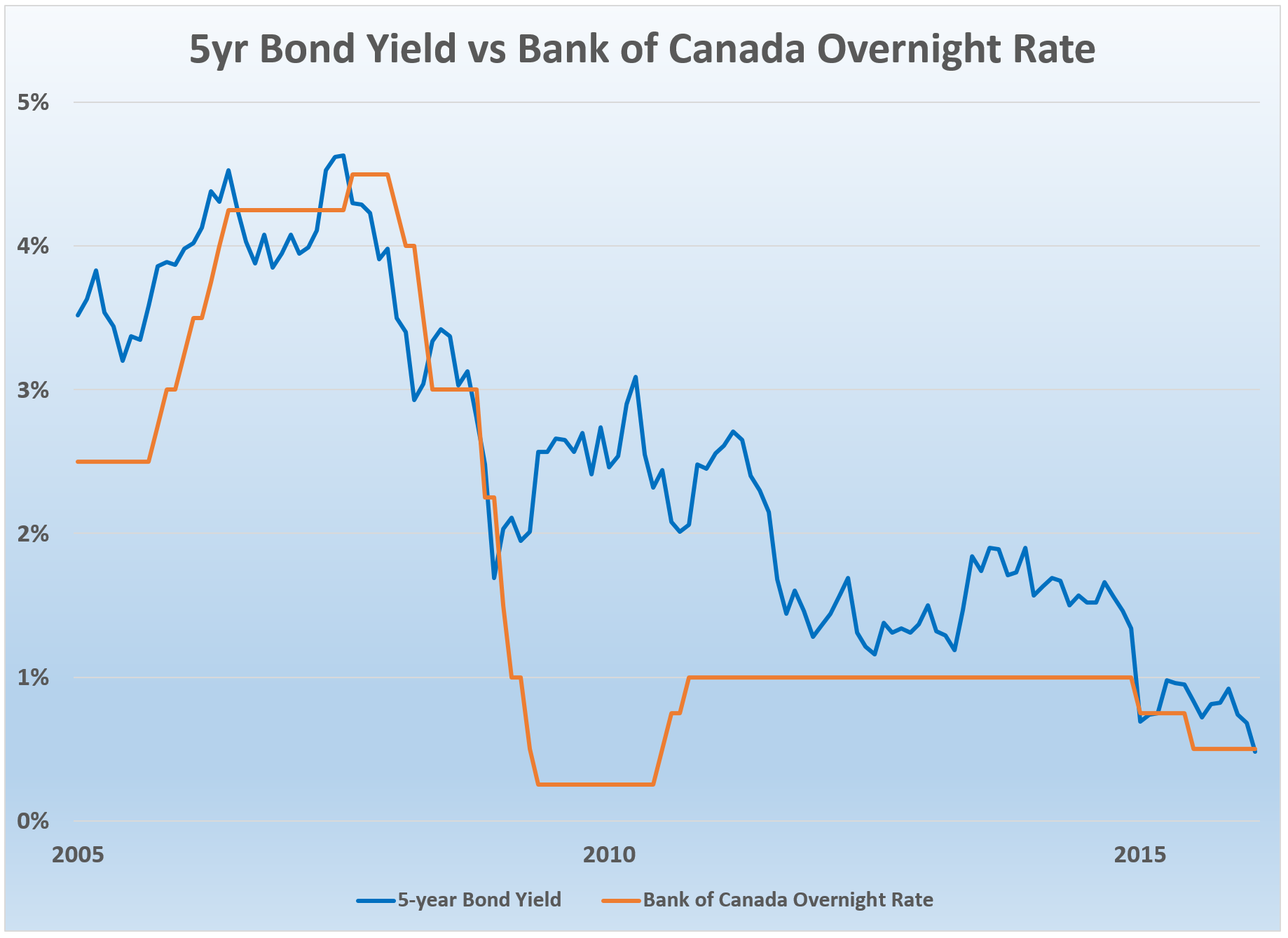

It finally happened. After a year of bouncing off the 0.50% range, the 5-year government bond yield finally closed below it. The last time that happened was…never.

Canada’s 5-year government yield (which guides fixed mortgage rates) closed even lower than the Bank of Canada’s overnight target. In other words, the rate to lend for five long years is less than the rate to lend for one single day. What a clear and distressing reflection of how pessimistic the “smart money” is about Canada’s growth potential. Not coincidentally, Alberta’s lifeblood (oil) also plunged to an all-time low on Wednesday.

