After a six-month hiatus, 2.99% five-year fixed rates are making a triumphant return.

You’ll start seeing brokers quote them online by next week. It may take major banks a bit longer to catch up (assuming rates keep falling). For the time being, however, these 2.99% specials may come with restrictions like 30-day closes, no pre-approvals, etc.

Some feared 2.99% five-year fixed rates would disappear for years. A recovering economy and Fed tapering were supposed to drive up bond yields, and take fixed mortgage rates with them. The return of sub-3% rates serve as just the latest reminder that rates take a random walk.

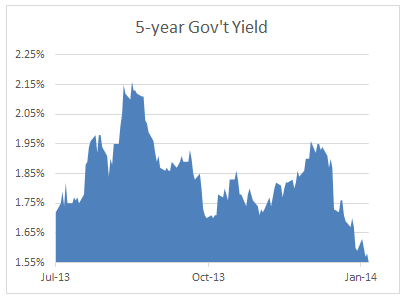

Falling Canadian bond yields have triggered the descent in fixed rates . This chart below says it all. Five-year yields, which guide fixed rates, have sunk 0.40 percentage points since New Year’s day.

At 2.99%, five-year rates are just 0.64 percentage points above deep discount variables. That’s a major drop since December when the fixed-variable spread was pushing one percentage point. (Click here for chart)

Variables have been getting more popular since the summer. But now we may see a rotation into fixed-rates again…in the near-term at least.

log in

log in

6 Comments

Godbless free market entreprize!

So which do you think is the better deal going forward? 2.35% on a 5 yr. variable or 2.99% on a 5 yr. fixed?

@RJ

It’s a fair question but the challenge is that everyone’s situation is unique.

To answer this one has to ask questions things like:

Can you handle 25% higher payments?

Do you need fixed payments to reduce cash flow risk?

How much equity and savings do you have?

What is the breakeven rate (i.e., the rate increase required to make these two options equal)?

Will you be accelerating your payments?

What is your amortization?

What are the odds of breaking or porting the mortgage before 5 years?

And so on….

As a very general statement, 2.99% is tremendous IF the mortgage contract has the flexibility you need.

That said, you may find that a combination of these two terms is most suitable.

The five year fixed is a good deal.

However variable is still the way to go if you want to save money.

Brian

Not sure what a combination of the variable and fixed 5 year rates means? Can you expand please?

Hey there tierom,

A combination mortgage has 2 or more parts. For example, suppose you need a $200,000 mortgage:

$100,000 could be in a 5-year fixed at 3.19%

$100,000 could be in a 5-year variable at 2.40%

The combined rate at closing would be 2.80%.

Hybrid mortgages are a good solution for folks who want to hedge their bets on rates.

Just be sure to keep the terms equal (i.e., don’t get a 3-year variable with a 5-year fixed). That way you don’t get a cruddy rate when the shorter term matures.

Cheers…

The Spy

RateSpy.com has been declassified. Please spread the word so more can save!