The foundation for all Canadian interest rates is the overnight target rate. It’s been stuck at or below 1% for an incredible eight years.

That’s never happened before.

We’re living in bizarro economic times and those with big mortgages are hoping they’ll last.

But inflation, the key interest rate driver, is not down for the count. As sure as the Maple Leafs will disappoint us again, core inflation will ultimately remind us that, yes, it can exceed the Bank of Canada’s 3% tolerance.

Will it happen this year? Not a chance (okay maybe a tiny chance).

But once that threat does become real, the Bank of Canada will rush like an addict on free needle day to lift rates. And everyone will be asking the same questions when they do: how many increases, and how fast?

History is a Guide…Sort of

Investment disclaimers always say, “Past performance may not be indicative of future results.”

But the past does provide a sense for what could happen, and history is unambiguous about one thing: rate spikes lack stamina.

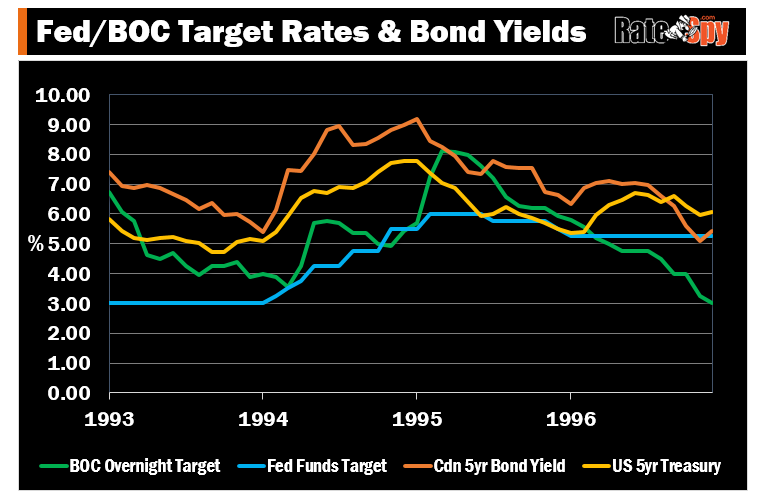

Since the 1980s, every time rates have surged, they haven’t stayed high for long. Case in point is this chart:

This graph depicts the largest rate hike we’ve ever seen in the modern era of monetary policy (i.e., since the Bank of Canada started inflation targeting).

In 1994, Canada’s overnight rate rocketed over 450 bps in just one year. If that type of eruption happened today, people would be leaping from their overpriced condo balconies.

But notice that it took only 20 months for rates to once again make new lows.

There have been four other rate spikes of note since inflation targeting began, and none of them lasted much longer. In fact, if you back-tested today’s level of mortgage discounting, and looked all the way back to 1991, you wouldn’t find a single case where the best 5-year fixed rate beat the best variable rate. (Albeit, if you ran this test with more typical rates you’d find several cases where a 5-fixed outperformed.)

Note: We ran this analysis this by comparing a discount 5-year fixed (i.e., one that was 150 bps over the 5-year bond) to the average variable rate over the following five years, based on prime – 0.70%. Obviously this isn’t scientific, mainly because of the sample size, the fact that rates have been downtrending long-term, and because discounts were never this big in prior decades. But discounts should stay in this ballpark or better going forward—barring further government changes.

Noted Professor Moshe Milevsky did a similar study in which he backtested large discounts on historical data. He found that variables win roughly three-quarters of the time. Although his research relied on rates that are higher and less realistic in today market.)

The Moral

Variable rates aren’t as risky as many think; at least they haven’t been in the past.

You could have taken a variable rate at almost any point during the biggest rate increases of the modern era—and still saved more than a 5-year fixed.

Long-term deflationary trends and debt-gorged consumers (who can’t spend as much as they used to) also favour a floating rate strategy. The lower inflation remains, the less chance the BoC will take away the low-rate punch bowl.

Of course, the fact that people think rates will stay low is not a reliable reason to go variable. Predicting rates is like predicting the path of a drunk chicken (or even a sober chicken for that matter). If you’re right, you’re probably just lucky.

The four best reasons to choose a variable boil down to these:

- you have the financial cushion to withstand higher interest costs

- you have the discipline to ignore headlines about coming rate hikes

- you prefer a mortgage with a cheap prepayment penalty, and

- you have confidence that variable’s historic outperformance will persist (in general, over time).

If you check these boxes above, a variable just may be your ticket.

log in

log in

The foundation for all Canadian interest rates is the overnight

The foundation for all Canadian interest rates is the overnight

10 Comments

Are we really living in “bizarro economic times”? The technology of interconnected markets and more transparent financial information has has lead to much lower costs for money management (MERs). The computer systems that have permitted easy access to stocks around the world have also permitted easy access to international bonds. More efficient money markets seems to be reducing the spread between interest rates an inflation, which isn’t bizarre at all.

Hey Ralph,

Choose your favourite adjective. ‘Bizarro’ works for this guy.

When 500 million people live with negative interest rates, that’s not normal — not by any historical definition of normal.

Twenty years ago, if you would have predicted that 1/4 of the world’s economies would have negative rates, you’d probably be committed.

In some parts of the world lenders actually pay customers with floating rate mortgages.

When Canada experiences its next recession, odds are good that our overnight rate will hit or break 0%. We’ll see big banks selling 1.99% 5-year fixed rates on every corner.

Negative rates are an act of desperation by central banks, regardless of what causes them (and there are lots of other causes besides what you mentioned). We’re living in unique times my friend.

p.s., now that you’ve done the 5yr fixed vs variable comparison, I’d like to see a comparison of 2yr vs 5yr fixed. For most of the past 15 years I’ve been a believer in the 5yr variable, but now I think short-term fixed is best. I think interest costs are about the same for 5yr variable and 2yr fixed, and you gain flexibility when you are locked in for just 2 instead of 5 years.

Let’s hope history repeats itself in the event of a rate spike, though I think that could be many, many (many) years out. I think like you’ve mentioned above we haven’t seen the end of rate cuts (and indeed negative rates).

I have always been of the opinion that variable will always be better off over time. When you go fixed you are basically paying a premium for the piece of mind that your payments won’t be affected should rates increase. I agree when the general population thinks variable they think risky, and it really isn’t the case. I just got a 5 year VRM for prime – .85 (1.85% current rate). Could have got a 5 year fixed for 2.39%. Choose variable even with a pretty low spread. That 55 BPS difference can potentially save me over $6000 on a 5 year term on my 335K mtg

Eric, is that on a low-ratio mortgage (<=80%LTV)? If so, prime -.85 is a steal. It's been a few years since I've seen discounts that low.

P-86 is the lowest I see anywhere for conventional and that is not available on refinances.

I don’t think it’s available on above 65% LTVs either.

This is for a high ratio mortgage. I only put the minimum 5% down.

Where did you get prime -.85? Please share how you got this?

Look on the website you’re on.

Brokers are advertising prime -1.01%

https://www.ratespy.com/best-mortgage-rates/5-year/variable