—The Mortgage Report: Aug. 19—

Properly’s “Backup Offer” for Home Sellers

- Someday, the majority of Canadian home sellers will get a quote from an iBuyer. What’s an iBuyer? It’s a company that offers you roughly 7% less than fair market value to buy your home…fast. Why would someone take 7% less? Because some people place a high value on speed, certainty and convenience. That’s what a company like Properly aims to offer.

- The firm just launched an automated service that gives Torontonians a backup offer before they list their home for sale. That lets them buy their next home without having to worry that their old home won’t sell. CEO Anshul Ruparell says, “The standard view is that you should sell before you buy or risk being left with two mortgages to carry. With Properly, you have the freedom to buy the home you love as soon as it hits the market.” And Properly can wait to list it until after you move out. Then, if your home doesn’t sell in 90 days, Properly will buy it at the agreed-on price. The company even covers your existing home’s mortgage payments while it’s waiting to sell. The catch, you have to list the property with Properly and can’t choose your own realtor. A 5% commission is deducted from sale proceeds when your home sells, whether it sells on the open market or it’s bought by (sold to) Properly.

- Among its criteria for home purchases: no detached homes over $1.5 million, no condos over $1 million, no 20+ year-old buildings. The company operates in only a handful of markets currently, mainly Toronto, Ottawa and Calgary, but has broader nationwide aspirations. “We plan to be in every major Ontario city by the end of 2022,” says Ruparell.

- As for its offers, Ruparell says Properly values properties using its proprietary automated valuation system. Its median offer has an absolute percentage deviation from the ultimate selling price of just 1%, he claims, adding that standard appraisers are “closer to 5%.” The company has partnered with CIBC for mortgage financing but says all major banks finance its customers.

- The Spy’s take: For a segment of home sellers, iBuyers like Properly and Sweetly are the future. They’re a legit option for those who value certainty over the maximum possible sale price. And with Properly, you’re not locked in if you decide to end the listing for some reason. That said, if you’re not in a rush and can carry two mortgages (if needed), you may net a bit more money by listing with a successful, experienced local realtor.

The End of Mortgage Deferrals

- The “mortgage deferral cliff” might not be as sheer as first thought. Rates.ca story…

Surging Home Prices No Fluke

- All 20 housing markets tracked by CREA showed month-over-month price increases in July. And check out nationwide resale inventory, at a 16-year low.

Happy Homebuilders

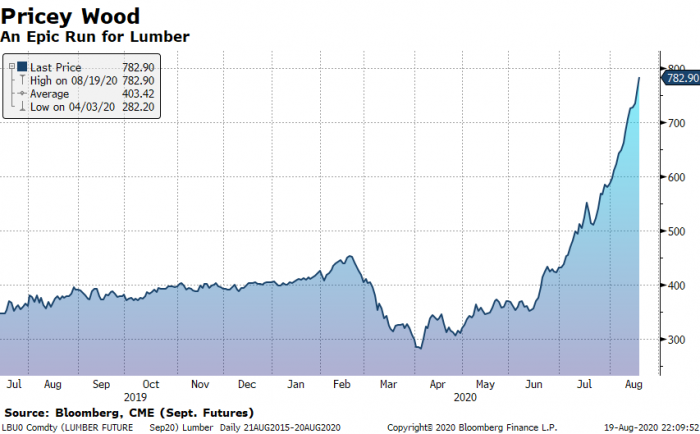

- So much for a recession. As mortgage rates drop to record lows, homebuilders haven’t been this optimistic since 1998, reports Bloomberg. They aren’t thrilled by lumber prices, though. Housing and reno demand is pushing lumber prices vertical. Lumber closed at another record high Wednesday. That’s not exactly helping the high home prices problem. It’s adding up to $10,000 to the price of a typical new single-family home.

TFSA or RRSP

- Which is the Better Down Payment Source? The latter, writes Rob Carrick. That story…

Housing’s Been Expensive a Long Time

- “A year ago, housing prices were sky high — it cost so much to buy a house in Vancouver that most people simply couldn’t afford it.”—CBC’s Knowlton Nash on The National, circa 1982. Of course, what goes up, can come down. That story from CBC…

log in

log in

2 Comments

iBuyers in the U.S. will buy your house without you having to agree to a listing agreement. Anyone know if Properly offers this option?

@Q:

From Properly:

“Our business model pre-COVID was this exactly: we would make an offer to purchase your home outright without the need to list. However, our customers were telling us that we were only solving half of their problem – removing the stress from selling but not making them more confident when buying. With this new service, our clients can make the purchase of their next home with confidence.

For the same cost as working with a traditional realtor (5% of the sale price), our customers receive a guaranteed minimum sale, are able to buy and move into their next home before their current home is listed on the market, and are able to sell for the top market-clearing price.”