I had a chat with BNN Bloomberg’s Greg Bonnell Monday about “sub-zero mortgage rates.”

A dozen years ago, uttering those words might have branded you a radical.

Some would have questioned your credibility had you even proposed the thought of banks paying borrowers instead of collecting interest from them.

And now with global yields at 120-year lows, it’s happening. Negative mortgage rates are fascinating people the world over with the Danes leading the trend.

It’s got Canadians asking the question, can it happen here too?

It Can (Theoretically) But It Probably Won’t

Save yourself the wait. It’s highly unlikely Canada’s Big banks would ever start paying you interest to mortgage your property.

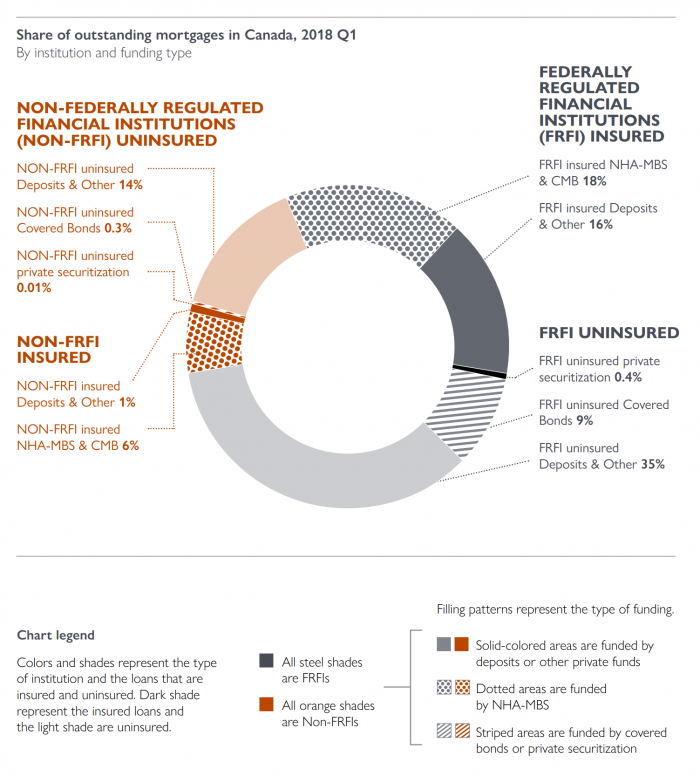

For one thing, our lenders source their funding very differently than countries like Denmark. The Danes fund almost all of their mortgages with AAA (i.e., ultra-low risk) covered bonds, which—for the first time ever—have negative interest rates. Investors looking for safe places to park their cash are actually paying 1/2% to loan money to Danish lenders.

By contrast, Canadian lenders fund most of their mortgages using deposits. And it’s hard to ask depositors to pay you to park their precious money in your bank. Heck, even the Danes don’t charge retail depositors.

How Canadian Lenders Fund Themselves

Source: CMHC

Despite covered bonds growing in Canada, our regulators impose some of the strictest limits on them in the world (unreasonably so, given the exceptional credit performance, strong collateral and lender guarantees with such bonds). Denmark doesn’t have such handcuffs.

The Scandinavian country also has much lower rates to begin with, e.g., a -0.65% central bank policy rate compared to Canada’s 1.75%. That -0.65%, by the way, results largely from structural factors that don’t apply in Canada (like having to maintain Denmark’s currency peg to the Euro, which has forced the country to slash rates).

What Would -0% Mortgages Require?

If you want to get theoretical, in order for 5-year fixed rates to be sub-zero in Canada, the 5-year government bond yield might have to plunge to -1.50% or less. No country we’re aware of has ever had a 5-year yield anywhere close to that low. Were yields ever to plummet that far in the hole, the economic carnage leading up to such event might be unthinkable.

And that’s not to mention government intervention. If anyone thinks policy-makers would just stand by and let millions of borrowers get a negative interest rate mortgage, they underestimate policy-makers. Left unchecked, rates near zero would pour kerosene on housing embers, potentially exploding prices higher—the last thing regulators want. Negative rates would also weaken the country’s banking system, increasing system-wide risk.

So in summary, mortgagors looking to get paid to finance their home should not get their hopes up. The Detroit Lions will probably win the SuperBowl before negative mortgage rates ever make it to Canada. (And for you non-NFLers out there, that’s a miserably low probability.)

log in

log in

If you want to get theoretical, in order for 5-year fixed rates to be sub-zero in Canada, the

If you want to get theoretical, in order for 5-year fixed rates to be sub-zero in Canada, the

3 Comments

Very interesting concept. Thanks for explaining it in laymen’s terms.

I think you hit the nail on the head that policy-makers would never allow us to get to the point of negative mortgage rates due to the severe ramifications that would have on the wider economy.

I can see it now. 0% mortgage rates and $3000 per square foot condos in Toronto.

If all this happened, it would be a disaster…….