Stricter mortgage rules are working, suggests the Bank of Canada in this report today.

Stricter mortgage rules are working, suggests the Bank of Canada in this report today.

Now if only we could take that report at face value.

New Stats on Mortgagor Debt Loads

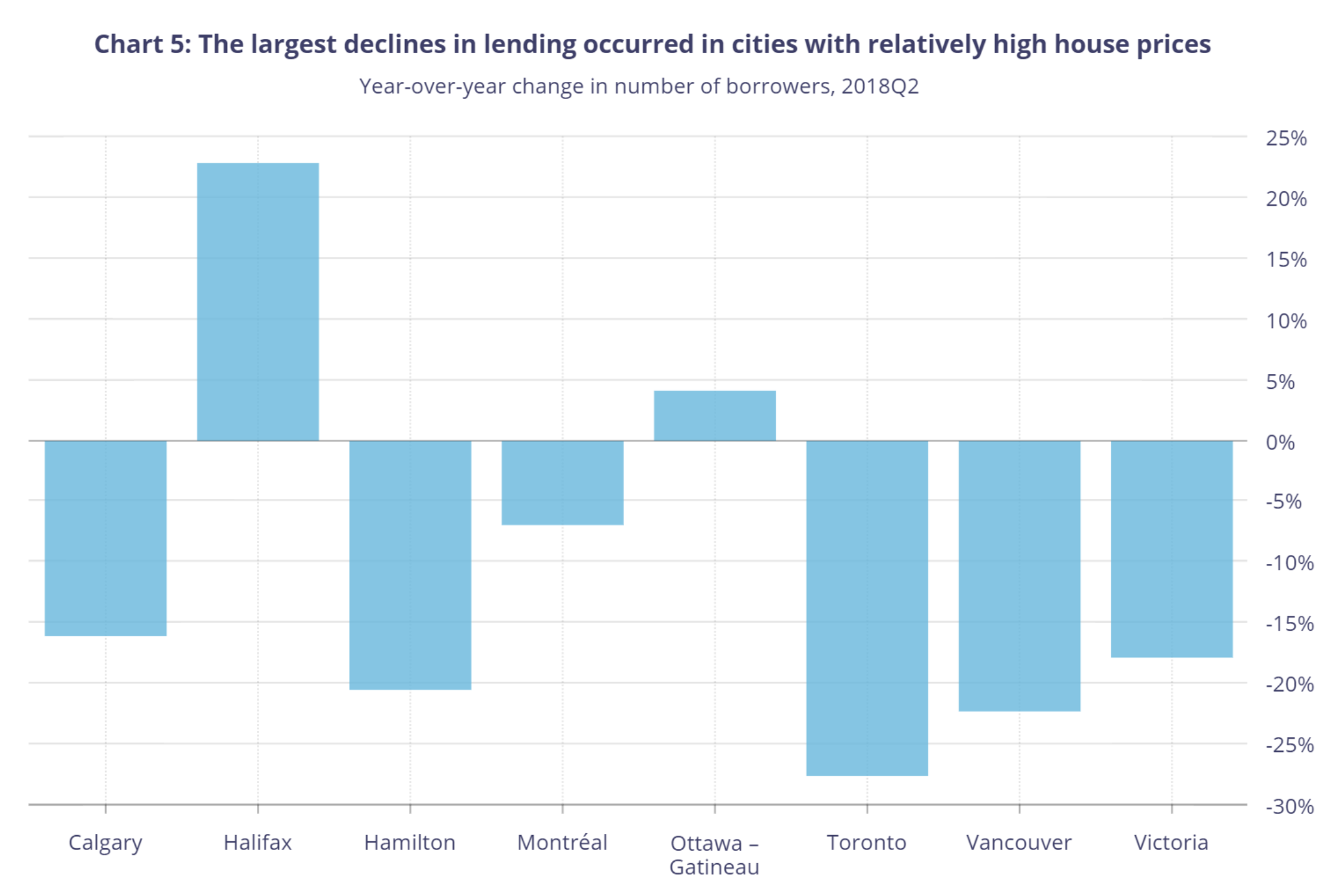

If the government wanted to slow the market, it did. As of the second quarter, the number of new low-ratio mortgages fell 15% year-over-year after the feds implemented the stress test on January 1, 2018.

