Almost every mortgage shopper has the same question at some point, especially when rates are surging or diving:

Almost every mortgage shopper has the same question at some point, especially when rates are surging or diving:

“Should I Lock in My Mortgage Rate?”

Answer this correctly and you’ll save thousands in interest. Pick the wrong rate type, and it could cost you just as much.

Seemingly everyone’s got an opinion on fixed or variable rates. But unless they’ve taken the time to understand your personal finances, your plans and your comfort level with rate volatility, their 2 cents is worth just about….2 cents.

What follows is a checklist of decision factors that everyone needs to weigh when deciding between a fixed and variable mortgage rate (or a long or short term).

******

Reasons to lock in

☐ You’re Worried It’s Different This Time

- Prominent research suggests that fixed rates underperform variable rates, but that conclusion depends heavily on the rate assumptions used.

- Historical backtesting confirms that when the best fixed rates are close to the best variable rates (e.g., about 0.25% apart) and variable discounts are smaller than normal, 5-year fixed rates have outperformed more than 3 times out of 10.

- Some Perspective: Research is always a rearview mirror. It may be a good indicator of long-term trends, but doesn’t tell us what’s coming in the next five years, or factor in changing inflation and bond market risks. (Threats of higher inflation and high demand for borrowing can both drive rates higher, and vice versa.)

☐ You Can’t Afford an Interest Spike

- A one-point hike in rates will cost you roughly $80 more interest each month for every $100,000 of mortgage.

- If you’ve got a variable mortgage with fixed payments, you won’t experience payment shock during the term of your mortgage.

- There are rare exceptions, namely when rates jump so much that you’re not covering your interest. Most lenders will then raise your payments.

- There are rare exceptions, namely when rates jump so much that you’re not covering your interest. Most lenders will then raise your payments.

- By contrast, if you have a payment that floats with prime rate (a.k.a., an adjustable rate mortgage or “ARM”), then a hypothetical 2-point rate hike would jack up those payments by $300 a month on a $300,000 mortgage.

- In the three rate cycles prior to the financial crisis, prime rose an average of 3.16 percentage points from its trough to its peak.

- Spy Tip: If you want to be ultra-conservative, use this mortgage stress test calculator and check what your payments would look like with a 2.00–point rate hike. Incidentally, regulators require all prime mortgage borrowers to prove they can afford a rate that’s two points higher than their actual, or typical, rates.

☐ The Break-Even Rate is Low

- Imagine you can get a variable-rate mortgage at 2.00% today. If we make some basic assumptions (like rate hikes occurring in the middle of your five-year term), here’s roughly how high rates must rise for that variable mortgage to cost you more interest than a 5-year fixed:

- 0.50%-point, assuming a 2.19% five-year fixed mortgage

- 0.75%-point, assuming a 2.29% five-year fixed mortgage

- 1.00%-point, assuming a 2.39% five-year fixed mortgage

- 0.50%-point, assuming a 2.19% five-year fixed mortgage

- As these numbers illustrate, the lower the 5-year fixed rate (relative to variable rates), the lower your breakeven rate—and the better your chances in a long-term fixed if rates increase.

- Spy Tip: When the difference between a long-term fixed rate and a variable rate is less than 1/2 a percentage point, you’re paying very little (historically) for the insurance of a fixed rate. Just remember that the difference is sometimes that small for a reason. It’s sometimes because the market expects lower rates ahead.

☐ You Think You Can Time Rates

- Let’s be honest, you can’t. And if you can, you should be running a hedge fund making an 8-figure salary.

- Not only will the bond market fake you out like an Allen Iverson crossover, but even if you could precisely predict rates in the next year, it would do you no good, research shows.

- And don’t plan to convert your variable to a good fixed rate when you see prime rate increase. Bond yields—which steer fixed mortgage rates—almost always rise several weeks before the Bank of Canada hikes rates. By the time you lock in, yields will likely have lifted 5-year fixed rates by at least 30 to 60 basis points.

- Be aware: Lenders often shrink their discounts when surging demand for fixed rates outpaces their supply of funding.

- Spy Tip: If you’re prone to lock in your variable-rate mortgage, don’t gamble. Get the best fixed rate you can from the get-go.

☐ Rates are Near Zero

- If Canada’s overnight rate approaches zero, it gets harder for banks to make money, on variable rates and in general. In that sort of environment, banks may choose to keep prime rate higher than the Bank of Canada’s overnight rate warrants, and/or they may reduce their discounts from prime rate.

