6:46 p.m. Update

- Prime Still Slated to Fall: Financial markets are still forecasting a 50-bps cut to the Bank of Canada’s overnight rate by April 15. Given government pressure on banks to pass through BoC cuts via prime rate, the expectation is for prime to fall to 2.45%. And while we were wrong on banks not cutting their prime rates by the same amount as the BoC, we were right that banks would not pass through the BoC’s 100 bps of monetary easing in full. Indeed, as noted below, banks have slashed variable discounts 80+ bps. That has the exact same result for new borrowers. They get squeezed despite BoC cuts.

- Quotable: “Governor Poloz suggested that the BoC wanted to have the benefit of the analysis on the impact of fiscal measures before taking its next decision on policy rates … If the BoC is waiting for everything to be set in stone before deciding whether it should cut rates towards zero, it may well be waiting for Godot.”—Desjardins Economics (via MT Newswires)

1:59 p.m. Update

- Cash Infusion: The Prime Minister says people who’ve lost income due to COVID-19 will get $2,000 a month. Canadians who qualify (more details on that) will be able to apply in “early April” and receive the cash in 10 days. The benefit is paid every four weeks, is designed to last up to four months and will end Oct. 3, 2020. This and mortgage payment deferrals will further mitigate credit delinquencies.

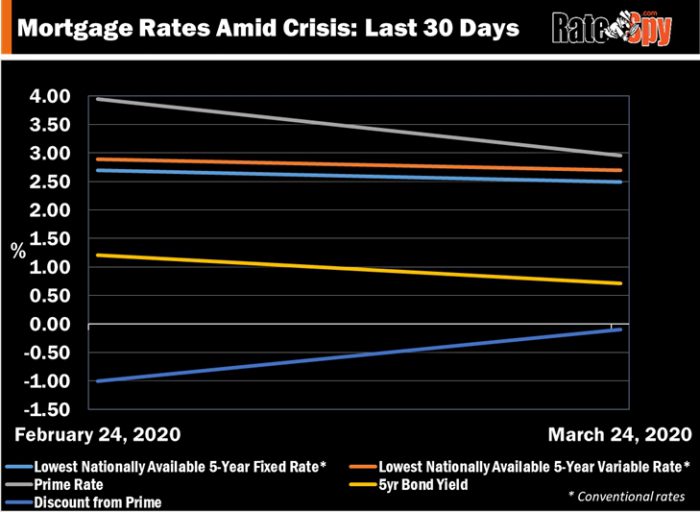

- Rate Changes: Here’s a look at how mortgage rates have moved over the last 30 days. This chart shows the lowest nationally-available conventional rates. And they’re mostly lower, thanks to a falling overnight rate. Government officials warned banks not to use this crisis as an opportunity to pad their profit margins. Meanwhile, big banks have slashed variable-rate discounts, thereby consuming (i.e., not passing along) over 80 basis points of the 100 basis points that the Bank of Canada cut.

12:18 p.m. Update

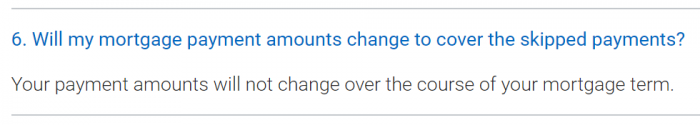

- Mass Confusion: There’s all kinds of misinformation over payment deferrals. Most lenders are not increasing borrowers’ payments during the term of their mortgage if the borrower opts for a deferral. And that’s the way it should be. People need a chance to get back on their feet. Lenders should defer payment increases until renewal on fixed-rate mortgages, but some are not. Here’s a screenshot of the policy from Canada’s biggest mortgage lender, RBC:

- C’mon: One reporter ridiculously sensationalized the fact that lenders must charge interest on the skipped payments, quoting someone who called banks “egregious and underhanded” for needing to get their interest back. As if banks should lend for free, in addition to offering unprecedented flexibility to borrowers in need.

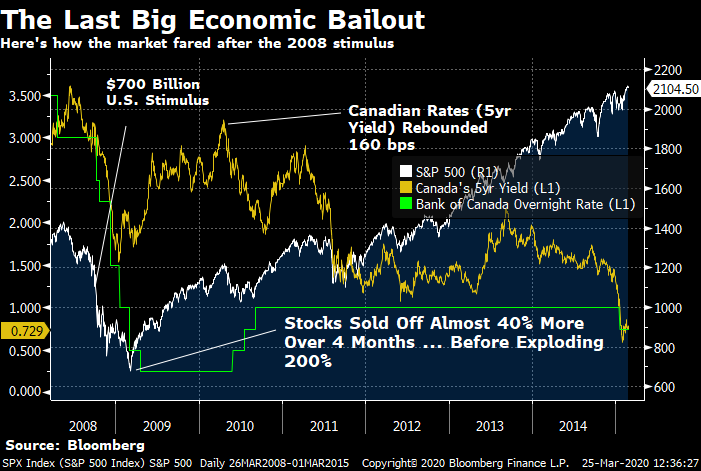

- Stimulated: The Americans have announced the biggest stimulus package of all time ($2 trillion) and the S&P 500 has mustered a 2.5% gain (as of this writing). Nonetheless, with C-virus cases doubling every three days in parts of the U.S., investors fear this crisis will outlast early government attempts to mitigate it. Markets need a continued feed of good news, possibly from a U.S.-Saudi oil deal, to keep the upward momentum going. Otherwise, analysts say we’re almost certain to test last week’s market lows.

