.

One truth in economics is that mortgage rates typically follow inflation expectations, at least over time.

That eventually poses a problem for borrowers, particularly after consumer prices take flight, like they have this year. U.S. core inflation, for example, recently jumped the most in four decades, 0.9% on a monthly basis.

That “was well above what I and outside forecasters expected,” remarked Federal Reserve Vice Chair Richard Clarida. (Our country usually takes its rate cues from the U.S., so when the Fed talks, Canadian markets listen.)

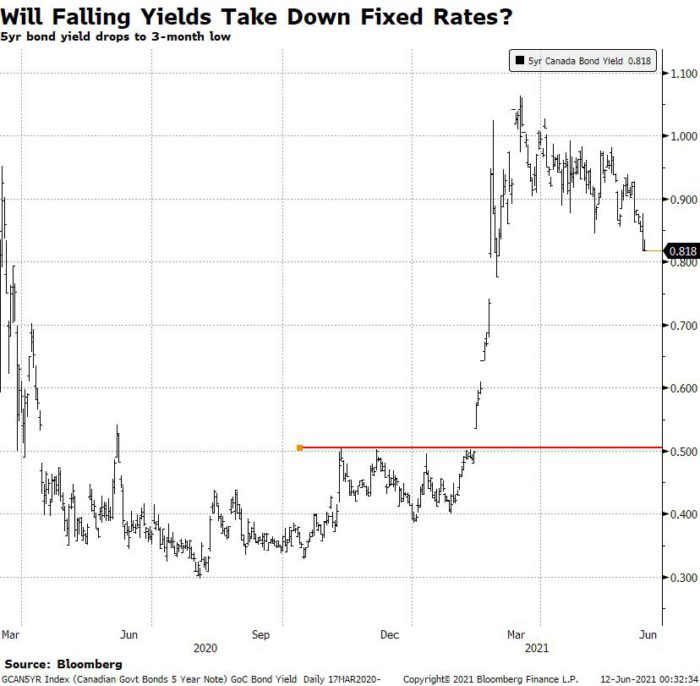

But the bond market, which is normally hyper-sensitive to rising inflation, did something unexpected this week. It shrugged off the inflation concerns.

Instead of pushing rates up, investors drove them to their lowest level in three months. The Bank of Canada said this week that inflation will ease up by year end, and markets believe it.

This all begs one key question, however. Are rising consumer prices just temporary or will record stimulus, supply shocks, opportunistic firms, rising wages, de-globalization, commodity price increases, spending record savings, and other trends keep prices elevated?

Clearly most of these inflationary trends will peter out eventually, but no one can say that all such inflation pressures are short-term. Some are clearly less temporary, and that should prove apparent when the economy fully re-opens.

If inflation remains above target for 6+ months, this would only reaffirm that rate normalization is Canada’s destiny.

“The speed of this economic recovery is like no other,” said TD Economics this week. In years gone by, economic forecasts like those we’re seeing from the Bank of Canada “would already have caused the Bank to start tightening policy,” Capital Economics said in a report.

So, the market believes it’s just a matter of time before bond yields resume their ascent. Knowing that, lenders may pass along a smidge of their funding cost savings (savings precipitated by falling yields). But we anticipate that few, if any, major fixed-rate cuts are on the near-term horizon.

Facts of the Week:

- Canadian’s real estate equity has shot up to a record high of 76.5%.

- “40% of household wealth was concentrated in real estate,” says TD, the highest share on record

log in

log in

8 Comments

If rates continue to climb, then mortgage payments will climb over time as well. That has to be bad for an economy that relies on consumer spending for 65% of GDP, You can’t spend money you have to pay to the bank for your mortgage. The BOC knows that which is why it will not raise rates in the foreseeable future.

Hey William,

What you’re referring to will result in fewer rate hikes, but the *timing* of the first BoC hike will hinge overwhelmingly on the BoC’s inflation forecast, and little else.

Caught you Spy!–still sneaking some articles here? lol

Yesiree Anthony, Guilty as charged. We’ll still be posting on the Spy for now, albeit most content has shifted over to Rates.ca as part of our news consolidation efforts…Cheers, R

During the 2008 world-wide financial crisis (caused by some reckless US banks, financial firms and lenders), US also printed a lot of new money but world-wide inflation was very mild. It was because US asked China to print trillions of new RMB and bought trillions of US treasury. It lowered the cost of all export from China and also restrained the world-wide inflation. (As you know, most countries shifted their manufactures to China to take advance of their low labor cost and fast learning talent. Apple is one of the big beneficiary. These companies also shifted their tech to China.) However, it caused huge inflation in China at that time. Not this time. China prefers to control their own inflation and not printing new RMB or buy new US treasury. (This is why US banks are the major buyers of US treasury now. Many countries (including US allies) also reduced their US treasury. Russia national fund even sold all their US treasury and US asset.) USD value dropped when they print trillions more comparing to RMB. They printed much more than the 2008 crisis! Almost all commodities are traded in USD and their price doubled and tripled. It caused all product prices to increase too, including China export. This is one of the cause for hyper inflation in US now. The raise of oil price is another reason and it is controlled by OPEC. The possibility of Iran-US-Israel war is not helping too… My 2 cents.

A weak USD is an inflation concern for sure. It may get a boost from an increasingly hawkish Fed but if the US dollar index ( https://snipboard.io/ctu34F.jpg ) breaks below 88, inflation hawks will have a lot more to worry about.

Forgot to mention that US added a lot of tariff to China import. 90% of these tariffs are paid by US companies (not Chinese exporters). It adds 10% to 25% to the cost !!! If US cancels these tariff, inflation will drop too. However, the president can’t cancel these tariffs because it means US failed in their self-inflicted trade war with China !! It can hurt the re-election of the president….

After Biden took over, their Fed called China a few times to restart the trade talk and ask for help. China doesn’t want the talk. China skipped on-site visit at G20 last week. They will also skip the next leader only G20 meeting later. US doesn’t have a chance to talk face-to-face with them. As we know, Canada/US is still keeping Huawei owner’s daughter as political hostage in Vancouver. Their plan to move western factories to India failed because India PM Modi restarted their massing gatherings for election and religions too early, and they caused hundreds of thousands of deaths. They also created the more deadly delta variant for the world. Many countries and cities are locked down again. China remains the only pandemic-free world factory for the world. One more to mention. When the world move factories to China, they also moved their pollution to China. Now, the world world blames China for pollution… China has spent a lot of afford to use green energy but it is still not enough. The world wants cheap and good quality goods, and they don’t want to pollute their own country… Many people just complaint at their local issues and don’t understand the global picture… My 2 cents.