Prime Rate Canada: 2.45%

“Prime rate” is the basis for variable mortgage rates in Canada. The official benchmark is calculated by the Bank of Canada. It generally follows changes to the central bank’s overnight target rate.

What is Prime Rate?

Prime rate is a floating rate that lenders use as the foundation for various lending products, like variable mortgage rates, credit cards and HELOCs.

The prime interest rate typically moves up and down with the Bank of Canada’s overnight target rate. For that reason, some people refer to it as “Bank of Canada prime rate.” That is incorrect because the Bank does not directly set prime. Lenders do.

People also refer to it as the “prime mortgage rate.” In Canada, very few lenders have a separate prime rate for mortgages; TD being one notable exception.

It’s important to remember that each lender sets its own prime rate. For that reason, lenders don’t always follow the Bank of Canada’s lead. In fact, there are multiple cases where lenders have not followed the Bank in dropping prime, much to the frustration of borrowers.

What is the Current prime rate?

Prime rate in Canada is presently 2.45%.

It last changed on March 30, 2020 when it decreased by 0.50 percentage points.

Canada’s benchmark prime rate is based on the “Big 6” banks’ prime rates, including:

| RBC Prime Rate: | 2.45% |

| TD Prime Rate: | 2.45%* |

| Scotiabank Prime Rate: | 2.45% |

| BMO Prime Rate: | 2.45% |

| CIBC Prime Rate: | 2.45% |

| National Bank Prime Rate: | 2.45% |

* Note: TD Mortgage Prime Rate is 2.60%. The bank has separate prime rates for mortgage and non-mortgage lending.

How is Prime Rate Set?

Canada’s benchmark for prime rate is published by the Bank of Canada each week. It’s calculated as a mode average of the Big 6 banks’ official prime rates.

RBC prime rate and TD prime rate are the most referenced prime rates in Canada.

What Causes Prime Rate to Rise and Fall?

Prime rate generally follows the overnight rate.

The Bank of Canada typically hikes the overnight rate (which causes prime rate to increase) when it is worried that inflation could exceed its 3% upper limit.

The Bank of Canada typically cuts the overnight rate (which causes prime rate to fall) when it is worried that inflation could undershoot its 1% floor.

Prime Rate History

The following table shows a history of Canadian prime rate changes dating back to the start of the millennium.

| March 2020 | 2.45 |

| March 2020 | 2.95 |

| March 2020 | 3.45 |

| October 2018 | 3.95 |

| July 2018 | 3.70 |

| January 2018 | 3.45 |

| September 2017 | 3.20 |

| July 2017 | 2.95 |

| July 2015 | 2.70 |

| January 2015 | 2.85 |

| September 2010 | 3.00 |

| July 2010 | 2.75 |

| June 2010 | 2.50 |

| April 2009 | 2.25 |

| March 2009 | 2.50 |

| January 2009 | 3.00 |

| December 2008 | 3.50 |

| October 2008 | 4.00 |

| October 2008 | 4.50 |

| April 2008 | 4.75 |

| March 2008 | 5.25 |

| January 2008 | 5.75 |

| December 2007 | 6.00 |

| July 2007 | 6.25 |

| May 2006 | 6.00 |

| April 2006 | 5.75 |

| March 2006 | 5.50 |

| January 2006 | 5.25 |

| December 2005 | 5.00 |

| October 2005 | 4.75 |

| September 2005 | 4.50 |

| October 2004 | 4.25 |

| September 2004 | 4.00 |

| April 2004 | 3.75 |

| March 2004 | 4.00 |

| January 2004 | 4.25 |

| September 2003 | 4.50 |

| July 2003 | 4.75 |

| April 2003 | 5.00 |

| March 2003 | 4.75 |

| July 2002 | 4.50 |

| June 2002 | 4.25 |

| April 2002 | 4.00 |

| January 2002 | 3.75 |

| November 2001 | 4.00 |

| October 2001 | 4.50 |

| September 2001 | 5.25 |

| August 2001 | 5.75 |

| July 2001 | 6.00 |

| May 2001 | 6.25 |

| April 2001 | 6.50 |

| March 2001 | 6.75 |

| January 2001 | 7.25 |

| May 2000 | 7.50 |

| March 2000 | 7.00 |

| February 2000 | 6.75 |

| November 1999 | 6.50 |

Prime Rate History

All-time high: 22.75% (Aug. 1981)

All-time low: 2.25% (Apr. 2009)

Longest period of no change: 4.33 years (Sep. 2010 to Jan. 2015)

Since the Bank of Canada started inflation targeting in 1991, the average Bank of Canada rate hike cycle has lasted 2.29 percentage points (as measured from the trough to the peak, as of September 2018).