- In such a case, even if the Bank of Canada cuts rates to zero, consumers may not see a matching reduction on their variable rate mortgage. That can diminish the benefit of a variable rate.

☐ You Can’t Re-qualify

- You don’t want to worry about re-applying for a mortgage if:

- There’s risk to your income (potential job loss, planned leave, etc.)

- You have a high debt-to-income ratio, which could prevent you from passing the federal mortgage stress test.

- In these cases, short-term mortgages (like a 1-, 2- or 3-year fixed) are unsuitable, as are adjustable-rate mortgages with the risk of higher payments.

- If your financial situation is less than solid, then—assuming a mortgage makes sense at all—lock into the best 5-year fixed you can find.

- Spy Tip: You’re also more at risk if you’ve got less than 20% equity. In such cases, if you had to lower your payments or consolidate debt, you wouldn’t be able to refinance cost-effectively. Reasonably-priced refinances are only available if your loan-to-value is 80% or less.

☐ You Might Break Your Mortgage

- The average borrower in a 5-year term renegotiates and/or breaks their mortgage in about 3.7 years.

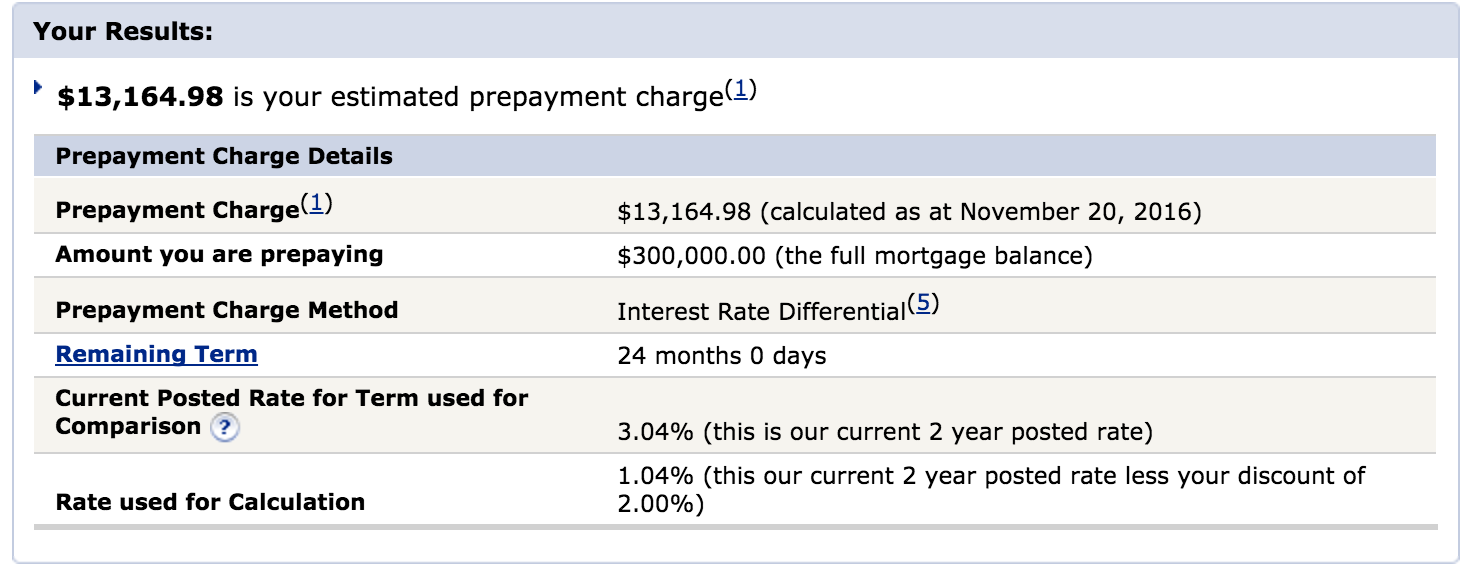

- The fee for paying off a 5-year fixed mortgage early can easily cost you thousands, especially if your lender charges a bank-style “interest rate differential” (IRD) penalty.

- Spy Tip: The more rates fall, the bigger IRD penalties can get.

- Spy Tip: The more rates fall, the bigger IRD penalties can get.

- With a variable mortgage, you generally pay just a 3-month interest penalty (the exceptions are low-frills mortgages, which have ugly penalties of up to 3% of your principal).