In some places the lending slowdown was even more dramatic (e.g., Toronto, where the number of uninsured low-ratio borrowers at federally regulated lender kerplunked 27.5% year-over-year, as of Q2 2018).

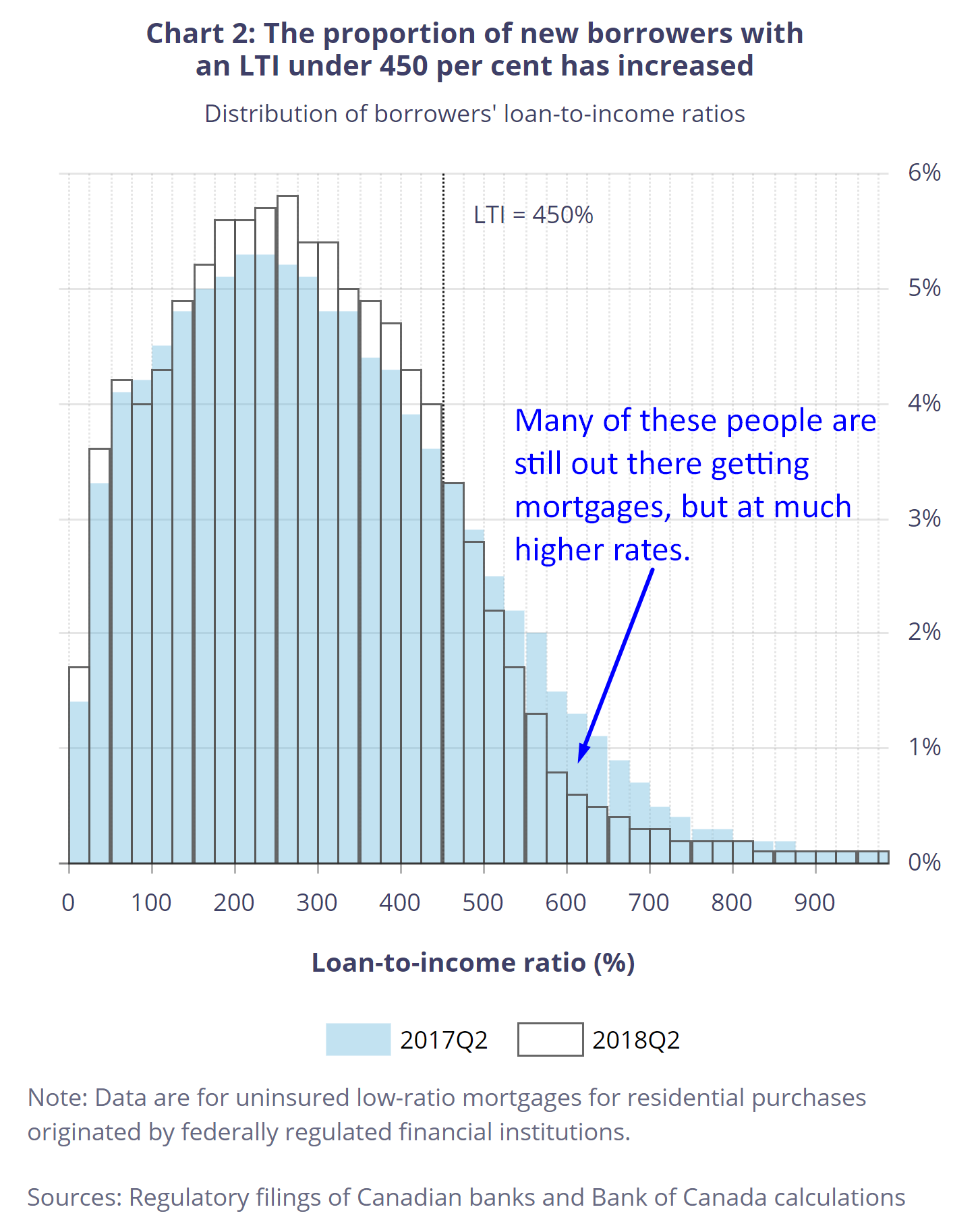

But just as importantly, following its stricter qualifying of mortgage applicants, the ratio of mortgages with loan-to-income (LTI) ratios above 450% has plunged.

