The latest intel from Canada’s mortgage market…

Rates Bounce Bigly

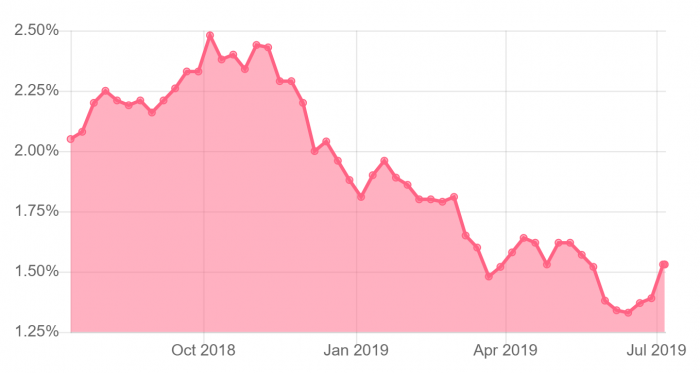

Canada’s 5-year bond yield catapulted to 1.53% on Friday. Its 11-basis-point gain was the biggest since June 2017.

That establishes at least a short-term bottom and suggests the best fixed mortgage rates probably won’t drop much more near-term. In fact, if yields close up in the 1.60’s, the lowest 5-year fixed rates could tick 5-10 bps higher.

5-year bond yields. Source: Bank of Canada, RateSpy.com

Will fixed rates make new lows this year? Possibly. But if you need to lock in a new mortgage rate, don’t wait days or weeks to find out. Take the bird in the hand because today’s rates in the upper-2%-range are outstanding.

Will Poloz Match Powell?

The U.S. “is still on track for a 25-basis-point cut” as soon as July 31, BNP Paribas economist Andrew Schneider tells Reuters. It’d be “an insurance cut,” he calls it, to forestall a budding economic slowdown.

The U.S. “is still on track for a 25-basis-point cut” as soon as July 31, BNP Paribas economist Andrew Schneider tells Reuters. It’d be “an insurance cut,” he calls it, to forestall a budding economic slowdown.

“Typically the Fed moves to cut within 2-7 months of markets first anticipating such action,” Macquarie Economics explains. And that anticipation “first occurred in March.”

One fact that “screams rate cut,” Bloomberg says, is that a stunning 99% of the world’s $38-trillion in developed market sovereign bonds—up to 10-year maturities—have a yield below the U.S. fed funds rate (a rate that ultimately influences Canadian rates).

Despite that, and despite that 3/4 of our exports are sold to the U.S., BoC boss Stephen Poloz isn’t anxious to follow the Fed. Our key rate is already three rate cuts (~66 bps) below the Americans.’ Moreover, Canada’s economy looks stronger by comparison, at least of late (i.e., we’ve had more positive surprises, than the U.S.).

Source: SeekingAlpha, Citigroup Inc.

“We still expect [the Bank of Canada] to remain on hold for the next six months,” TD told Reuters. And the broader market agrees, with traders cutting odds of a BoC cut this year to only 15%.

That said, “The Canadian economy and loonie do not hold up for long once its largest trading partner enters a persistent downturn,” Seeking Alpha wrote this week. Stubbornly higher rates in Canada—versus the U.S.—would be bullish for our loonie. And a Canadian dollar that’s too high slows exports and eventually puts downward pressure on our rates, other things equal.

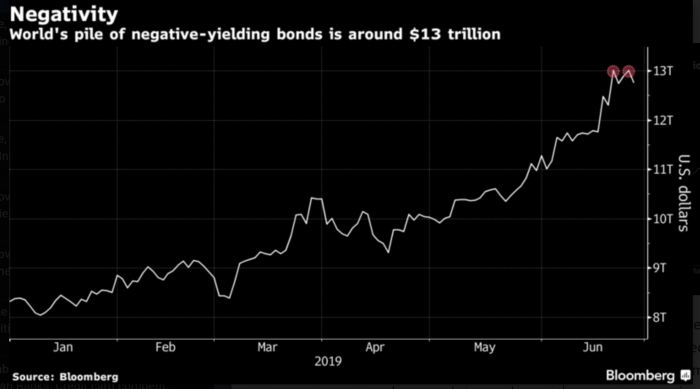

The global rate trend is also declining in general. In fact, more and more bond-holders have experienced negative rates as this chart shows. That adds incremental downward pressure on both U.S. and Canadian rates.

Bad Policy Keeps Holding Buyers Hostage

It’s now 34 months and counting since September 2016. That’s when the benchmark big bank 5-year posted rate was last cut.

It’s now 34 months and counting since September 2016. That’s when the benchmark big bank 5-year posted rate was last cut.

Despite one point of rate decreases since the fall, most mortgagors must still prove they can afford the same rate they did one year ago (5.34%).

But it’s hard to blame banks for the government’s flawed policy. It was regulators who bestowed upon them this anti-consumer power to control the nation’s mortgage stress test. (The stress test rate is based on a Bank of Canada poll of just six big banks, with complex tie-breaker rules).

