Imagine this.

You’ve just found the perfect house after weeks of searching.

You’ve clawed together every available dollar for the down payment.

You’ve gathered up all the necessary documents.

And you’ve found an amazing mortgage rate on the Spy.

But wait. What’s that? Your credit score has sunk to 645?!?

Those two missed payments, 85% credit utilization and recent credit inquiries have driven down your score 75 points since you checked last year.

You can now say adios to that amazing rate.

Good Scores: Important Before. Crucial Now.

In June 2016, Canada’s most-used credit bureau (Equifax) changed its reporting formula. In doing so, it reportedly made credit scores even more sensitive to credit utilization. It also added mortgages and telco accounts to your score.

As a result, we heard countless cases where people’s scores were plunging or soaring for no apparent reason (according to them).

Add to that a mess of government policy changes that forced lenders to assign greater weight to credit scores in their underwriting decisions and mortgage pricing.

The result is that your credit score matters now more than ever, literally.

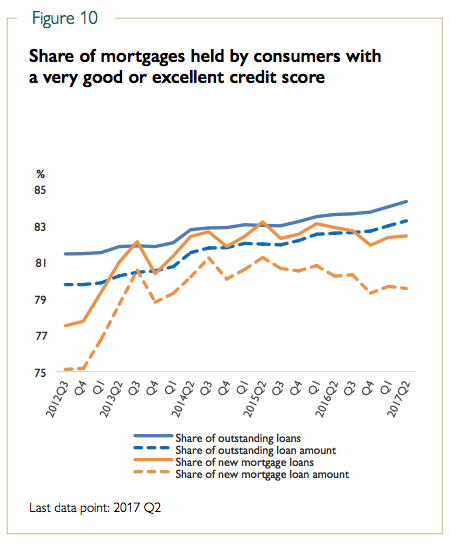

If you don’t have at least a 680+, you can almost forget about getting the best deal. In fact, some lenders now want to see 700 or 720 before they’ll even think about granting you their lowest rate. (The average Canadian’s score is 750, according to CMHC’s latest edition of Mortgage and Consumer Credit Trends.)

Source: CMHC

Defend Your Score

The actual credit score formula is a black box but there’s no magic to what makes a great credit score. Scoring high is largely the result of always on-time payments, low credit utilization (relative to your credit limits) and established (aged) accounts.

If you’re curious, here’s the recipe for score improvement from FCAC: link

And remember, you can’t manage what you don’t measure. So step #1 is getting a credit score.

Nowadays companies are giving free scores away like candy. Leading that trend are Borrowell, Mogo and Credit Karma.

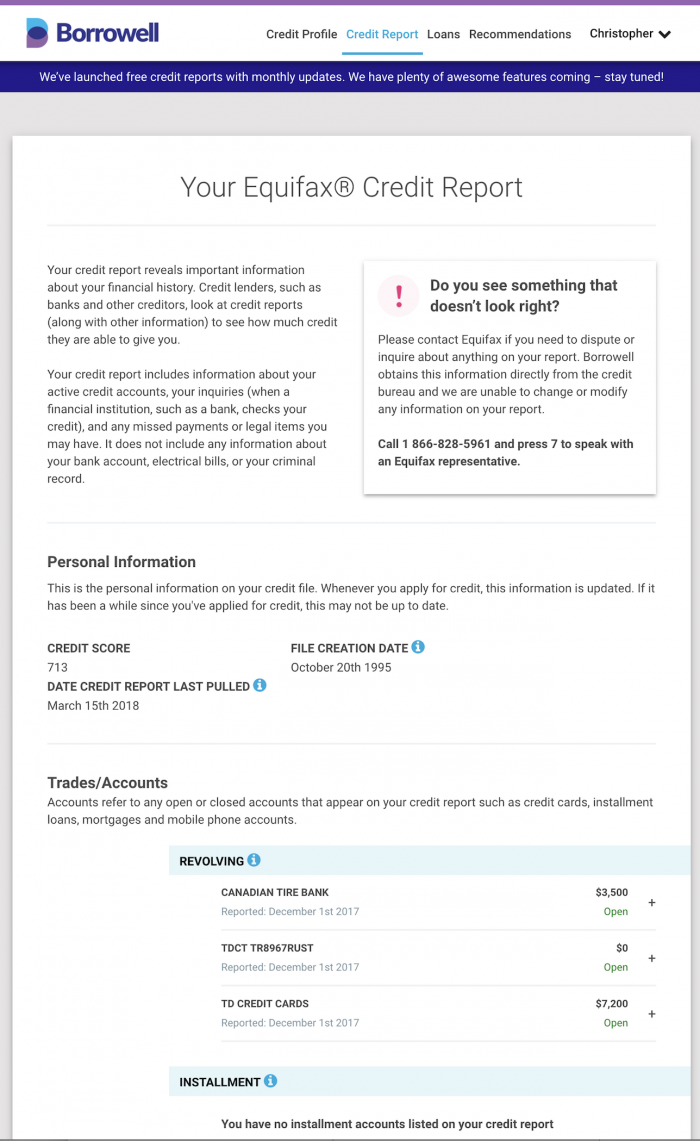

Of these three, Borrowell is the only one that also gives you your Equifax credit report for free. Here’s a link with more info.

