Opps!…They…Did…It…Again.

For the third time in 11 years, the planet’s monetary policy superpower has elevated America’s key lending rate by 1/4 point. Now it’s a question of how Canadian rates will react.

In and of itself, one highly anticipated U.S. rate hike is immaterial. It’s the longer-term trend that’s worth talking about.

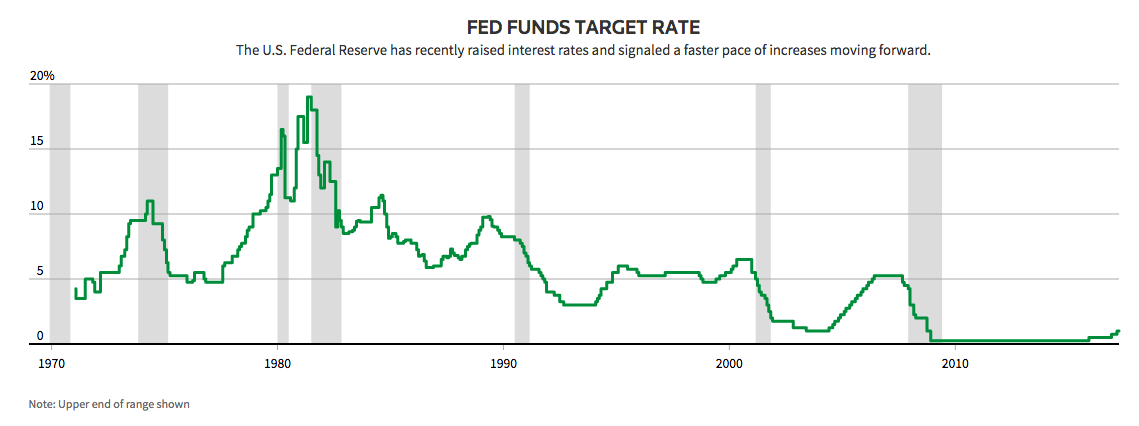

Source: Reuters

On that note, the Fed projects its policy rate will end up near 3.00% (the so-called “neutral rate”) by 2019—a full two points higher than today. Mind you, its forecasting record is as imperfect as my March Madness record.

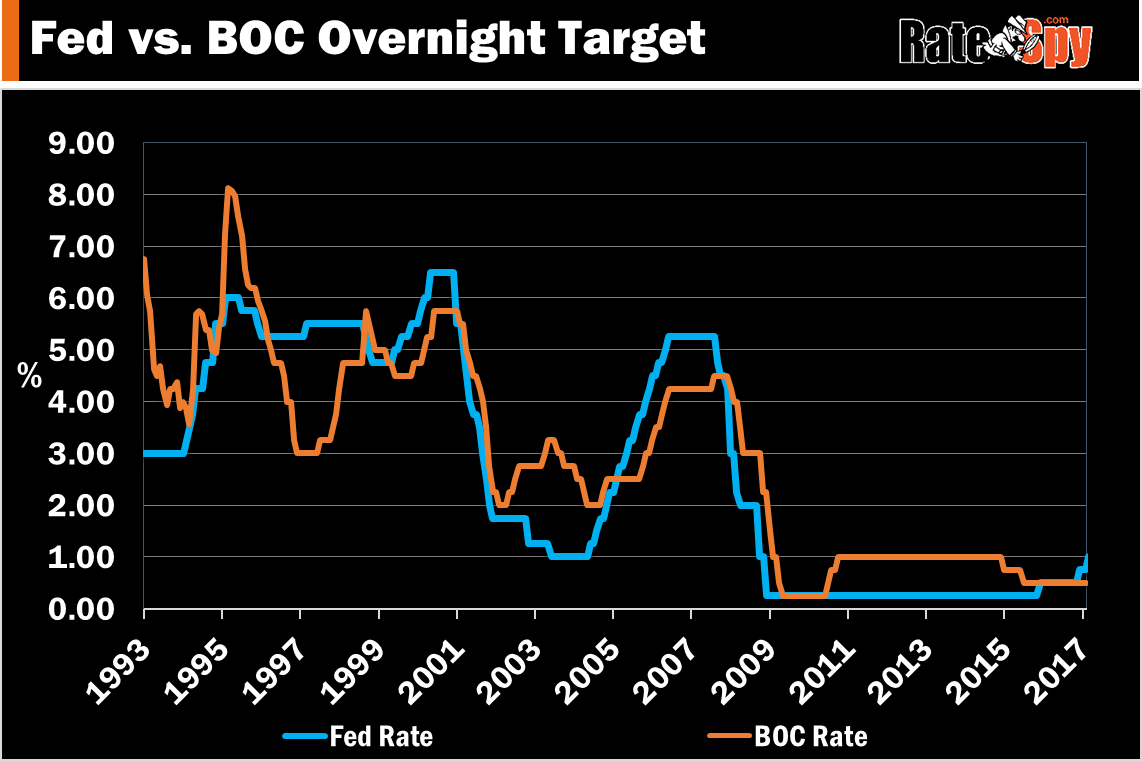

Whether U.S. rates get to 3.00% is neither here nor there. With rate predictions you’re either wrong or lucky, so we won’t speculate. But if the Fed funds rate does pierce 3.00%, that doesn’t mean Canadian rates have to.

