Bond yields have sunk this month. And it’s taken no time for skeptics to pronounce that inflation fears are therefore unfounded.

Yields were unjustifiably high, they say, because inflation is transitory.

But those who believe that historic global stimulus and spending and supply constraints won’t lead to above-normal inflation and higher rates might want to give it more time. Economic recoveries don’t travel in a straight line. Yields have been prone to setbacks in most meaningful recoveries throughout history. This recovery will be no different.

Heck, consumers haven’t even begun to spend like they’re going to once re-openings are complete and vaccinations meet federal targets. And that should happen soon. New federal spending will also fuel the rebound.

So, give it time. Markets are one of the best indicators of future inflation we have, but they’re wrong a lot. “At times when inflation has significantly accelerated in the past, such as in the 1960s, markets have lagged rather than anticipated developments,” Former U.S. Treasury Secretary Lawrence Summers told Reuters.

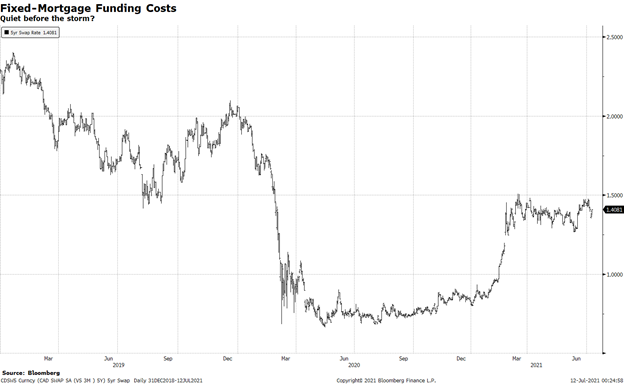

Meanwhile, the 5-year swap rate, a rough approximation of the basic cost to fund a 5-year fixed mortgage, is waiting for the next shoe to drop — awaiting a rekindling of inflation fear. And those fears are still smouldering. A record percentage of businesses now expect inflation to exceed the Bank of Canada’s 3% limit over the next two years.

All that is to say, barring a new unforeseen crisis, the reflation trend (and fixed mortgage rates) have more room to run. If inflation stays robust through year-end, the BoC’s “transitory inflation” spiel will lose credibility. In that case, rates could easily challenge their December 2019 highs within 6 to 12 months.

The Takeaway: Any drop in fixed rates (don’t expect much of one) should be viewed by mortgage shoppers as an opportunity, not a sign that the rate run-up is over.

log in

log in