- Far From Over: The U.S. also passed a historic stimulus package back during the financial crisis. Stocks then plunged another 40% over four months. Canada’s 5-year yield—which usually steers fixed mortgage rates—rebounded over a point-and-a-half. But the Bank of Canada’s key rate stayed at a record low for over a year before rising modestly and flat-lining. Here’s what happened next…

9:49 a.m. Update

- Survival Mode: This Toronto Life article features a restaurant owner contemplating a costly second mortgage to keep his business afloat. How many countless others are in the same boat? It’s why qualified entrepreneurs need home equity lines of credit — which still have rates as low as 2.85%, by the way, a rate that seems completely illogical (too low) given rising credit risk and HELOC liquidity constraints.

- Tough Times for Banks: “Drastic rate cuts announced by the Bank of Canada and the Fed is the most visible earnings headwind for the banks,” says National Bank Financial. Worse yet, expect more than a 100% increase in loan loss provisions, it says. “We believe the next few quarters will reflect recessionary-like credit performance.” It’s no wonder banks are padding their mortgage rates.

- Waning Homebuyer Interest: Some anecdotal evidence that home searches are decreasing.

- Joblessness: One of the last things lenders want to hear is: “the unemployment rate will climb to near 15% in the coming months,” and that’s exactly what they just heard from Capital Economics and others.

- RBC Sees 0.25%: “…We anticipate the Bank of Canada will cut its policy rate further to just 0.25% and turn to large-scale asset purchases, also known as quantitative easing, a tool that has not been used in Canada.” But think twice if you believe record-low rates will stoke real estate prices. The nation’s biggest bank is also forecasting a stunning 18% plunge in Q2 GDP. Here’s a long-term chart of quarterly GDP if you’re curious how big -18% is.

Quarterly GDP

Source: tradingeconomics.com

log in

log in

8 Comments

We are looking at moving our $100,000 HELOC (4.45% big bank rate) into a 3 year fixed term mortgage at 2.39 %. Do you think it would be wiser over the same time frame to go with another HELOC at 2.85% (prime -0.10)? Or take the fixed rate? We would be cutting our interest down either way. I’m thinking prime rates wont change much or will go lower over the same period. Your thoughts?

Hi Mark, Regarding a HELOC vs 3yr fixed: It’s largely a question of how long it will take to pay back the HELOC borrowing. The best approach would be another open HELOC if the debt were to be paid off in the next year for example. If the debt we’re going to linger for 3+ years then a low cost 3yr fixed could indeed be appropriate, assuming that is the optimal term for the borrower.

“ Most lenders are not increasing borrowers’ payments during the term of their mortgage if the borrower opts for a deferral. And that’s the way it should be. ”

Yes, but your payment will be reset when your term matures, whenever that is. Which could be for some serious payment shock when you don’t pay principal for 6 months (or more if it’s extended).

Hi Tbahz, The increase will be immaterial for most people. On a standard $300,000 mortgage, the payment might go up $20/month for example. Theoretically, one could extend their amortization a mere seven months to cancel out that payment increase.

Hi there..I’m not quite sure how you answered my question?

I have a question:

I have a fix 4yr with 2.69% which I got 5mo ago. With current situation I also got approved for variable 5yr with prime-1.01%. I am hesitant to switch since I need to pay $8k penalty, and I am not sure how long prime will stay low. Mr. Spy, based on your experience and my current rate and penalty, do you think it is wise to switch or I will loose money long run??

I really like your writing style and content. It’s instructive and entertaining! At this stage I think the 5 years fixed are starting to look more and more attractive, rates will probably stay low for a few quarters and start to creep back up.

The housing market that I was looking at was having 3-4 homes listed steadily every day since March it hit the wall, lot of sellers are waiting on the sidelines or not ready to cut their price 10-20%, some motivated sellers did heavy price cut some are listing 25 – 30 % above average ( * shrugs * ).

P.S. Small town buyer market

The thing Im worried about in a falling market is an increased city tax bill, omce that sets in, it keeps a lid on any price appreciation.

Hi Patrick, You’re right. Much has changed in just the last 2-3 weeks. That means (for new borrowers) certain 5-year fixed rates are looking better than variables at this point. There are also a few good short-term fixed offers out there.