With policy-makers biased toward tighter lending rules, many wonder how much moral suasion they’re applying to banks to keep the rate inflated. Bank regulator OSFI states, “business decisions including [setting posted rates] are made by the banks.”

For its part, the Department of Finance says: “The Government of Canada does not interfere in the day-to-day business decisions of financial institutions.”

But when asked to reconcile that with the past DoF Minister actually phoning banks to influence their mortgage rates, we got no comment.

Back to a Duopoly in Mortgage Insurance?

There’s speculation that mortgage default insurer Canada Guaranty could buy out Genworth. That would likely be a negative for consumers if it happened.

There’s speculation that mortgage default insurer Canada Guaranty could buy out Genworth. That would likely be a negative for consumers if it happened.

For one thing, the government effectively owns most of the insurance market via its crown crop., CMHC. That gives it considerable market power and is why three insurers are better than two.

Keeping three competitors:

- Fosters an incrementally freer market

- i.e., it slightly reduces the Department of Finance’s/CMHC’s ability to dictate policies and pricing to lenders, and ultimately consumers.

- Keeps “bulk insurance” premiums lower

- That’s important for consumers with 20%+ equity

- Bulk insurance reduces low-ratio funding costs for lenders, which allows for lower rates in some cases

- Private insurers have filled some of the void left by CMHC in bulk insurance, and both CG and GW have been competing against each other on pricing, lenders tell us.

- Encourages better service levels and greater technology investment.

More Rate & Housing Reads

- Zero out of 38 economists expect a BoC rate cut next Wednesday

- Stress test loophole: Just heard from a client who got qualified at a 2.99% 5-year fixed rate by a credit union (banks stress test at 5.34%+)

- Reverse mortgages are flying off the shelves

- IMF: A severe recession/housing selloff could stick 29% of households with mortgage payments over 40% of income (an elevated risk), versus 17% in 2016. “…Mortgage insurers would need a capital injection,” as well, projects the IMF. Albeit, chances of this in the next few years are just 3.8%, it says.

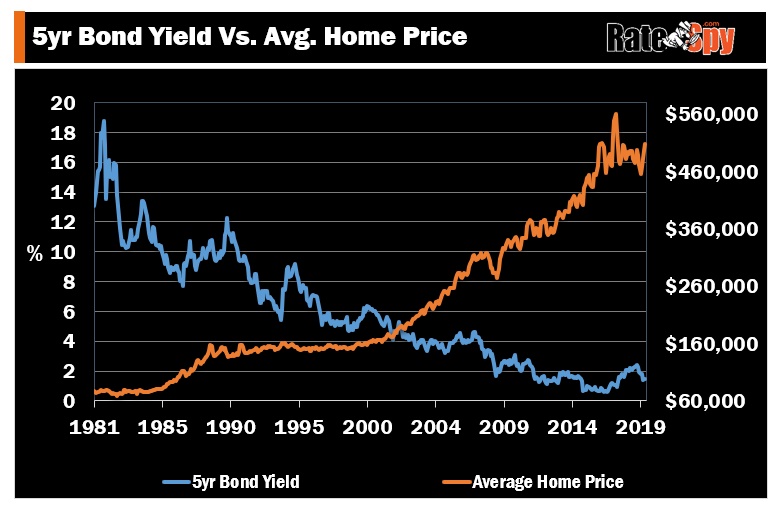

- Chart of the week: Causation aside, do you see any inverse relationship?

log in

log in

5 Comments

I’m convinced the Department of Finance gave major banks the power to set the stress test so regulators could control the qualifying rate behind the scenes. The Finance Department should be sued for negligence on this rule. Why should people not be able to buy because of horrible arbitrary decisions of a few idiots in Ottawa? The stress test is supposed to get harder or easier as market rates move up and down. Rates have moved DOWN. The stress test rate should move DOWN.

POB, I feel your frustration. And while we don’t condone insulting policymakers we do support holding them accountable for bad decisions. Suffice it to say, the mode Big 6 bank 5-year posted rate is one of the least objective and least adaptive stress test measures they could have chosen. They let the country down on this policy.

Canada has more inflation than Statscan lets on and I think we’ll see that in the data over the next few months. Wage pressures are already heating up. I see no reason to go variable here.

If one wants to argue that inflation is building beneath the surface, now would seem a fitting time. Core inflation is the hottest it’s been since 2012. Wage inflation is creeping up too at 3.8% (second strongest reading in a decade).

P off B: first, the government and regulators have the authority to choose whatever rule they want. You can`t sue them. Stress tests and rate floors are not unique to Canada, by the way, and are even more punitive in places like Australia. there`s no single rule used across all countries to my knowledge, but pretty much every country appears to be taking action to control household debt a decade into almost free money – read about the Irish situation (again) and Dublin – they don`t allow mortgages with more than 350% loan to income from what I can see. half of everything in life is to some extent, arbitrary. the chart at the bottom of the article speaks volumes.