Any creditworthy mortgage shopper is practically guaranteed to get a better rate today than they could have at the start of the year.

Fixed mortgage rates have been on a ski slope this year, sliding to two-year lows this month.

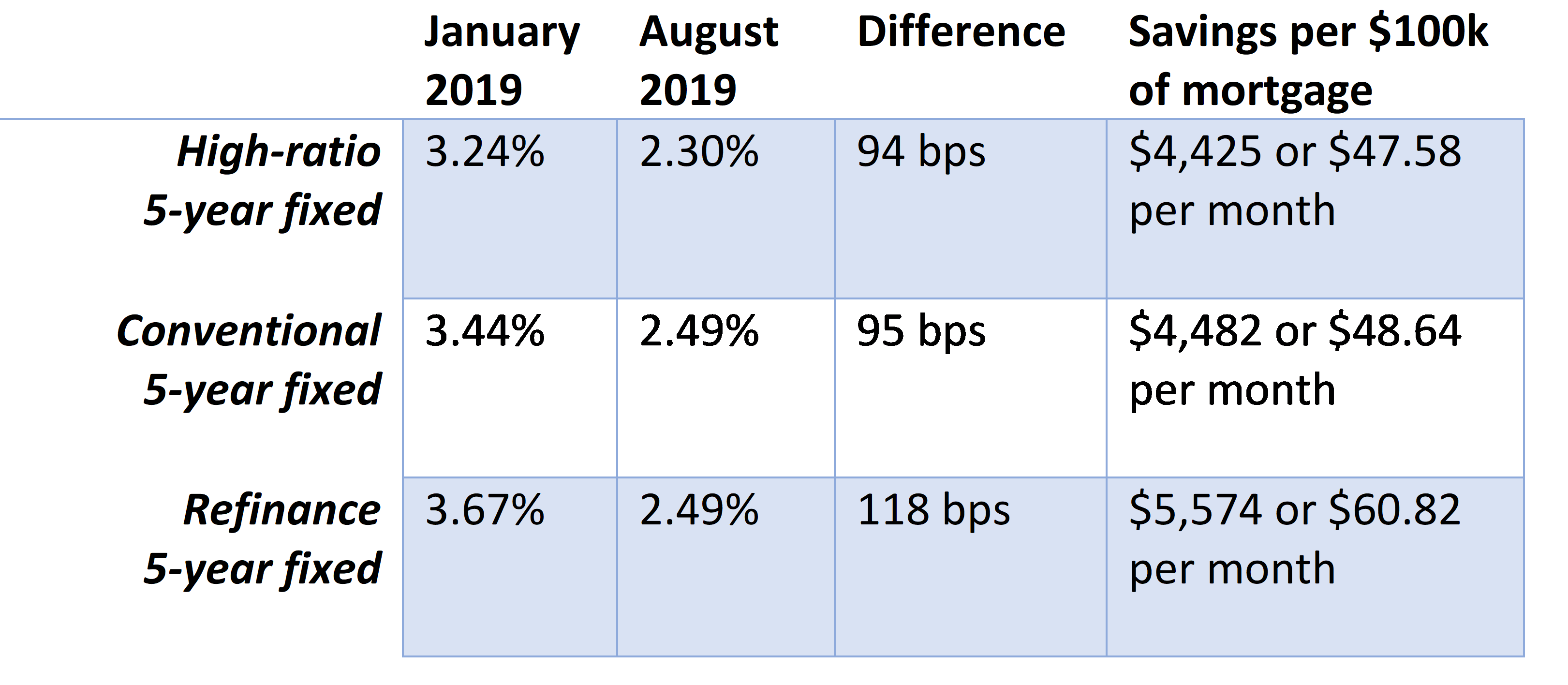

If you’re wondering how far they’ve tumbled, here’s a look. These were the best widely available 5-year fixed rates, as of January 1 and yesterday:

Notice the material interest cost savings of today’s lower rates. That savings has a very real and positive economic impact, boosting aggregate consumption by tens of billions of dollars over time.

Mortgage Rates Falling More Than Yields

Plummeting bond yields almost always take fixed mortgage rates down with them. But these days, fixed rates are dipping faster than yields.

Since January 1, the 5-year bond yield has dropped 71 bps to a two-and-a-half-year low of 1.18% (as of Wednesday). But 5-year fixed rates are down 15-39 bps more than that, depending on the mortgage type.

