If we only had a milli-bitcoin for every time someone said this:

“…Long-term data tells us that a variable-rate mortgage is the best option.”—LowestRates.ca

No, it doesn’t.

What the “data” tell us is that a variable-rate mortgage was the best option in a specified timeframe based on particular assumptions.

The data in no way mean that a variable-rate mortgage is the best option for you.

In the investment world, “Past Performance is Not Indicative of Future Results” is a legally required disclaimer. Damn shame that all mortgage advisors aren’t bound to this same disclosure requirement.

Bankers and brokers have overplayed the historical outperformance of variable rates since Moshe Milevsky first published his milestone 2001 report, Mortgage Financing: Floating Your Way to Prosperity. Far too many advisors use this study to confidently claim that variables cost less 9 times out of 10.

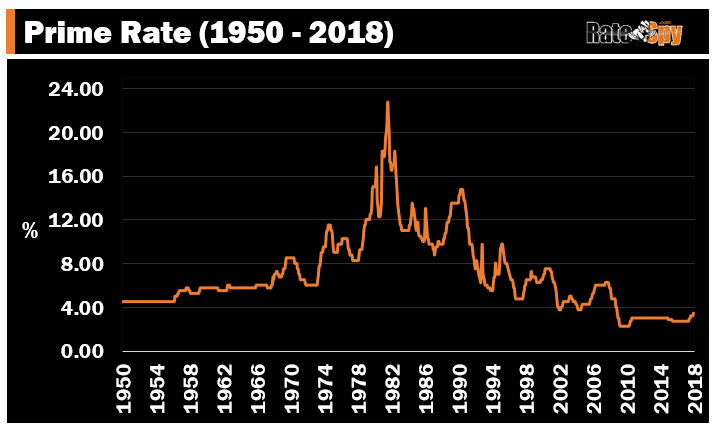

Indeed, the study did show that variable rates beat 5-year fixed rates 70-90% of the time, using data from 1950 to 2000. Yet, as someone who knows the study’s author well (and deems him one of the most gifted financial minds in this country), I can tell you one thing: Milevsky would be the first to tell you his research doesn’t imply that variables will win in the next five years, or in any given five-year period. As he wrote in 2001, “the future is random.”

Milevsky’s simulations (which are more telling than his historical backtest) found that floating rates might win roughly 65% of the time. Among other things, these findings led him to conclude, “When interest rates are at (temporarily) low levels, one is much better off locking in at long-term rates.”

Well, Canada is still at low levels today.

(Whether they’re “temporarily” low is another question.)

What history has proven beyond a shadow of a doubt is that predicting rate direction is a waste of time. The very futility of such exercise is exactly why lenders charge more for fixed rates. Financial markets charge a premium for predictability. Fixed-rate mortgages must therefore be funded from more expensive (higher yielding) sources.

Mind the Fine Print

Backtested mortgage performance depends heavily on the fine print (assumptions), so it pays to confirm two things:

- Will the study’s assumptions (which might have made sense in the past) continue being relevant in the future?

- Rate discounts and monetary policy (inflation targeting) are great examples of key influences that have changed dramatically since Milevsky’s research.

- Do all the assumptions apply to you?

- For instance, how might your amortization or likelihood of breaking the mortgage before maturity (and paying a penalty) affect your personal outcome?

It’s also helpful to understand how rates have behaved in similar circumstances in the past. Milevsky wrote that, “The cyclical nature of economic cycles and interest rates dictate that…when rates are low, they tend to move back up…” And vice versa. So, it pays to be cognizant of where prime rate is relative to its long-run average, and what the spread is between today’s best fixed and variable rates.

History has shown that the tighter this spread and the more that rates lie below their long-run moving average, the better longer fixed terms have performed—based on those two factors combined. (That is partly why I made this call in November 2016.)

In case you’re curious: The spread right now is about 85 bps based on the average 5-year fixed rate minus the average 5-year variable rate on RateSpy.com. (Milevsky cited a 135 bps average spread in his long-term study). Prime rate is now above its 10-year (120-month) moving average for the first time since 2008.

One point commentators routinely omit is that Canadian rates have had a natural downward bias. In other words, rates have dropped for longer than they’ve risen (because rates tend to move up quicker than they move down). This does skew the research results.

Borrower Qualifications

It is “very important that consumers be aware of the inherent cash-flow uncertainty that comes with [a variable-rate] strategy and make absolutely sure that their monthly budget can in fact sustain this variability,” said Milevsky.

That’s the single most important consideration when deciding what kind of mortgage to get. It’s the reason we built this mortgage stress test calculator—so you can test your budget against future hikes.

All this is to say, no “expert’s” citations of historical research should ever make you myopic when it comes to mortgage selection. The fixed or variable rate question is a multi-factor decision that can’t be boiled down to what happened 20-70 years ago. Variables should still win long-term, but there will come a day when inflation surprises to the upside and boosts rates faster and for longer then we ever expected. If you’re not cut out for that eventuality, then a variable-rate mortgage may not be “the best option.”

log in

log in

If we only had a milli-bitcoin for every time someone said this:

If we only had a milli-bitcoin for every time someone said this:

5 Comments

I think of fixed rates like an insurance against variability. Most people lose out on any type of insurance in the long run, while a select few make money. Alot like gambling. Over a 25 year period, going fixed has never been cheaper!

Actually in fall 2016 fixed rates were a lot cheaper.

In the actual context of COVID-19 with Bank of Canada’s Rate at 0.25%… What to think? Since rates can’t go much lower, they can only be stable or rise in my opinion.

I would definetly go with the longer term option assuming a certain stability in my life. Does my reasoning make sense?

Hi Guillaume, Sounds like it makes total sense to you. If that strategy makes you rest easy and you can find a lender with a great rate, fair penalty and the flexibility you need, a longer term might indeed be suitable. Worst case, if you’re wrong, you won’t be *that* wrong. If you do take a 5-year fixed, just be sure not to overpay. In this market, anything over 2.89% is starting to get pricey. There are many better deals to be had.

Interesting that the first comment says “Over a 25 year period, going fixed has never been cheaper!” when the entire point of this article was that you can’t look at historical rate data to judge future decisions! As inflation skyrockets here in Jun.2023 and the Bank of Canada continues raising the Prime Rate to now 6.95%, people that locked in for 5 years back in 2021 are breathing a huge sigh of relief.