Canada Prime Rate Forecast 2021

As of September 7, 2021, economists’ median average forecasts for prime rate are:

- 2.45% by year-end 2021

- 2.83% by year-end 2022

* These estimates are based on RateSpy’s projected spread between prime rate and future overnight rates. Overnight rate forecasts reflect the consensus of major economists, as tracked regularly by Bloomberg. Forecasts are subject to change.

In the long-run, the Bank of Canada projects a normal (a.k.a. “neutral”) overnight rate of roughly 2.75%. That implies a long-run prime rate of 4.95%. But keep in mind that BoC rate forecasts are notorious for being too high.

Overnight Index Swap (OIS) Implied Forecast

The most commonly cited market forecast for Canada’s prime rate is derived from overnight index swaps (OIS).

OIS are derivatives that traders use to bet on the direction of Canada’s overnight target rate.

Note: OIS prices are highly volatile, are subject to change and should not be relied on for mortgage decisions.

How Does Prime Rate Affect Variable Mortgage Rates?

Closed variable rates are typically priced at a discount to prime rate. For example: prime – 0.50%.

Open variable rates are generally sold at a premium to prime rate. Example: prime + 0.75%.

HELOC rates are also generally priced at a premium to prime rate. Example: prime + 0.50%.

When Will Prime Rate Change Next?

Prime almost always changes right after Bank of Canada rate announcements. The Bank meets eight times a year. Most of the time, the Bank does not change rates at its rate meetings.

The next Bank of Canada rate meeting is October 27, 2021.

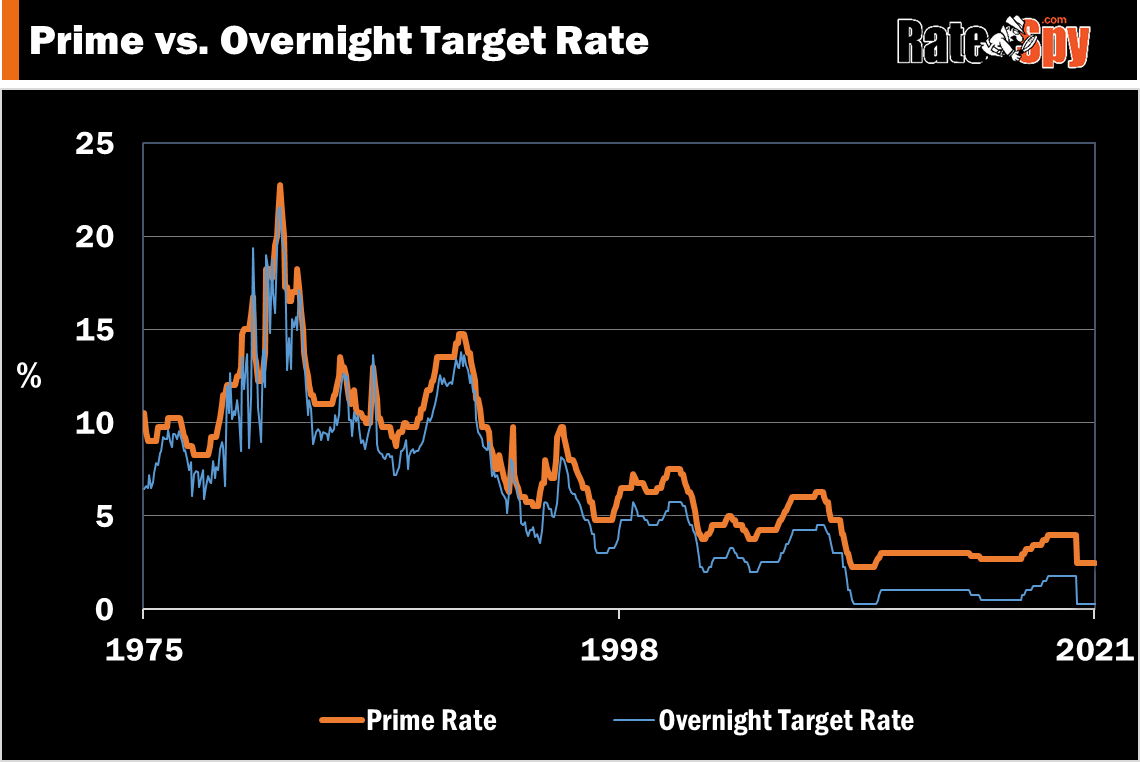

Canadian Prime Rate Chart

Below is a graph of Canada’s prime rate since the mid-1970s. It typically follows the Bank of Canada’s overnight rate but there have been notable exceptions, most recently in 2015 when Canadian banks refused to pass through 20 bps of BoC rate cuts to borrowers.

log in

log in