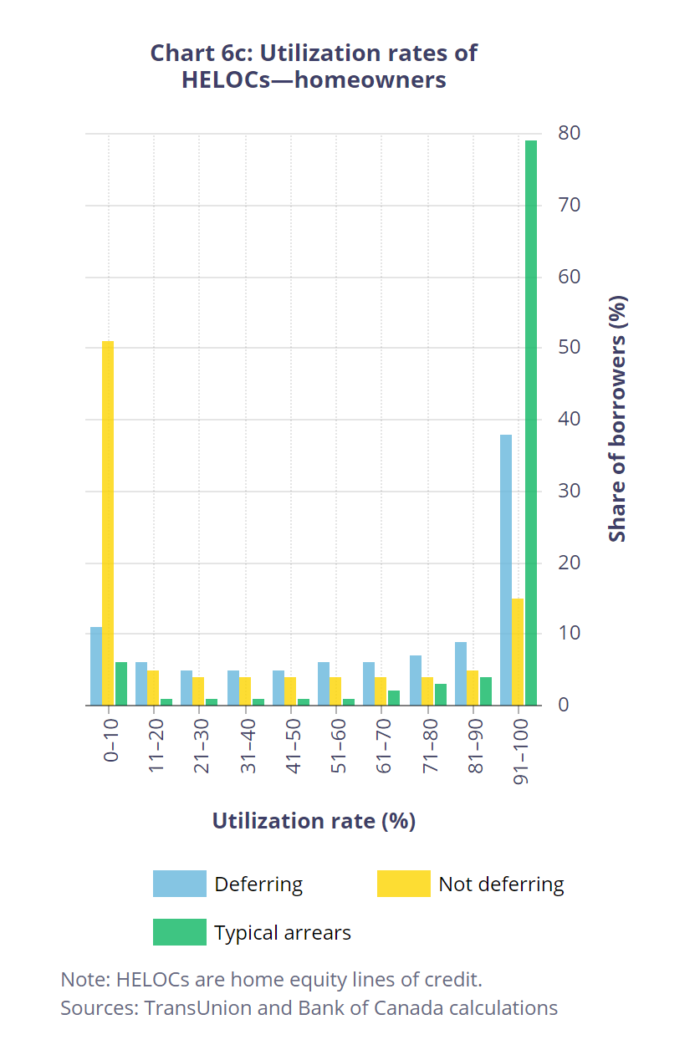

- If there’s one trusty pattern in real estate secured lending, it’s that people run up their balance before they default on a HELOC. Check out this chart below from the Bank of Canada. It shows that 79% of defaulters used all, or almost all, of their HELOC credit limit before they decided to stop paying. Among those who paid as agreed, just 15% used the same degree of HELOC credit.

- It’s no wonder banks often reach out to borrowers whose HELOC debt has been continually growing without any principal payments being made.

Quotables

“We expect to keep interest rates low for quite some time.”

—Toni Gravelle, Deputy Governor, Bank of Canada, Nov. 23, 2020

“While renewed lockdowns could soon dent home sales, we doubt they would lower prices.”

—Stephen Brown, Capital Economics, Nov. 20, 2020

“We expect Congress to pass another stimulus package of $0.5-1.0 trillion in 1Q [2021].”

—Bank of America Securities (This would potentially be bullish for both U.S. and Canadian mortgage rates, other things equal.)

log in

log in

4 Comments

Is it just me or does it always seem like we get these amazing low rates right before rates go up?

Good day Vince !

I think the B of C has its hands tied and rates will have to stay low to encourage spending.

There will most likely be record bankruptcies coming in the new year In both the personal and business spaces.

The Trudeau government is throwing away money in record amounts and taxes will definitely be going up to just pay the interest on that debt.

That will be a huge drag on consumers and business and i believe the unemployment rate will be stubbornly high in this country.

Throw in the Trudeau unrealistic and disastrous environmental policies slapped on Alberta that dispite low oil prices has driven huge amounts of capital out of Alberta and discouraged foreign investment and they have killed the goose that laid the golden egg.

Prople will be lucky to have a job and there will be have to be huge layoffs in government departments and services.

Money and rates are going to be cheap and have to stay down for a long long time.

The B of C sees this.

We are in a lot of trouble and unfortunately there is going to be a lot financial strain on all provinces for the forseeable future.

I suspect Freeland is coming to the “rescue” Monday with an exorbitant spending proposal backed by the socialist NDP. Personally I think it will be enough to lift GDP 4% or more in 2021 and push unemployment down to the 6% range. We may have to pay the piper down the road as Alan says, but that is well down the road. I would be shocked if rates were not higher by the end of next year.

We had a horrible experience with tangerine mortgages and will never do that again. Can hardly wait for renewal so I can switch banks.