Apart from the interest rate, probably the biggest complaint among reverse mortgage borrowers is that they can’t get enough money.

That’s now changing thanks to the launch of “CHIP Max” by HomeEquity Bank.

In a nutshell, CHIP Max is a reverse mortgage that lets you borrow more money in return for a higher interest rate.

That higher rate compensates HomeEquity Bank for higher risk, since you never need to make monthly payments and since you are guaranteed to never owe more than your home is worth (assuming you maintain your home and pay your property taxes when due).

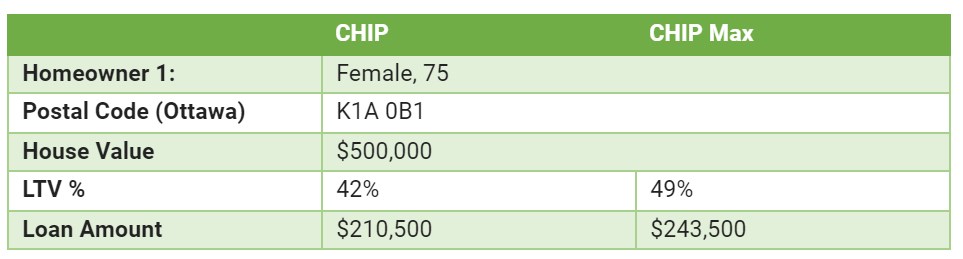

Here’s how CHIP Max compares with the original CHIP reverse mortgage.

|

CHIP |

CHIP Max |

|

|

Maximum loan-to-value |

55% |

55% |

|

Maximum loan amount |

Varies |

Up to 30% higher |

|

Lending area |

National |

Urban locations in AB, BC, ON and QC only |

|

Rate |

Currently 0.75 percentage points higher |

Here’s a “real-life” example of how much additional money a particular borrower might expect:

One might wonder how much extra risk HomeEquity is taking with this product. The answer is, not a lot.

Reverse mortgage lenders are extremely conservative. Less than 1% of all reverse mortgages that are discharged have a loan balance that’s higher than the property value. It almost never happens (reverse mortgage underwriting accounts for home price corrections as well), and CHIP Max won’t change that in any material way.

Pros and Cons of the CHIP Max

Some alternatives to the CHIP Max are:

- settling for less cash (which might leave you with other higher-interest debt)

- selling your home (most seniors want to stay in their homes as long as possible)

- getting a HELOC (difficult for most seniors who need to improve cashflow—due to the qualification requirements)

- getting a second mortgage (which comes with even higher rates and fees).

For many seniors, none of these are ideal solutions.

Compared to getting a second mortgage, CHIP Max is almost always cheaper (i.e., has a lower annual percentage rate with all things considered). That’s because the rate and fees are much less.

With a second mortgage, you generally pay a lender fee and broker fee, which can be upwards of 4-10% (or more) combined. That’s on top of often double-digit second mortgage rates. And, a second mortgage generally requires you to make a monthly payment and incur renewal fees. (FYI: The maximum total loan-to-value if you put a second mortgage behind a CHIP reverse mortgage is 65%.)

All this said, the borrowing costs of CHIP Max eat away at your home equity faster. Based on today’s best 5-year fixed reverse mortgage rate (6.74%), your loan balance would double in roughly 11 years. With the CHIP Max at 7.49%, it would double in just 10 years. For senior with no better options, however, that may just be the cost of doing business.

In Sum

CHIP Max will help a subset of seniors who need more money to live, but want to remain in their homes.

It will almost certainly boost demand for reverse mortgages, which have already been growing in excess of 30% a year.

Thankfully, products like this now exist for seniors who didn’t sock away enough money in their earning years. But at the same time, resorting to a 7.49% loan in your golden days underscores how vital it is to save for retirement early.

log in

log in

Apart from the interest rate, probably the biggest complaint among

Apart from the interest rate, probably the biggest complaint among

3 Comments

My home value is Approximately 400k with a mortgage of 160k what would I qualify for.

Hi Dave, Here’s a calculator that estimates potential loan amounts: https://www.chipadvisor.ca/calculator/

my home is all paid for, no mortgage .

The value i got last year was more or less $650.000.00

could i have the Chip advance ?