- Even if rates go sideways, IRD penalties can be thousands higher than variable penalties, especially if your lender is a major bank or you have a “low-frills” mortgage.

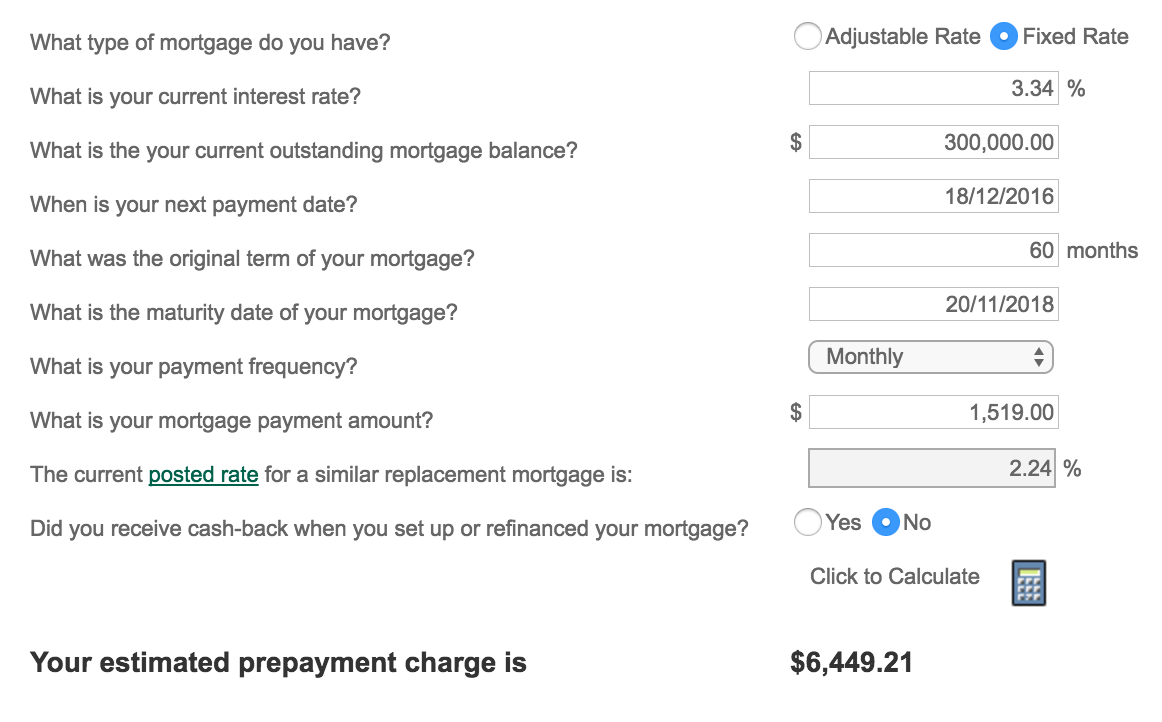

- Canada’s Big 6 banks have IRD penalties that are often more than double those of mortgage finance companies. See for yourself by plugging the exact same assumptions into a mortgage penalty calculator. Here’s an example of someone who got a mortgage three years ago and wants to break it two years before maturity:

Sample penalty from Canada’s biggest bank:

Sample penalty from Canada’s biggest non-bank lender:

- These two scenarios use the exact same assumptions. Yet the major bank’s penalty is more than twice as large as the non-bank’s.

- Spy Tip: If you want the flexibility to refinance at another lender (at best rates) or break your mortgage before maturity, think hard before locking into a long-term fixed rate—especially at a Big 6 bank.

☐ You Might Move

- Most fixed rates are portable if you change homes and want to take your mortgage with you to avoid a breakage penalty. Many fixed mortgages also let you increase your borrowing before maturity—at the lender’s then-current rates—without a penalty (a.k.a., “blend and increase”).

- Spy Tip: Many lenders do not have penalty-free blend and increase options. Many say they do but they sneak the penalty into your new “blended” interest rate. Be careful to choose the right lender if you might need to increase your fixed mortgage later.

- Most variable rates are also portable. But many are not increasable. Without a blend and increase feature, you’d have to break the mortgage and pay a penalty if you wanted to increase your loan. Those who choose a variable-rate mortgage and later buy a more expensive home, often find this out the hard way.

******

Reasons not to lock in

☐ You’ve Got an Amazing Rate

- If you can get a variable or short-term fixed rate that’s 75+ basis points below going 5-year fixed rates, interest rates could jump over 1.00 percentage point and you’d still pay about the same interest cost as someone in a 5-year fixed.

