The latest mortgage rate reconnaissance…

Prime Sticks at 2.70%

Poloz and Co. issued another snoozefest rate announcement this week. The BoC delivered the same narrative we’ve heard for months: Canada’s economy is tenuous, U.S growth is positive, upside inflation risk is limited, federal stimulus may obviate the need for near-term rate cuts, debt and housing risk are at Defcon 5, and so on and so forth.

Poloz and Co. issued another snoozefest rate announcement this week. The BoC delivered the same narrative we’ve heard for months: Canada’s economy is tenuous, U.S growth is positive, upside inflation risk is limited, federal stimulus may obviate the need for near-term rate cuts, debt and housing risk are at Defcon 5, and so on and so forth.

If you are planning a mortgage, the only thing to know about Wednesday’s Bank of Canada action–or non-action as the case were–is that it changed nothing. The inflation picture (inflation drives rates) is still non-threatening.

Oil and Your Mortgage

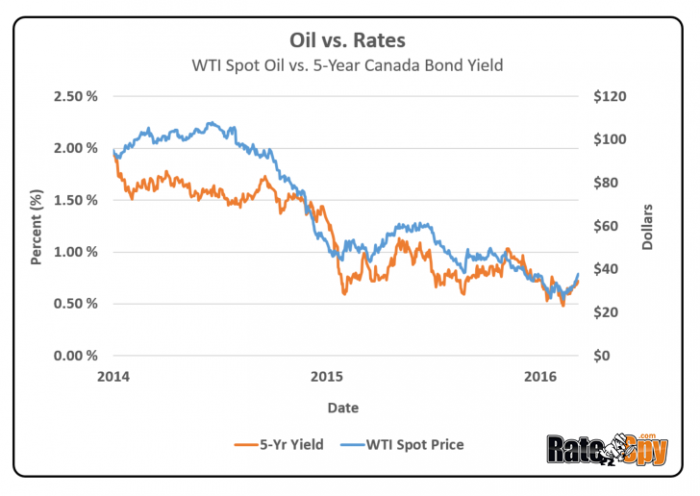

The rate you pay for your mortgage is largely determined by the inflation expectations of bond traders. At the moment, the biggest indicator of future inflation may be the cost of oil. The entire rate market has been hanging off of every dollar that oil moves, simply because our economy is so dependent on the stuff.

This chart paints the picture.

Ever since oil fell off a cliff in 2014, the 5-year bond yield (which heavily influences fixed mortgage rates) has been tracking crude like a bloodhound. In fact, statistically speaking, roughly 86% of the 5-year yield’s movements can be explained by oil’s movements. It’s no surprise then that BoC rate policy is also guided by oil prices.

Eventually this cozy relationship between oil and interest rates may decouple. But for the foreseeable future, mortgage rates and oil will remain bedfellows.

The Next Rate Increase…

Wouldn’t you love to know when fixed rates will start a steady climb higher?

Me too.

For that matter, every bond trader on the street would pat to know. But alas, we must wait for the market to tell us. And the market will notify us that things have changed when the 5-year bond yield remains above 1.10% to 1.25%. To get there, we’ll potentially need a return to $60 oil, or some other inflation inspiring event.

Until this happens, the most that fixed rates should rise is likely 0.25% give or take—not enough to drop your computer, run out and lock in.

By the way, the 5-year yield is up 40 basis points from its record low last month. Barring a downward reversal next week, don’t be surprised if the lowest long-term fixed rates tick up by 5-10 bps. Looking further out, Canada’s economic vital signs (the latest being February’s gawdawful loss of 51,800 full-time jobs, ) are still not supportive of persistent rate increases.

Variable Rate Discounts

If you want to call them that.

In Spy land, the prime – 0.35% variable rates that most lenders are peddling don’t deserve the title “discounted.” P-.35 is about as discounted as a Louis Vuitton handbag. You’re paying top dollar.

On a positive note, spreads (the difference between what banks lend at and their cost of funds) have improved in recent weeks. But variable rates haven’t. That’s annoying for mortgage shoppers, but give it time. So long as short-term rates don’t plunge again, we could see variable pricing (for new borrowers) get a little better in coming months. Till then, short-term fixed rates are the way to go for most risk-tolerant, financially sound borrowers.

log in

log in

6 Comments

Not that a BOC cut would have trickled down to us anyway. Excuse me for being skeptical, but the Bank of Canada lowered rates by 0.50 points last year and the big banks responded by dropping prime by 0.30 points .

Hundreds of thousands of variable-rate mortgagors share your grumpiness.

@Grumpy

It could be worse, we could be looking at multiple rate increases by year’s end like in the US. I don’t see that happening here

We wont see $60 oil when the taps will start to open up at $40.

http://www.cnbc.com/2016/02/29/us-shales-message-for-opec-above-40-we-are-coming-back.html

That oil vs rates chart is intriguing. If we are to believe some experts (if you can call them that) who foresee sub-$20 oil, and if that led to 5-yr yields in the 0.25% range – what kind of 5-yr fixed could I end up negotiating with my bank?

In that hypothetical, you’d see the lowest 5-year fixed rates at 1.99% or less, barring some unexpected ballooning of lending spreads.