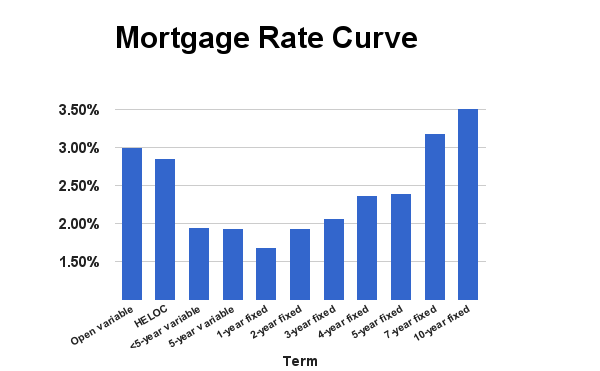

The chart below shows the average best rates for each mortgage term on RateSpy.com.

This graph provides a sense of how much of a rate premium you’ll pay for the security of a longer-term and/or fixed rate.

Key Takeaways

- The difference (spread) between 5-year fixed and variable rates has shrunk in recent weeks to roughly 0.39 percentage points. That’s far less than the long-term average, which is about 1.25.

- When the fixed-variable spread gets narrow, it means people are paying less for the security of a long-term fixed rate. That increases the appeal of a 5-year fixed (Canada’s most popular term), especially for risk-averse borrowers.

- Well-qualified homeowners willing to ride out potential rate hikes will find the best upfront savings in a 1-year fixed, which range from 1.79% to 1.99%+ (on RateSpy.com) depending on features and restrictions.

- A few providers are still advertising 1.49% effective rates on one-year fixed terms, but those specials require a line of credit and potential legal fees to set up. They also include cash back as part of that 1.49% rate, in lieu of an actual rate discount (which can actually put you further ahead if you use the cash to make an immediate prepayment).

- People hoping to diversify rate risk might want to consider a hybrid — 50% fixed and 50% variable. The lowest rates on hybrids (a.k.a., combination mortgages) are currently 2.36-2.50%. A hybrid lets you participate in rock-bottom rates while still providing partial protection against rising interest costs.

log in

log in