- Note: This rule of thumb doesn’t work if rates surge early in your mortgage term (e.g., in the first 12 months).

☐ You’re a Disinflationist

- Rates will likely never gain much altitude so long as inflation stays near or below 2%. That’s its average over the last 25 years.

- Mega-trends like aging consumers, automation, offshoring, outsourcing, internet retailing, over-leveraged consumers and cheaper energy have conspired to suppress inflation.

- If you’re betting on those trends persisting, and there’s a fair chance they might, then the threat of soaring inflation and monster rate hikes is less of a concern.

- Spy Tip: When the Bank of Canada starts a new rate cut cycle, or the yield curve inverts (i.e., 10-year government bond yields are lower than the overnight rate), and/or unemployment rises over 1/2 percentage point from its lows, history has shown that interest rates fall for multiple years thereafter, the majority of the time.

☐ You’re Financially Secure

- Strong borrowers can withstand sizable rate hikes.

- What’s a sizable rate hike? Over 200 bps is a good rule of thumb.

- What’s a strong borrower? Someone who has:

- Enough savings to pay 6 months of their mortgage

- A stable job

- A reasonable consumer debt load, and

- A mortgage payment, property taxes, utilities and condo fees that total less than 1/3 of their gross monthly income

☐ Your Mortgage and/or Amortization are Small

- Risk is relative, and it depends partly on the size of your mortgage.

- For example, paying a 2-point higher mortgage rate will cost you about $450 more interest each month on a standard $300,000 mortgage, but just $150 more on a $100,000 mortgage.

- A small mortgage relative to your home’s value also affords you more options if you need to refinance to improve your cash flow.

- Spy Tip: It’s easier to get approved if your loan-to-value (LTV) is 65% or less. There are many more lenders willing to lend when a borrower has 35%+ equity. These low-LTV mortgages often have cheaper rates too, unless your credit is shabby.

- Higher rates hurt less when you have a short amortization.

- Here’s a simple example: Over a five-year term, a 1%-point higher rate increases your interest cost almost 80% more on a 25-year amortization than a 5-year amortization.

☐ You’re a Risk-Tolerant Rate-hike Skeptic

- We’ve spoken with a lot of economists over the years. We like to ask one question in particular: “What mortgage term would you choose if you had to pick between a 5-year fixed and a variable?” The most popular answer: “a variable rate.” Why? Because they know two things:

- It takes less monetary tightening to slow today’s over-leveraged consumers.

- Whereas it might have taken a 3-point rate hike to control inflation in the past, today it could take half that. Thus, the upside risk in variable rates is theoretically more capped today.

- GDP has been in a long-term downtrend with no sign that we’ll return to the glory days of consistent 4%+ growth.

- Sustained 4% growth, even if only for 3-4 quarters, would almost certainly boost interest rates materially. But it’s questionable how long it would last.

- It takes less monetary tightening to slow today’s over-leveraged consumers.

☐ If Rates Have Already Risen

- History is clear on one thing. If rates are already up 150-200+ basis points, your odds of saving more in a variable soar.

- Spy Tip: If rates have increased 150+ basis points from the lows of the cycle, financially stable borrowers should start looking at shorter terms, like a 2-year fixed rate instead of a 5-year fixed. Once rates rise over 200 basis points from cycle lows, all but the most risk-averse borrowers should consider short or variable-rate terms.

☐ Your Lender is Noncompetitive

- When you lock in your variable rate to a fixed rate, the fixed rate you get is called a “conversion rate.”

- Some lenders quote conversion rates that are more than 1/4 to 1/2%-point above their best discounted rates. Scandalous!

- If your lender is a rate pirate on conversions, that’s just one more reason to ride out a variable rate.

☐ Because Economists Predict Higher Rates

- Your grandma could probably predict long-term rates as well as most economists. Research shows that economists have an optimism bias and can’t foresee recessions. Their

predictions give you utterly no edge.

predictions give you utterly no edge. - If you’re prone to rely on rate predictions that are wrong half the time, save yourself the guesswork and consider a hybrid mortgage (one that’s half fixed and half variable).

******

Boiling it down

Choosing the optimal mortgage term is rarely a single-factor decision. People lock in—or don’t—for multiple reasons. What you need to do is weigh the factors above and ask your gut whether the risk of a variable is worth the reward of a variable. Then make the call on your own….because no one knows your mindset and finances better than you.

log in

log in

41 Comments

Kudos for providing such an exhaustive checklist! I’ve been researching fixed vs. variable and weighing the pros and cons of each for some time now. I’m just about ready to enter the market and get my pre-approval, but I’ve been really torn as to which route to go.

