By The Spy on

January 12, 2021

“What’s the lowest rate?” is one of those questions you can’t answer with one number. There are just too many factors that determine the rate someone pays. You have to ask more questions, like: How much equity do you have? Are you purchasing a home, refinancing, or just switching lenders? What term do you prefer? What province are you in?...

read more

By The Spy on

September 13, 2018

Equifax Canada recently announced it was getting rid of the “Beacon” score, which lenders use to assess mortgage applicants. It’s replacing it with the “FICO” credit score. “The FICO Score has been a critical part of the lending process in Canada for nearly 30 years,” said FICO Canada’s Kevin Deveau in a press release. So we dug a little deeper...

read more

By The Spy on

August 16, 2015

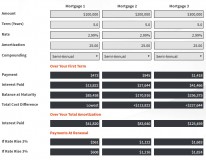

It’s often helpful to know how much extra interest you’ll pay with a higher rate, a bigger mortgage, shorter compounding and/or a longer amortization. Now, the Spy makes that easy with anall-new monthly payment calculator. This tool lets you: Compare three different mortgages Instantly find the lowest cost option View interest cost over the term and amortization Check yourbalance at...

read more

By The Spy on

August 2, 2014

Mortgage rate widgets are no longer created equal. If you want to display mortgage rates on your website, do your visitors a service and display the best mortgage rates available.Only one mortgage rate widget in Canada makes that possible: RateSpy’s. Other rate widgets primarily show the lenders and brokers who pay to promote their rates. That does your visitors a...

read more

By The Spy on

June 5, 2014

Got a hot rate tip? The Spy buys rate Intel. The Top 2 rate tips of the month earn a crisp C-note! Here’s the fine print.The rate must be: Arate that is at least 5 basis points lower than the lowest rate currently advertised by RateSpy.com for that term A current rate offered by a lender (not a broker) and...

read more

By The Spy on

April 19, 2014

Do you want to monitor specific types of mortgage rates? For example: Rates on 5-year fixed terms with 120-day rate holds? 10-year fixed rates from brokers in British Columbia? Variable rates, but only from banks and credit unions? RateSpy makes it easy to monitor specific rate groups like this. All you need to do is create a custom rate URL,...

read more

By The Spy on

January 23, 2014

You can now email the Top 10 rates you find to anyone you like. Simply click the “Email Rates” icon on the homepageand away you go. The rates emailed are based on the rate search criteria you set. This new feature is part of theSpy’s redesigned and simplified rate search controls. We hope you like!

By The Spy on

January 16, 2014

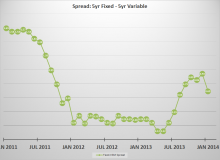

The two most popular mortgage terms in Canada are the 5-year fixed and the variable. They account for the lion’s share of mortgage searches on RateSpy.com. For that reason, the Spy has two new dedicated rate pages: Best 5-year Fixed Mortgage Rates Best Variable Mortgage Rates

By The Spy on

January 3, 2014

Sometimes you want to quickly compare the best rates for several terms at once. For this purpose, we’ve created the rate comparison tool. First pick your province and the number of rates to display. The comparison page then returns every lender and broker serving that province. Quick tips: Click on any rate to make the Mortgage Intel window appear with...

read more

By The Spy on

December 28, 2013

Mortgage commentators are a dime a dozen, so we’ll keep this on point. Spy News has two missions only: 1. Deliver only the essential elements of breaking rate market news; and 2. Provide briefs on new mortgage rates, terms and products. If you have ideas for a rate topic you want analyzed, email us 24/7 at info -at- ratespy -dot-...

read more

log in

log in