We’ve got our own anxieties to worry about up here, not the least of which are vulnerability to oil prices and home values, overleveraged consumers, soft business investment and sluggish non-energy exports.

While we sort out those things, the Fed is telegraphing at least two more hikes in 2017.

Further out (2018 and 2019), the rate picture is far more opaque, especially in Canada. But here’s an interesting factoid mentioned on RateSpy TV last week. One year after the Fed hikes rates, Canada’s 5-year yield has actually fallen, on average.

That’s utterly unscientific (we only reviewed the last 20 Fed hikes), but it is a reminder that rates are cyclical.

Moreover, not only have rate increase cycles proven notoriously short over the past three decades, but come the next recession, rates are headed right back near zero.

So don’t read too much into what Yellen & co. are up to down south. Simply be aware that in the Trumpinator’s growth-obsessed economy, the path of least resistance for U.S. rates should be up. And if historical correlations persist, Canadian rates could be dragged along for some of that ride.

But fret not. The ride won’t be a painful four-year ordeal, a la the late 1970s. Secular trends and monetary policy have anchored core inflation below the BoC’s 3% tolerance since the dawn of Canada’s inflation targeting regime (circa early ’90s). A sustained surge above that limit is almost unfathomable, and the bond market agrees. Real return bond prices imply that total inflation will actually average below where it’s stood over the prior five years, according to a recent CIBC report.

So if you’re a mortgage shopper keeping score, it breaks down like this.

For financially secure borrowers and/or those planning changes to their mortgage down the road, this week’s Fed hike is no reason to rush to your lender and lock down for five long years.

It is, however, a reminder to set aside more of your future paycheques for interest expense…just in case.

If financial security is more of a dream than reality in your world, you really have no business in a floating rate, not at this point in the rate cycle. Go long and catch a sub-2.50% 5-year fixed rate with a fair penalty, decent refinance options and good portability. Then you can worry about more important things than your rate…until 2022.

log in

log in

7 Comments

I agree with your assessment that the BOC’s overnight rate may rise slightly more than they would have otherwise without US influence. I think the big question is timing and how long it is going to take us to get to more normalized rates. But as we’ve seen in the past, and as you allude to, sustained rate increases can quickly have the wind knocked out of them by unexpected geo-political events. I guess we can only wait and see.

Whether Cdn interest rates go up or down, one might bear in mind that a recession usually comes with job losses. A 5 year fixed mortgage means you won’t have to re-qualify for 5 years. That security may have value for some.

Rates are going nowhere. They increase one quarter, they decrease the next. I went with var in 2014 when everyone was telling me (mortgage brokers) that the increase is imminent. Now in 17 I went with 5 year var… that is how sure I am that I will still be ahead vs fixed. Would do the same in US. No real growth in the whole world only economy based on housing and stock market speculation. The economy is on life support and they can’t pull the plug… so they try to prop it up with words. I don’t trust anything out of fed (or any other central bank) mouth. Good luck. See you in 5 years…

Nenad,

With all due respect, what rates have done is irrelevant. History is no predictor of the future.

In 2014 the bottom fell out in oil. That is why you did better in a variable and that could not have been predicted.

No one can predict U.S. inflation either, which by the way is running at a 5-year high and trending higher.

Like I said see you in 5 years. Good luck…

One cannot predict oil, inflation and so on. However one can look at the global economy and see no real growth since at least 2009 and I would even go to since dot com crash. Economy is based on debt, debt and more debt. There is a chance fed will pull the plug, but that will lead to hyper inflation, high unemployment and quite possibly revolution or war. In that case I’ll probably not be too worried about my mortgage. There is only so much money you can print and only so much debt you can create.

The real inflation is running much higher actually as they changed ratio of inclusion to artificially make it seem smaller.

I agree with Nenad and I too went variable this month, although for 5 years. My strategy is to inject a good cashdown in my new condo, and accelerate payments with lump sums if I see rates increasing. The way I see things, the Bank of Canada doesn’t have the freedom to raise rates substantially with all the over leveraged mortgages on overvalued properties right now in Canada.

That being said, I’m actually betting on a stock market crash within the next 5 years and I actually believe rates will go lower, so let’s see that the future brings and good luck to all.

Nenad,

If “one cannot predict” the market as you say, then why are you looking back at the economy and inferring what it means for the future?

That is a contradiction, no?

To suggest the North American economy will behave the same post-Trump as pre-Trump is a stretch and little more than supposition.