HSBC Chops 5-Year Rates

Canada’s biggest mortgage industry disrupter is at it again. HSBC dropped its bank-leading 5-year fixed rates today by another 10 basis points.

Among its latest 5-year fixed offers:

- 2.49% for high-ratio mortgages

- The lowest nationally advertised insured rate available directly from a lender

- Rate Details

- 2.59% for uninsured purchases, switches and refinances (from another lender)

- Canada’s lowest advertised refinance rate in over two years

- Rate Details

Note: For 30-year amortizations and rental properties, add 10 bps to that 2.59% rate.

Bond Yields Tank Again

Mortgage rate watchers have their eyes glued to U.S. rates. Among the reasons:

- The U.S. 30-year yield broke its record low today

- The U.S. 10-year – 2-year yield spread (a key recession indicator) just went negative for the first time since 2007.

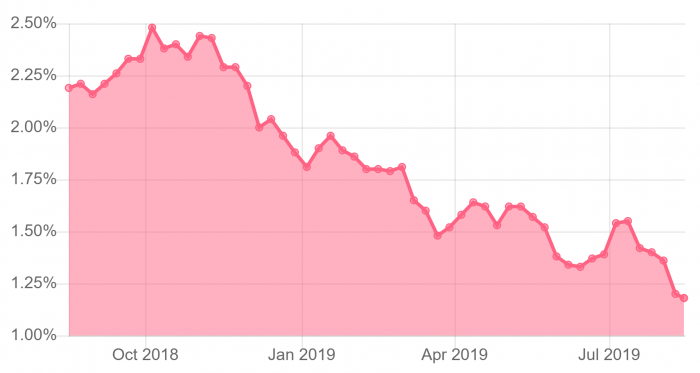

Given our economic dependence on the Americans, today’s historic moves hammered Canadian rates. The mortgage industry’s all-important 5-year yield ended the day at 1.19%, down 6 bps. That’s just a stone’s throw from the two-year low. As for the overnight rate, markets are now pricing in two Bank of Canada cuts by the end of next year.

Some of Canada’s most competitive lenders have already trimmed their deep-discount fixed rates this week. And at this pace, there’s likely more to come.

Meanwhile, the benchmark 5-year posted rate (the minimum rate used in mortgage stress testing) remains stubbornly high at 5.19%. That’s stymieing untold thousands of Canadians from refinancing.

If you’re wondering what it will take for big banks to drop posted rates, you’re not alone. The Big 6 have kept their posted fives inflated far longer than virtually anyone guessed. Bankers we talk to think more cuts are coming, but they don’t expect major reductions near-term.

Big 5 banks cough up mortgage share

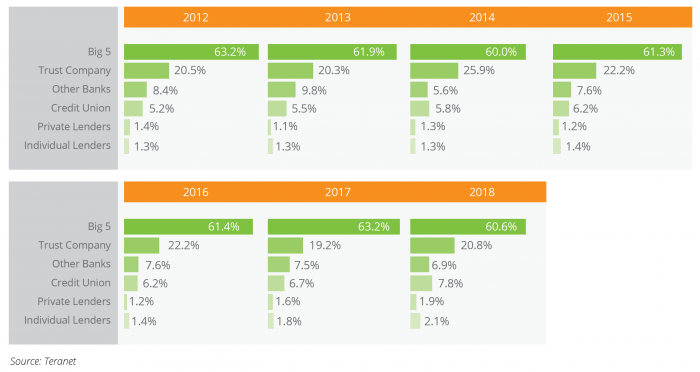

Since 2012, the Big 5’s slice of the Ontario mortgage market is down from 63.2% to 60.6%, according to Teranet.

Meanwhile, credit unions are up from 5.2% to 7.8%. Their share jumped 110 bps in 2018, following the launch of the uninsured stress test. While share gains aren’t completely attributed to the stress test, it’s definitely a contributor. Provincially regulated credit unions remain the most cost-effective alternative for prime borrowers who can’t pass the federal mortgage stress test.

Note: Teranet reports on Ontario data only, but as the most populous province the numbers are reasonably representative.

Banks Ratchet up Competitiveness

There are just two and a half months left in the fiscal year for banks to hit their annual mortgage targets. And we’re still hearing some banks are behind on those targets.

There are just two and a half months left in the fiscal year for banks to hit their annual mortgage targets. And we’re still hearing some banks are behind on those targets.

Given that and bank’s market share losses, it wouldn’t be surprising to see them get more aggressive. And, based on anecdotal cases, that’s exactly what’s happening. We’re aware of three big banks that have increased mortgage sales incentives. They’re offering both better rates and compensation. They’re also keeping the pot sweet for consumers by extending big cash rebates (up to $2000+), as they have been for weeks.

Rate Nuggets: Miscellaneous Mortgage & Housing Reads

- North American rates could have another 40-65 bps to fall, say analysts

- Half of Canadians don’t trust professionals to bail them out of debt

- The wind-down of the petrol era has deflationary implications (which could weigh on rates long-term)

- Fed cuts during 3.7% unemployment are almost unprecedented.

Quotable: “I asked officials from the Department of Finance how they reached the 100,000 number [for estimated First Time Home Buyer Incentive adoption]. They told me that the CMHC gave it to them. When I asked Evan Siddall [CMHC’s CEO] where he got the number from, he said the Department of Finance provided it.”—MP Tom Kmiec (More on that story…)

log in

log in

HSBC Chops 5-Year Rates

HSBC Chops 5-Year Rates

8 Comments

It’s shocking that the Big 5 have not reduced their advertised discount closer to the HSBC exemplar. It’s greedy.

HSBC buying market share is smart. Mortgages are anchor products. While I could have a mortgage at a fringe lender for 2.30%, I am old enough to prefer to be with a real Bank where I can go in and speak to a real person face to face and conduct my business. But the cost of that isn’t 50 bps. Especially when a loyalty factor plays a role.

What is the cost of being loyal to a bank in return for a low rate that is competitive? You cannot be loyal to a fringe lender. It’s a one-off transaction and most likely at renewal, you’ll be transferring it to another lender. I think consumers should consider that.

The great thing about these fringe lenders is the competitive option. Lots of consumers will take advantage of it too. But as a Banker, I think there is real value in dealing with a schedule A bank, but at what cost. I personally think it’s 20-25 bps. Thoughts?

Why would you pay more for a big bank mortgage with a far worse penalty?

You can save .2% on a 5Y fixed at MCAP for example with a much lower breakage costs.

@Tbahz It sounds like you are claiming an intangible value. I certainly can’t see any tangible value from dealing with one of the big-6.

My wife and I use no-fee bank accounts at Tangerine and Simplii. We have mortgages at BMO, Scotia, TD because they offered the lowest rates at the time for uninsured primary residence and rental deals.

20 basis points is $2,800 more interest on a $300k five year fixed. You’re telling me you’d pay $2,800 just to have a sched I branded mortgage and the ability to “speak to a real person face to face?” who is this real person you get to speak to for that money? Elvis reincarnated?

Did all there rates increase on Aug 16??

Not according to its website.

I am generally a big fan of brokers but could not disagree more. I sleep no better having my rental mortgage with a big bank. I have found, independent of my broker, a 2.69% rate for a 5 year fixed which my broker says he cannot match. Has anyone found anything cheaper they can share?

Hi Paul, Yes, sadly, brokers currently have no good options near that rate for rental properties. The closest most can get is in the 2.80s. Albeit, depending on how complex one’s rental portfolio is (or will be), paying 20 bps more for a good income property expert can *sometimes* pay for itself. In any case, rates are always changing so shopping banks, brokers and rate sites is never a bad idea.