Some quick hits on the mortgage/rate market (we’ll update these throughout the day):

5:14 p.m. Update

- Behold Sub-2% Variables: Existing variable-rate borrowers with prime – 1.00% are now enjoying 1.95% mortgage rates. Some homeowners have prime – 1.30% or lower. That’s an incredible 1.65%. New borrowers can still get prime – 1.00% or better but, as noted below, they have to qualify (prove they can afford) a payment at 5.04%.

3:49 p.m. Update

- Stress Test Eases Tomorrow: The benchmark rate (a.k.a. minimum stress test rate) will fall from 5.19% to 5.04% tomorrow. That’ll boost the mortgage amount typical borrowers can qualify for by roughly 1.30%.

- NBC Cuts: National Bank has dropped these posted fixed rates:

- 1yr: 3.39% to 3.29%

- 4yr: 4.89% to 4.64%

- 5yr: 5.19% to 5.04%

2:41 p.m. Update

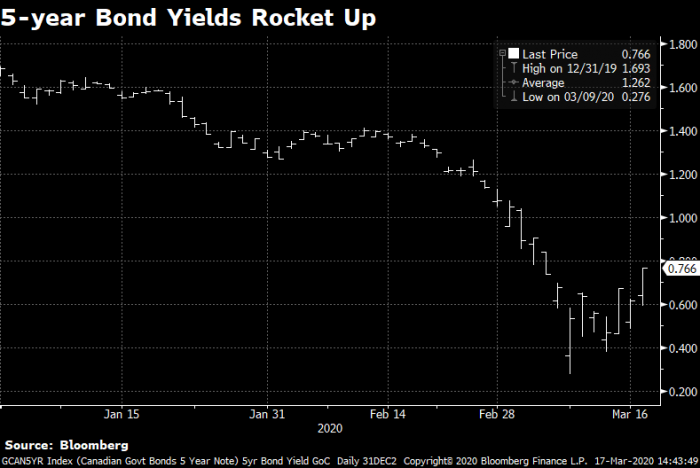

- Yields Rally: Canada’s 5-year bond yield, which impacts fixed mortgage pricing, is taking off. This will add further lift to fixed rates, which are already trending up due to liquidity/risk concerns. If you’re fixed-rate shopping and haven’t already, apply for a rate hold now. The lowest 5-year fixed rates are just 12 bps from the all-time low and this isn’t the time to be greedy. Rates can always turn lower and if they do, you can reset your rate if necessary (or apply elsewhere if the lender that approved you isn’t competitive).

12:28 p.m. Update

- Bank of Canada Statement: The BoC says it saw “considerable benefit to reducing interest rates immediately and significantly,” and that the oil crash could weigh on interest rates longer than the coronavirus.

- Fiscal Relief Ahead: Ottawa is expected to announce a fiscal aid package tomorrow. It will partly mitigate the economic slowdown and might add upward pressure to bond yields, which influence fixed mortgage rates.

- Quotable: “The modern economy is run on confidence and credit … if we each tighten the belt 1 per cent or 2 per cent, when the economy is only growing at 1 per cent or 2 per cent, you have a recession”—Brian Madden, Goodreid Investment Counsel (Globe & Mail)

- Default Perspective: Self-employed mortgage applicants are coming under greater scrutiny by lenders. Income type matters more than ever. A borrower who makes widgets in a widget factory is a whole different risk profile than a borrower who can e-commute. Factoid: One quarter of small businesses would not survive more than a month if their revenue dropped 50%, says the Canadian Federation of Independent Business.

11:09 a.m. Update

- Trudeau on Mortgage Aid: The Prime Minister said today that it’s possible the government will set up a program to help Canadians adversely impacted by the coronavirus with their mortgage payments.

- TD Moves: TD cut its posted variable rates by 50 bps today to match the drop in prime:

- 5-year closed: 3.60% to 3.10% (prime + 0.15%, or “TD Mortgage Prime + 0%)

- 5-year open: 4.60% to 4.10% (prime + 1.15%)

- TD left its 5-year variable-rate “special” at 2.85% for now (i.e., prime – 0.10%)

-

CIBC Moves: CIBC also lowered its posted variable rates by 50 bps

-

3-year closed: 3.45% to 2.95% (prime + 0%)

-

5-year closed: 3.45% to 2.95% (prime + 0%)

-

5-year open: 5.25% to 4.75% (prime + 1.80%)

-

-

BMO Keeps the Rate Cut: Bank of Montreal left its advertised variable rates effectively unchanged. In other words, like some other lenders we’re seeing, it hiked its variable-rate premium to prime rate and pocketed the 50 bps BoC cut:

-

5-year closed: 3.45% (from prime to prime + 0.50%)

- 3-year open: 4.65% (from prime + 1.20% to prime + 1.70%)

-

10:12 a.m. Update

-

Variable Deals Still Here: Despite our major banks taking the variable-rate punch bowl away, there are still tremendous (prime – 1.00% or better) floating-rate deals to be had from HSBC, brokers, motusbank and others. This could change on a dime, however, as the trend is a shrinkage of prime rate discounts. We’ll keep updating deals throughout the day on the best variable rates page.

-

Scotiabank Moves: Scotia cut the following posted variable rates by 50 bps today:

-

3-year closed: 4.35% to 3.85% (prime + 0.90%)

-

5-year closed: 4.05% to 3.55% (prime + 0.60%)

-

5-year open: 6.75% to 6.25% (prime + 3.30%)

-

9:45 a.m. Update

-

RBC Shaves Variable Discount: The nation’s biggest mortgage lender and rate trendsetter has increased its special variable rate from 2.85% to 2.95%. More importantly, it has boosted its posted 5-year open variable rate from prime + 2.00% to prime + 2.50%. RBC’s internal discretionary variable rates reportedly surged 60+ basis points to prime + 0%. The move more than cancels out the 50 basis point cut to prime that it made today. Its 5-year posted variable remains at prime + 0.00% (corrected from a previous report of prime + 0.50%).

- Stocks near lows: If we break yesterday’s lows in major stock market indices, there’s worry of a free-fall. We don’t know if that will happen but if it does, it could further improve one of the greatest buying opportunities of our generation, say analysts. “Since 1900, there have been 22 equity drawdowns of 20% or more and the current 30% slide would rank #14 overall,” said Morgan Stanley. In every single instance, stocks were higher one year later.

log in

log in

7 Comments

I am in the 6 month window to renew with Scotia. Called last Thursday and was given these options

5 year fixed 2.52%

4 year fixed 2.42%

3 year fixed 2.40%

5 year variable 2.71%

Called earlier today ,(Tuesday) and got this

5 year fixed 2.77 %

4 year fixed 2.67%

3 year fixed 2.65%

5 year variable 2.81%

So there is truth that rates have been slightly hiked after the boc rate drop

Thanks for the report Tom. That variable is up 60 bps if one factors in prime falling 50 bps.

Darn those big banks and their sneaky rate-premium hikes! I can’t wait to see how much they pocket after the BoC’s next rate cut!

So the question remains – lock in now or wait and see??

We just got 2.37% 5 year fixed rate

Carlos which bank is it?

Where did you get 2.37% for 5 yrs fixed?