Millions of Canadians have “won” the Canadian housing lottery in the last year.

Of the three quarters of homeowners who have owned for more than five years, they’ve amassed over $175,000 of equity, on average.

Many, including those most able to spend their equity, have accumulated far more thanks to incessantly rising home values.

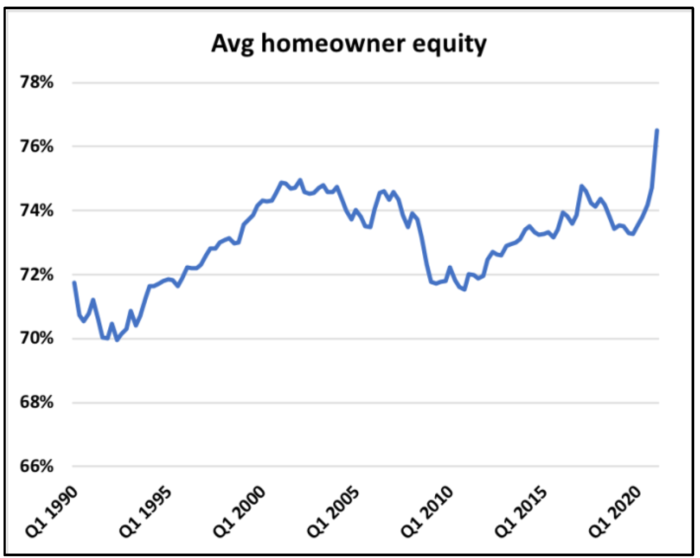

“Canadians have never had this much equity in their homes,” reports Ben Rabidoux from Edge Realty Analytics.

That equity is not just a theoretical number. Equity is real and it can be spent. And Canadians will spend a good chunk of it if history is a guide. That spending should, in turn, fuel inflation to some degree, which (other things equal) is supportive of higher interest rates.

That herein begs the question…

How much equity will people spend?

When home values soar, so does people’s spending. And, as noted, that “wealth effect” can be inflationary to both price levels and mortgage rates.

Using Mortgage Professionals Canada data as a guide, for every $1,000 in principal residence value in Canada (i.e., not including second homes, rental properties, etc.), we estimate that average equity has risen to approximately $736.

Over 9 million out of 10 million homeowner households now have over 25% equity. And, despite more people being “up to their eyeballs” in debt, this equity cushion is a “very good thing for household financial stability overall,” says Rabidoux.

Total homeowner equity is now estimated at over $4.78 trillion, with a “T,” up $560 billion in just the last six months alone. If those massive numbers mean little to you without context, consider that total consumer spending is just $1.2 trillion, according to IBISWorld.

Canada’s home equity windfall is having meaningful wealth effects. In fact, we estimate that equity take-outs could potentially break $100 billion for the first time ever in 2021. That compares to $74.5 billion last year and $89 billion during the housing peak in 2017.

Long story short, it’s plausible that equity-driven spending growth could tack on up to 1.4 percentage points to GDP in the next year. And that’s just from equity gains of primary residences.

If Delta COVID doesn’t derail the economy again and home values don’t plummet, it’s possible the Bank of Canada’s 6% GDP growth estimate for 2021 could be shy. And other things equal, that could add some bullishness for mortgage rates in the next five months.

log in

log in