Much of that is lenders playing catch-up since they took so long to cut fixed rates after the November yield slide. Some of it is lenders getting more anxious to meet targets as fiscal year-ends approach.

How Low Can They Go?

Canadian rates are following U.S. yields lower as trade wars escalate economic uncertainty. Below the border, the U.S. 30-year Treasury sunk to a record low of 1.90% on Wednesday, while European benchmarks also fell to levels never seen before, according to Bloomberg.

At the moment, few can see the bottom. “Anyone who is handing you a hard forecast in that scenario is throwing darts,” Wells Fargo analyst Michael Schumacher told CNBC.

Meanwhile, that oft-mentioned recession indicator called the yield curve just keeps on inverting. Long-term rates are now further below short-term rates than they have been in a dozen years. But we really need to see stumbling consumer confidence, retail sales, stock prices and/or oil prices to presage another major nosedive in yields. Albeit, our 5-year bond could easily fall below 1.00% without such confirmation. That would push Canada’s lowest 5-year fixed rates amazingly close to 2%, a number some pundits in 2016 suggested we might not see again.

As for traders, they’re pricing in another U.S. Federal Reserve cut next month and 100 bps of cuts in 2020. As noted here before, if the Fed lowers its key rate 50 more bps, the Bank of Canada will be widely expected to embark on its own rate cutting cycle. If the Fed cuts just 25 bps from here, the timing of the next BoC cut is more of a toss-up.

log in

log in

Plummeting bond yields almost always take fixed mortgage rates down with them. But these days, fixed rates are dipping faster than yields.

Plummeting bond yields almost always take fixed mortgage rates down with them. But these days, fixed rates are dipping faster than yields.

4 Comments

Q1. if the refinance market is so uncompetitive and so damaged by previous government policy decisions (e.g., insurance), how can you explain the drastic and obviously hyper competitive refinance rate available to Canadians.

Q2. how can anybody look at this table and come to any conclusion other than Canadians have access to amazing low rates across the board from a very competitive and healthy marketplace.

Q3. would you agree that if there was ever a time for a stress test of at least 200bps or more, it is now and this decline only solidifies that rational position. thanks.

Hey David, Great questions. Some thoughts…

A1. Refinance competition is notably weaker today than it otherwise would be, had policymakers not killed economical securitization of refinances. That’s indisputable fact.

That’s not to say refinance rates aren’t low. They’re low. But the better question is, are Canadians now better off. In other words, are we better off giving more of our paycheques to banks (via 10-20 bps higher refi rates) and better off with lower insurer and securitization revenue (which would have improved Ottawa’s balance sheet), in exchange for marginally lower bond yields and bailout risk.

A2. See above.

A3. High debt loads, falling rates and rebounding home prices (among other risks) make it a good time for a 200 bps stress test. But not this stress test. What regulators concocted has serious flaws that hurt more Canadian families than necessary (e.g., the mortgage qualifying rate is not adapting as it should because the benchmark is being manipulated, renewers being are needlessly trapped at higher cost lenders, etc.). Some argue the B-20 stress test wouldn’t even be necessary had housing policy leaders had the foresight to address building supply shortages years ago.

High school economics and a little bit of research into savings trends is all it takes to figure out that interest rates are likely to stay generally low for years to come.

More demand for bonds drives the yields lower, and one example of that demand is from pension funds. Recent OECD data shows pension funds growing much faster than GDP. Those funds tend to allocate much of their savings to bonds, which helps push lower rates.

Obviously there are other factors like QE, private investments, ect., but the pension funds is one factor that is primarily driven by demographic factors that are very stable.

https://www.oecd.org/daf/fin/private-pensions/Pension-Funds-in-Figures-2018.pdf

I see this as a good reason to be overweight equities, since PE ratios will continue to grow as bond yields drop. The inverted yield curve doesn’t scare me as long as unemployment doesn’t rise. An inverted yield curve does not cause a recession, but unemployment often does. Consumers don’t stop spending when the yield curve inverts, but they they do when they stop getting a paycheque.

I tend to agree with the latest forecasts that are calling for a 25-basis point cut in October. They’ve held off long enough to monitor domestic economic data. The big question is whether we get another 1 or 2 rate cuts next year. That would bring variables back into a more normalized range. But as you’ve pointed out here before, I don’t have much confidence that the big banks will pass the full interest savings on to consumers through their prime rate reductions.