As we turn the page on 2015, get ready for a host of new mortgage trends in the next 12 months. We’ll see new down payment rules, more talk of negative interest rates, and surprising moves with bond yields.

Analysts are already making their predictions on how mortgage shoppers will be affected. Here’s a glimpse of what they’re saying now:

On Higher Down Payments

Last week the government raised the minimum down payment for properties from $500,000 to $1 million. A sampling of reactions:

- “We’re recognizing that we don’t want to stop the opportunities for first homebuyers because we’re not impacting those homes under $500,000 at all.”—Finance Minister Bill Morneau on Global TV

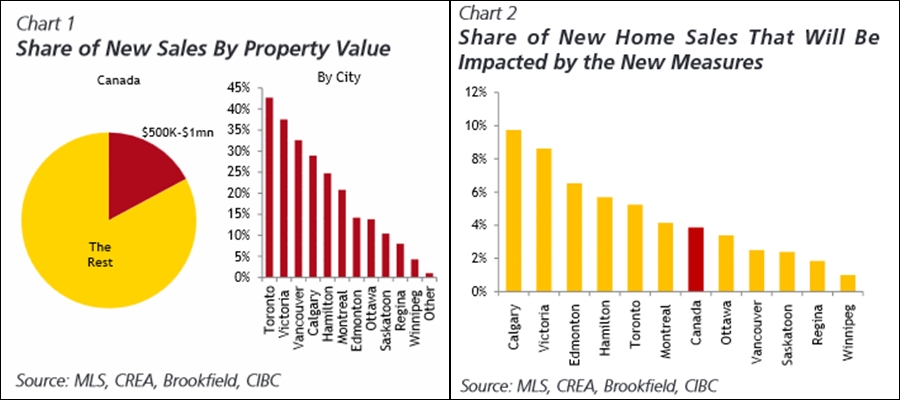

- “In Toronto, the new (down payment) measures are estimated to impact close to 5% of new sales while in Vancouver, the impact will be on only 2.5% of sales. Note that the largest impact (close to 10%) will be on Calgary (due to its relatively large share of high-ratio mortgages)—not exactly a city that needs additional cooling.” Benjamin Tal, CIBC Economics

- “We believe that the increase in the minimum down payment for higher-priced properties is a clever way to address…concerns [about Toronto and Vancouver home prices] without putting at risk most other markets in Canada, the majority of which not displaying any signs of overheating….We expect the impact to be, at the margin, a modest decline in homebuyer demand in both Vancouver and Toronto markets, which would be a positive development in our view.” Robert Hague, RBC Economics

- “…Speculative fervour thrives on expectations of rapidly rising prices.” Economist Commentator via CBC (While population growth, immigration, interest rates and housing supply drive prices the most, Canada’s housing market is still partly psychology-driven. To the extent that higher down payments reduce expectations of soaring prices, this is positive for housing stability.)

Bond Yields & Fixed Mortgage Rates

“…The Fed [is] expected to hike several times while the BoC stands pat,” says BMO Economics. BMO suggests that Canadian yields (which guide fixed mortgage rates) should therefore rise less than U.S. yields, even though they normally move together over time.

“…The Fed [is] expected to hike several times while the BoC stands pat,” says BMO Economics. BMO suggests that Canadian yields (which guide fixed mortgage rates) should therefore rise less than U.S. yields, even though they normally move together over time.- “…A downgrade to our outlook for global and Canadian growth has pushed off prospects for a rate hike by the Bank of Canada into mid-2017…”—Avery Shenfeld, CIBC Economic Insights

- “The Bank of Canada’s two rate reductions and falling global bond yields have reduced mortgage rates about 30 basis points in the past year. This effectively lowered mortgage service costs by just over 1% of income, thereby accommodating a 3% price gain. In addition, millennials continue to drive household formation. The leading edge of this sizable generation is now purchasing their first home, and starting careers in two cities that are serving up jobs faster than the rest of the nation.”—Sal Guatieri, BMO Capital Markets

- “We expect the Fed to go very slowly in raising rates, with the overnight federal funds rate being brought to 0.75 per cent by the end of next year. That magnitude of a rate hike has in the past correlated with a modest increase of about 20 basis points in Canadian 5-year bond yields, which is then partially passed through to 5-year fixed mortgage rates.”—BCREA

Other Interest Rate Catalysts

- “OSFI’s proposed [capital] rules add a wrinkle…Holding more capital, or protection, is effectively a tax on lenders.”—Globe & Mail (And when lenders are taxed, they pass it right along to Joe borrower. In this case, expect banks to raise mortgage rates slightly to offset this additional cost.)

- In the next year or so, “the financial institutions’ regulator will force lenders to hold higher capital against mortgages underwritten in neighbourhoods where house prices are high relative to income,” says National Bank Financial. “Ideally, this would prompt lenders to impose price discrimination in setting mortgage rates across the country – i.e., the same mortgage size in a less-expensive neighbourhood would carry a lower mortgage rate than one in an expensive neighborhood. But we wonder whether this will actually occur…Lenders may elect to forego material price discrimination to preserve their customer franchises.”

- “Meanwhile, we estimate the increase in CMHC securitization fees will put only 5-10 bps of upward pressure on mortgage rates – an increase the Bank of Canada could easily offset with a 2016 cut to its policy rate.”—National Bank Financial

log in

log in

2 Comments

Economists have been pushing back their forecasts for rate hikes since the financial crisis. I guess this ensures that they’ll be right one of these years. It would be nice to see one of them actually go out on a limb and forecast that rates won’t materially rise for another two or three years.

Maybe eventually they’ll give up and do just that. Probably right before rates soar.