Given our situation, we’re now leaning towards locking in for 5 years given some of your points above.

Thanks Mike

So, for a well qualified/financially stable person with 20% down, and I am open and willing to get a variable rate, it still seems that the 3 yr fixed are only 2.34 while you can still get the 2.35 HSBC 5 yr fixed. And for 20% down, the lowest variable rates aren’t available. In my case would you say the crusty 5 yr fixed is still the best bet at this point?

Hi Carolyn, Lots of factors to consider but based on interest cost alone, you can find variables today (Feb 28, 2017) at:

* 2.15% (for 80% LTVs)

* 1.84% (for 65% LTVs)

At 80% LTV, paying just 20 bps more for a set-and-forget 5-fixed is a steal. One exception is if there’s a likelihood of breaking the mortgage before maturity. In that case, I wouldn’t want to get stuck with any big bank IRD penalty, including HSBC’s. As for the 3-year, there’s not a lot of value at 2.34%, relative to a 5-year at 2.35% — unless that term happens to match your anticipated mortgage duration.

Love this website! We are first time home buyers and it was a real debate between fixed and variable. Ultimately decided to go variable 5-year closed. Got a great rate 1.85% (-85bps). Could of got a 5 year fixed for 2.45%. We are saving 60bps currently going variable. 335k mortgage, we put the min 5% down. Still not sure if I made the right decision? Your thoughts?

Thanks Eric, For someone with a financial safety net and solid job, a 60 bps spread in a low inflation environment is often a risk worth taking. To be safe, plan on at least 3-4 BoC rate hikes in the next 24-36 months, not because they’ll necessarily happen, but because you need to budget for the possibility. And be sure you’re putting any variable-rate payment savings to the highest and best use (building a savings buffer, debt paydown, investing, etc.).

Thanks for the input Spy! We will be saving approx $100/month by going variable for now! Planning on putting that extra savings away into a separate account to build a nestegg in case rates go up. Using your awesome “what if” calculator, if rates go up less than 1% over the next 5 years we are ahead, if rates go up 2-3% we lose. We both have stable jobs and can afford the payments should rates increase. It’s a gamble but I think a good one! I just don’t see rates increasing drastically anytime soon. With so many borrowers living on the edge even a 2% increase can cripple the housing market! I don’t see the BoC taking that risk.

Happy to hear you found the calculator useful Eric.

Here’s a link if anyone wants to run their own fixed/variable scenarios: Compare Amortization Scenarios

Awesome article thank you!

As of today July 25, 2017, I have two options to renew my existing mortgage:

2.25 variable over 25 years amortization

2.84 fixed over 30 years

Both provides the same monthly payment. I’m leaning toward the variable rate. Do you have any suggestion ? In light of the recent .25% hike by BoC

Thanks Omid,

If you’re well qualified my best advice is to shop aggressively, unless your mortgage is small and you’re happy with your existing lender. You can save up to 1/4%-pts off those rates, depending on your scenario.

The fixed versus variable decision hinges on your answers to this checklist. Just keep in mind that the market is pricing in 1-2 more rate hikes minimum. If the Bank of Canada stopped after another 1/2 point of increases, the decision would be easy (for most qualified borrowers): go variable or short term. But there’s no way of knowing how much the BoC will have to raise to thwart inflation. I’m guessing it won’t be much more, given that inflation is near multi-year lows, but term selection isn’t a guessing game.

Hi Spy:

My scenario is a bit…..different. I have been downsized. I cannot get the great pay i once had. Now my yearly income is only 33,000/year gross, my Mortgage balance is 230,000 and the value of my home is $700,000. My mortgage is up for renewal on Dec.31-2019. I have no debts and some investments. How do i prepare ahead of time. I am fretting! Grateful for the advice, Clara 22 January 2018

Hey Clara,

I don’t know what your mortgage payment is but let’s assume it’s $1,000 a month (you could refinance to this number if necessary) with no condo fees.

If you have no other income and no one else sharing the expenses, you’re debt ratios are way out of whack.

Your total debt service ratio is roughly 63% based on the above. That’s far above the traditional 40% maximum: http://prntscr.com/i48sx4

I can’t give personal advice in this forum (partly because I don’t know enough about your situation), but if I were facing a similar situation I would likely:

* Find a roommate…fast

* Secure part-time supplementary income

* Find a job that pays at least $50,000 a year, or

* Sell the home and downsize.