- For high-ratio mortgages, the percentage has dropped from 20% in Q4 2016 to 6% in Q2 2018.

- For low-ratio mortgages, the percentage has fallen from 20% in Q2 2017 to 14% in Q2 2018.

Rising interest rates are also taking borrowers out of the market. “As average contractual rates for five-year fixed-rate mortgages have increased from 2.7% to 3.3% over the past year, the overall share of new highly indebted borrowers has decreased, from 18% to 13%,” the BoC writes.

Suffice it to say, tighter lending is accomplishing what policymakers think they want.

What We Don’t Know

There’s something the Bank of Canada is not stressing enough.

Chart comments are from RateSpy.com

“The overall riskiness of new mortgages has therefore decreased…” claims the bank. “Tighter mortgage policies have contributed to a decrease in the creation of highly indebted households.”

In terms of number, the bank may be right.

In terms of overall risk to the economy, the jury is so far out that we may not get a verdict until the next decade.

Many new mortgagors are settling for smaller mortgages — and the government might argue that’s a good thing. But over the next few years, hundreds of thousands of borrowers who can’t get approved for a prime mortgage (at the amount they want or need) will likely go sub-prime.

Clearly the mortgage stress test has shifted lending from transparent lenders (e.g., the Big 6 banks) to non-transparent lenders (e.g., private lenders).

According to the bank’s own data as of Q2 2018, big bank share of originations in the GTA dropped from about 78% to 73%, while private lender share increased from 6% to 9%. And other data suggest the shift to privates and mortgage investment corporations (MICs) has been much greater than that.

That matters for several reasons:

- Private/MIC rates are a minimum of 3-4 percentage points higher than big bank rates

- Private/MIC lenders charge much higher fees

- Private/MIC lenders often have more onerous contractual terms

- Materially higher borrowing costs spike default risk

- Private/MIC lenders are far less regulated with respect to their solvency.

So no, there’s not enough information to definitely conclude that “the overall riskiness of new mortgages has therefore decreased.” Not unless you limit that statement to federally regulated lenders.

It’s not all about protecting the big banks from their own “greed.” There are economy-wide considerations too. From that standpoint, you can expect a greater-than-normal spike in mortgage defaults in the non-prime segment come the next recession.

The Spy is not clairvoyant enough to know how that will impact economic sentiment, GDP and jobs, given less than 1 in 10 borrowers (nationwide) use private/MIC lenders. But hopefully regulators are because the flight to non-prime is clearly on them.

log in

log in

According to the bank’s own data as of Q2 2018, big bank share of

According to the bank’s own data as of Q2 2018, big bank share of

13 Comments

This is stating the obvious but regulators cannot regulate an unregulated market. If a borrower wants to go to a MIC or private lender to borrow beyond their limit then both of those parties need to carry the risk of default/delinquency. The government is not going to bail out unregulated lenders. But they have to put controls on lenders within their purview and those which are essentially backstopped by the tax paying public.

Why is the flight to non-prime clearly on regulators? No one is forcing people to go to unregulated lenders and pay higher rates and fees. If a borrower has been told they don’t qualify for prime lending and have been warned of the pitfalls of sub-prime and they still decide to do it, that responsibility is solely on them.

Instead borrowers should carefully examine their situation and make adjustments as necessary: save more before buying, buy smaller, don’t refinance, downsize. And for those new buyers – wait as the only thing keeping prices unaffordable is the willingness of people to overextend themselves on debt in the first place. Once that practice stops then prices will adjust with demand. We’re not talking huge numbers here but small adjustments for a small number of borrowers.

I suspect that these articles are primarily read by mortgage brokers so there will be a lot of push back on my comments. I understand that offering such suggestions doesn’t support their business model.

I’ve heard that in the past non-prime borrowers would be able to switch to a prime lender within a year or 2 and escape from the high rates. But now the transfers can’t be funded. This means the cost associated with non-prime lending will be a lot bigger than previously. Also, the investors will find it difficult to get out. Your thoughts?

When I was doing private lending, seconds were far more common than firsts. A typical borrower would have a first with Home Trust or Maple at 60-70% LTV, and with a private second behind that.