Source: Bank of Canada, RateSpy.com

What’s the big deal?

Well, from a mortgage standpoint, collapsing yields are relevant for three reasons:

- Spreads are out of control: The difference between the average 5-year fixed mortgage rate and the 5-year government bond yield (a crude measure of lender gross margin) is now a sizable 2.13 percentage points. Normal is closer to 1.75. There is no way that this inflated spread is sustainable over time. Either fixed mortgage rates must come down or yields must go up.

- The Fed is Dead: Bond traders are fighting the Fed…and winning. As recently as December, the U.S. Federal reserve was projecting four rate hikes in 2016. Some expected Canadian yields to follow. Bond traders then said, “What-E-V-E-R” and unceremoniously drove yields through the floor. Borrowers have had enough of the headfakes and “rates are going up” mantra. Many are opening up to taking more rate risk. In turn, expect 1- and 2-year fixed terms to gain appeal, especially with some banks near prime (2.70%) on variable rates.

- Near-term rate discounts: Barring a rebound in yields, fixed rates could slide again soon. If/when they do, the lowest 5-year fixed rates for 30- to 45-day closings could dip into the 2.20% range. RateSpy’s lowest 5-year rate on record was 2.25% on May 1, 2015. We will break that record.

Even the 10-year bond yield sank to a new low, cracking 1.00% for the first time. Ten-year fixed rates will also drift down from their ridiculously inflated 3.91% average, not that anyone cares about 10-year rates.

Of course, all of this is happening right before peak season in real estate: the spring market. If we see rates drop materially in the next month, you might as well add a few more bidders to those multiple-offer properties in Toronto/Vancouver.

log in

log in

9 Comments

WTI didn’t hit an all-time low. I doubt it was even a 20yr low.

Hey Ralph, The reference was to Alberta oil (Western Canada Select) which, according to Bloomberg, made a record low.

Chart: https://www.ratespy.com/wp-content/uploads/2016/02/WCS-Oil.png

it hit 10.65 in 1999.

it could go a ways yet

Hey there Peter,

That record came from Bloomberg, which notes that Western Canada Select (WCS) oil prices were not tracked prior to 2008. Source:

http://www.bloomberg.com/news/articles/2016-01-06/world-s-cheapest-crude-hits-record-low-as-oil-slump-deepens

However, WTI was at those levels around 1999: http://www.euanmearns.com/wp-content/uploads/2016/01/pricecrash9899motd.png

Is it possible you’re referring to the WTI benchmark instead? If not, would you happen to have a source for that $10.65 price?

Peter is referring to WTI. Since WCS trades at a discount to WTI (-13.25 on the March contract), WCS may well have traded near US$5/bbl in 1999.

Oil should be near a bottom though. The current contago is such that oil producers should be locking in a price in the mid-30’s less than a year from now with a costless collar (sell call & buy put), and store the oil for free (in the ground).

If the market is still in heavy contago when the contract is about to expire, sell the put for a big profit and repeat the trade.

@Ralph

#1) Always enjoy trading tips. If you’ve got a play on the 10-year bond future, I may have to re-open my futures account.

#2) WCS didn’t trade in 1999. It was introduced in 2004 and has never been lower since then.

Cheers……

@Rob,

#1) Never played the futures market. Did make some safe money in options by selling front-month naked puts instead of placing limit order buys for shares when I wanted to go long. Writing some good arb bots is my retirement plan; lots of opportunities that are too small for the big guys to go after.

#2) While WCS per se may not have traded before 2004, 3.51Wt. percent sulfur and 20.5 API gravity heavy crude certainly did. And if we can find some old oil company financial statements from the late 90’s, I’d bet the price at Hardisty was near $5/bbl, and maybe even under $5 at Edmonton.

@Ralph

Guess that settles it. The Spy was right in referencing Alberta oil using the current unit and you’re right by being pedantic.

The problem is, no one’s coming here to read your opinion Ralph. Go start your own blog, and quit polluting this one.

Still a lot of hurt to come yet, I suspect. And you’re absolutely right, anyone with half a brain could see that the Fed was so out of touch with its forecast of a four-step rate hike in 2016. Talk about jumping the gun! The bond traders have won this round.