You may love your house and be quite comfortable there, but financial stress negates comfort. Believe me. Been there!

I am very confused about the decision making of having 5-yrs fixed mortgage(3.05%) and Variable rate (2.25%). Mortgage amount $337000. How can I save more money? Should I go Variable and when it gonna be break even if BoC increase the interest rate?

2.25% is prime – 1.20%, a tremendous rate. That rate buys a borrower four “free” Bank of Canada rate hikes. If the BoC lifts more than that (which would require unexpectedly high inflation), the 5-year fixed would win, based on interest cost alone.

But penalties are a consideration too. Breaking a variable can be cheaper than breaking a 5-year fixed, depending on the lender’s penalty policy and rates at the time. That’s important, given many borrowers don’t last 5 full years before renegotiating

Hi Spy,

First of all, I’m a big fan on this website and find it very impressive.

I’ve to sign my mortgage approval documents today and although I’ve done my calculations to place my bets on variable rate, I still have a little doubt and request your help.

Situation: $650K mortgage (including CMHC) for first 5 years of term. Variable closed at 2.21% (124 b.p. discount from prime) vs. Fixed closed at 2.99%. Household Income: $145k. Could easily afford at least 3 rate hikes in 2018 and 2019 combined. Plan to stay put in this new home for at least 3 years, but not sure of future.

Requirement: Just want to keep the payments low for now and don’t want to pay a whole lot more over the total term.

Thinking:

– With almost 78 b.p. difference, I’m planning to invest the differential ($255/ month) in TSFA –

ETFs – to save me for two 25 b.p. hikes in coming 2 years and two/three hikes spread in the last 3 years of term.

– If major hikes (50 b.p. or 100 b.p.) are on the horizon, as BoC hints before taking the step, there is always an option to ask my lender to change to Fixed term.

Please comment what would you do if you were in my position. Thanks in advance.

Thanks Nick. You scored some solid rates, good job.

While we can’t give personal advice on a message board, were I in a similar position (with good qualifications, lack of housing clarity after 3 years, expectation of further rate hikes, etc.), I’d likely play the odds and take the variable rate — assuming it has a 3-month interest penalty and not a 2.75% or 3% of principal penalty.

Note I said variable, not adjustable rate. The former has budget-friendly fixed payments in case rates surge.

Also, you didn’t mention your loan-to-value. The risk of a variable drops if you know you’ll have 20%+ equity after five years — and can therefore refinance if needed.

Hi Spy,

I have a secure job with 8 figures salary and I was approved for a mortgage with 5 years fixed rate of 3.22% or variable rate of prime – 0.75%

I don’t know which one to choose and I’d like to know your opinion please and thank you.

Hi Mo, Folks making $10+ million a year usually have a mortgage or HELOC for investment/business reasons. They typically have a higher risk tolerance and want more flexibility, which a floating rate can provide. Most prefer a HELOC which allows interest-only payments. The total payment can then be tax deducted, assuming the reason for borrowing meets CRA rules. HELOCs almost always come with floating rates. Incidentally, despite banks routinely quoting prime + 0.50%, it’s possible to get prime rate (3.45%) on larger HELOCs (e.g., $1 million+).

Hi Spy, Thank you for all your time and effort in this incredible website, I’m grateful and a new subscriber, Overwhelmed by all the knowledge I got.( I’m a slow learner ) My situation is this: I had a variable rate of 2.10% in 2015, now 2 years remaining with 2.85%. My house was purchased in 2009 @ $350,000 ( 25 years Mortgage ) and $150,000 remaining. Today’s value is $530,000. My question is whether I go ahead and lock the remaining two years @ fixed rate which is 3.09% offered by my bank, or leave it as is but I’m stressed about BoC hikes until March 2020 time for my renewal. I’m paying a double payment bi-weekly accelerated of $1,140. I just want to be mortgage free coming March 2020 and start investing in ETF’s and bonds for my old age security since I’m 55 single parents of 4 kids ( still in University ) with no savings at all, but healthy and I could keep working for 15 years more hopefully. My house is in a great area in Ontario and I intend to keep it as long as I live. I need your kind advice on this as I have to take a decision in April before BoC meeting and many thanks in advance 🙂

Thanks for the kind feedback Lobna,

Just to confirm, you are considering converting your current prime – 0.60% variable rate to a 2-year fixed at 3.09%?