What a credit report does is show you what’s impacting your score. You can see your history of payments, your credit inquiries, any judgments filed against you, etc.

Most importantly, you can see if you’re using too much credit and if there are any mistakes on your report.

Spy Tip: Keep your revolving account utilization under 50%. You can let it run higher temporarily, but if you exceed 80-90% you might see your score take a beating.

If you want the best mortgage rates, it’s vital to check your report well before you apply for a mortgage. Reason being, credit bureau mistakes and high credit utilization can take at least a few months to fix, if not longer.

This is a sample credit report with mock data for demonstration purposes only.

Note: All credit scores provided by free providers, and even Equifax’s own paid score, are ERS (Equifax Risk Scores). They’re a little different from the “Beacon Score” that lenders and brokers use, but they’re usually (not always) close enough. There is no provider who provides Beacon Scores to consumers for free. But almost every mortgage broker has access to it.

Expunging Your Delinquencies

Creditors understand that we all make financial mistakes and, like an understanding parent, are willing to forgive and forget, as long as you can prove rehabilitated financial behaviour.

Equifax recently released an updated timeline for how long it takes black marks to be purged from your report. Here is an overview:

*********

Credit Inquiries: 3 years

Any time a creditor makes an inquiry into your credit report, it is recorded and remains on file for three years. Although inquiries only account for a small portion of your credit score—around 10%—it does negatively affect your rating as it indicates you are seeking additional credit.

Credit history and banking information: 6 years

This is a record of all of your borrowing and repayment activity on credit and loan accounts. Credit transactions disappear six years from the date of last activity.

Credit counselling: 2 years

Individuals struggling with debt can seek credit counselling, which may be a prudent step to get one’s financial house back in order. However, credit counselling services negatively impact one’s credit score, and remain on your report for two years after the plan is paid off.

Consumer proposal/Orderly payment of debts: 3 years

A consumer proposal is a legally binding agreement with your creditors to change the terms of your debt repayment, or reduce the amount owed. The process is administered by a Licensed Insolvency Trustee, through which the monthly debt repayments are made. A registered consumer proposal is purged three years from the date paid or six years from the date filed, whichever occurs first.

Bankruptcy: 6 years (14 years in the case of multiple bankruptcies)

The biggest black mark of all, a bankruptcy automatically purges from your credit report after six years from the date of discharge

A single case is forgivable, but if you have declared multiple bankruptcies in your lifetime, each case (and all of the associated accounts) will remain on your file for 14 years.

Judgments: 6 years

This covers any debt that you owe through the courts due to a lawsuit that went to trial. Judgments disappear six years from the date filed.

Collection accounts: 6 years

A collection occurs when an account falls seriously past due. After multiple attempts to contact the borrower and secure payment on the loan, the creditor hands the account over to an internal collection department, or in some cases sells the debt to a collection agency. A collection account can have a significant negative impact on your credit score as it shows failure to honour your financial obligations. Collections purge six years from the date of last activity.

Secured loans: 6 years

This covers any loans that are secured with collateral—a car loan for instance. These loans are reported separately from unsecured debt on your credit report, and remain there for a full six years.

*********

One Last Spy Tip: If your report has an error, correcting it yourself can be a royal pain. Mortgage brokers have a back door into the credit bureau and can get errors fixed in 48-72 hours. That’s far less than the weeks or months it might take to use the credit bureau’s consumer correction process.

log in

log in

Imagine this.

Imagine this.

2 Comments

For uninsured mortgages, it is still relatively easy to get the best rates with a <700 score. Emili may be a credit score Nazi, but banks seem to realize credit scores are not very reliable.

Rob, as you know well, cell phone companies won't hesitate to send your account to collections 60 days after you switch providers, even when you've disputed your bill.

Another example where the banks will discount a lowish credit score is a landlord who has refinanced or switched 2-3 mortgages in the last year.

One last point I'd make is that utilization should ideally be in the 10-20% range at the time the balances are reported. I always used to wait the 20 days after the bill date to pay credit card accounts. Now, a few days before the bill date I make a partial payment if the account is over 25% of the limit.

For a specific example, a family member with a 703 score from Borrowell got a 2.39% 2yr fixed mortgage on a non-owner occupied rental at Scotiabank last September (deal closed in October).