What stresses you out about BoC hikes exactly?

* You can clearly afford higher payments

* Your current rate gives you a 1/4 point buffer against BoC hikes

* You only have two years left

* You have lots of equity if you ever needed to refinance

Are you trying to time interest rates?

Hi Spy,

Yes, I’m considering a switch to a 2-year fixed at 3.09%. No, I do not want to refinance. What I’m asking is Should I shop around for a better rate first? I’m afraid by 2020 rates will reach 4 or 5%. I just don’t want to pay more than $5000 yearly interest towards my mortgage.

Definitely, trying to time interest rates.

Thank you so much for your quick reply, I very much appreciated. Cheers!

Hey Lobna, Timing rates is a waste of time. If you’re that good at rate timing you should be trading bonds on Bay Street.

Regarding 3.09%, it’s near the best one can expect today, without having to pay a penalty and switch lenders. Bank usually don’t negotiate much in these kinds of situations.

Hi Spy,

First of all really love your site!

My mortgage amount is $219,000. I am hoping to keep my house for a long time and will need to renew by end of April 2018. I make 50k a year and I can pay without issues even if the rate is over 3.5%. I am currently considering three options (Yes I am greedy) and am hoping you can offer me your opinion:

1) 5 year variable closed at 2.50%

2) 2 year fixed closed at 3.09%

3) 5 year fixed at 3.29%

The variable offers 3 FREE BoC rate hikes. The 2 year gives me some time to observe the rate market. Last but not lease, the 5 year fixed rate I get is pretty nice as of 2018-APR-19. What would you choose if you were me?

I want to gamble on the variable because I just don’t think BoC will take us to over 3.5% in the next 3 years? I am not a fast learner and will appreciate any comments!

Thanks Dave,

Greed is often good when picking terms, so long as you’re well qualified.

I don’t know your personal situ so it’s tough to make a recommendation. But what I can tell you is that most risk tolerant borrowers with 20%+ equity, modest non-mortgage debt and access to 3-6+ months of living expenses can roll the dice on a variable (or worst case on a 50/50 hybrid).

The 2-year at 3.09% offers little benefit unless there’s a good chance you’d need to break in two years.

That 5-year fixed is high at 3.29%. Try for 3.19% to 3.24% (or better if your mortgage is insured).

The variable at 2.50% is decent, especially if your mortgage is uninsured.

Good luck!

What would you pick. I have been struggling to pick but still not yet.

– My mortgage 350K out of 850K house

– Very stable income 100K+

– My risk level I would say just above average

Offers from mortgage lenders

– 5 y fixed at 3.09% with heloc at prime

– 5y variable at 2.49% with heloc at prime

– 5y variable at 2.21% but heloc at prime + 0.5%

Cheers,

Hey Tom, As a news site, we can’t provide personalized advice but if you reply back with these answers, one of the brokers on the board will respond with suggestions: https://www.ratespy.com/term-selection-checklist

As a general statement, that’s a tremendous 5-year fixed rate for a readvanceable mortgage. Any chance that lender is the same lender offering one of those variable rates you mentioned?

Hello

This site is really nice for me to consider some options. I am a newbie cos I took 2year fixed at 2.15 and I’m renewing in August. So far the variable and fixe rates from my current bank is asking 3.44% fixed closed 5 years and 2.6% 5 years variable.

My income is stable about 45k.

My amortization remaining is 28 years and I have 178k in mortgage remaining or a bit less after the renewal.

If other banks are offering 3.33 – 3.38% for fixed and 2.45% variable is it benificial to transfer to another bank? Or is it better to stay since not all banks will offer to pay the notary fees…?

Hi Michelle,

There’s so much to consider but from a simplistic interest standpoint, for every 10 bps you save on rate, you’re saving about $900 of interest over five years, give or take. See: https://www.ratespy.com/mortgage-rate-comparison-calculator

Compare that to your switch costs (which depends on your mortgage type and mortgage provider).

Then compare any product features that might be relevant to you (portability, refinance-ability, prepayment-ability, penalty, etc.).

And of course, get some personalized advice on term selection, which is hard to do in a forum like this.

I have my 5yr variable up for renewal next may 2019.

My home is valued approx $900000. Mortgage is $210,000. $100000 owed on loc investment being paid back approx July 2019.

I want to maximize borrowing the equity in my home.

What would be the best mortgage i should shop for that’s readvancable/has heloc/ borrow up to80%ltv??

Several lenders have HELOCs to 80% LTV:

BMO

CIBC

Manulife Bank*

National Bank

RBC

Scotiabank*

TD

* These banks deal with brokers as well and they may be able to get you a higher approval amount.

The best mortgage features wise is Manulife and National Bank but they also charge monthly fees.

Scotiabank and BMO have the best no fee options but they don’t have built-in bank accounts and interest offsetting.

What % rate*more* would i pay to have this type of mortgage^ based on current rates of 2.58% 5yr variable and 3.27% 5yr fixed.

10,20, 30 points higher??

For a well-qualified borrower at this very minute, roughly 40+ bps on the 5-year fixed and 55+ bps on the 5-year variable, compared to the insured effective rates you’re quoting.

3% variable vs. 3.38% fixed. Both 5 years. Any advice? Thanks.

Hi Charles, There are several factors to consider, including: https://www.ratespy.com/fixed-or-variable-rate-the-decision-checklist-02223752

Currently have a 5 year fixed @ 2.39% (30 year amortization) or a 5 year variable @ 1.78 (prime minus 0.67, also a 30 year). Purchase price is 1230000 with 20% down. Any advice given this covid era?

Hey Greg, There’s not enough info here to make a personalized recommendation unfortunately. That said, a 61 basis point head start in a variable would be compelling for most well-employed, risk-tolerant, financially stable borrowers — especially given the recessionary disinflationary outlook.

Thank you.

You are the best, ratespy!

We have a $307,000 mortgage up for renewal at the end of this month. We have always gone with a fixed rate but have been told that variable rates often out-perform fixed. We have to offers from RBC 5 year fixed at 2.59% or 5 year variable closed at 2.25% . With covid and lock down the market is in recession but for how long ? Will rates continue to fall? In the 5 years will BOC hikes negate the variable rate . We are not moving in next 5 years

Hi LCouto,

Regarding: “variable rates often out-perform fixed”

That’s historically been true the majority of the time. It’s been particularly true heading into recessions where the variable rate discount is large relative to a 5-year fixed rate.

Unfortunately, past term selection research is based partly on assumptions that no longer hold true. And, as your quote illustrates, the upfront rate advantage of a variable is historically small. I personally prefer variables but never at prime minus 0.20%. If you’re stuck on RBC, try harder to negotiate those rates and use the data on this site to do it.

Good luck!

Hi,

I’ve been doing a bunch of research on what’s the best mortgage for me.

I’m a first time home buyer (not in the GTA), I’ve looked at the big banks and a mortgage broker at both fixed and variable rates. I’m not 100% certain if I’ll move or want to sell in the next 5 years, probably not.

HSBC high-ratio 5yr variable at 0.99 is pretty attractive. 7.5% down.

Meridian high-ratio 5yr variable at 1.35 is good too. 5% down.

The broker rate is a bit higher 5yr variable 1.65 with 5% down.

All the above are 25yr amortization.

I’m tossing up the idea of 20% vs 5% down. Seems to me that putting 20% down avoids CMHC and allows for a higher purchase price.

Also, variable vs fixed. It sounds like there are some flexibilities with variable. I’m also trying to be conscious of portability of the mortgage in case I’d like to move to something more expensive later.

Lots of things to think about and consider but good to consider all risks associated with getting in to a mortgage. I would like to pay minimal penalties if needed to break a morgage. There are some scary pay-outs I’ve seen and would like to avoid if I get in to that situation.

Any advice on what are the best options considering where the rates are and where to invest my money?

If you need more info, let me know.

Thanks in advance…

Hi CP,

A few thoughts:

1) Not sure why you have to put 7.5% down with HSBC’s 0.99% offer but only 5% down with Meridian’s offer. Is that what each lender told you?

2) You can indeed maximize the purchase price with 20% down vs. 5% down, particularly since you’re allowed to extend the amortization beyond 25 years, if desired.

3) Here’s a rundown of fixed vs. variable: https://www.r`atespy.com/fixed-or-variable-rate-the-decision-checklist-02223752

4) Penalties are mainly a factor if you’re getting:

* a longer-term fixed rate, like a 5-year fixed or longer

* a shorter term if there’s a high probability you’ll break before maturity

* a low-frills variable with a 2.75%, 2.9% or 6-plus month interest penalty

See here for a list of fair penalty lenders: https://www.ratespy.com/fair-penalty-lenders-which-lenders-have-the-lowest-mortgage-penalties-05109252