It would be interesting to have data on the number of borrowers taking out second mortgages, and who is doing the lending on the first and the second. Although private lenders don’t have to report, a few queries and a data dump from Teranet would give you almost all you’d want to know for the Ontario market.

This is in response to Yolo’s comment.

He/she is way off base. An unregulated market can become regulated in no time at all. Look at all the regulations securities regulators are throwing at MICs. It’s ridiculous. If you think the Department of Finance can’t clamp down on private lenders, you’re smoking the wrong stash.

B-20 is leaving people who could have been approved at a bank last year with no other option (in their minds) but alternative lenders. You can spin it any way you want but there is zero disputing that the rise in private lending is because of B-20. If the government justifies B-20 as saving people from their own bad decisions, then they are hypocrites because just as many people are now making even worse decisions.

All those “adjustments” Yolo lists are easy for him/her to say. It’s not so easy when you have to put a roof over your family’s head or refinance out of costly debt.

As for Yolo’s point that “the only thing keeping prices unaffordable is the willingness of people to overextend themselves on debt in the first place, this shows great ignorance. Unaffordability is a function of insufficient supply more than anything else. If Canada had 25% more housing stock there would be no affordability crisis. Ottawa has completely fumbled the ball on creating middle class housing. To this day, despite all the evidence about supply constraints, they are still doing nothing to help typical working class Canadian access reasonably priced housing near big cities.

Lastly, I resent Yolo’s broad comments about brokers disagreeing with him/her because of our business model. That’s a lame insulting way to try and make a point. It’s the type of thing people do when they don’t have a strong point to begin with.

How do I get in the private mortgage business? Sign me up.

Hello GTA Broker. I’m afraid we’ve come off on the wrong foot so let me make amends.

The ownership structure of a MIC is subject to securities regulations as they are issued as shares. The lending activity of a MIC is not regulated. That isn’t to say that the government won’t decide to intervene in the future – look at pay day loans as an example. The point is their operational activities are not currently regulated.

Just because a person qualified for a Bank mortgage last year does not entitle them for the same mortgage this year, B-20 aside. You’re right – making adjustments is not easy but they’re necessary. The more people feel they are driven into the arms of predatory lenders the more necessary the adjustment is.

Rightly or wrongly B-20 wasn’t introduced to save people from their own bad decisions. It was introduced to prevent federally regulated financial institutions from lending beyond the limits considered reasonable by the regulators. Of course it’s had other adverse affects too, such as restricting peoples ability to change lenders, but that wasn’t the intention.

People often confuse supply issues with affordability issues. We don’t have a housing supply problem in Canada. If we did there would be lots of people with nowhere to live and no properties available for sale. Instead we have an affordability problem which is a function of the demand to purchase housing driven by available credit and the supply of homes for sale. The point at which those two variables meet is what determines prices. When the supply of available credit decreases it has a proportional impact on the price. Needless to say, the demand to purchase is not necessarily correlated to the need to purchase.

As for your last comment, I think it proves my point correctly.

It is totally misleading to suggest B-20 was introduced solely to protect banks. The four amigos, Department of Finance, OSFI, Bank of Canada and CMHC, all meet and communicate regularly on mortgage policy. The government has gone on record again and again saying how it wants to slow indebtedness (read, the mortgage market). B-20 was created largely to do just that with support from all these agencies. Whether they or you admit that is irrelevant.

The four amigos? Seriously?

The intention of the policy was to reduce the number of mortgages issued to over-indebted consumers at federally regulated Banks, which it has. Are you guys dealing exclusively with over-indebted individuals which is making you think this is a restriction on the overall market? The only reductions have been at the fringe. For everyone else it’s BAU, as illustrated in the chart above.

Yolo said, “Just because a person qualified for a Bank mortgage last year does not entitle them for the same mortgage this year“

Of course it doesn’t entitle them. It means that this borrower is essentially no more risk this year than they were last year. The government has dramatically moved the goalposts for qualifying without justifying it based on risk. It’s gotten 25% harder to qualify for everyone. If you’re arguing that everyone is all of a sudden 25% riskier and could prove that, you’d have a case. But you can’t and they aren’t.

I think I fall in the middle on this debate. Default risk has gone up tangibly in the last year, but the new rules, especially B-20, are not proportional to the increase in risk.

I see at least 2 reasons why risk has increased:

1) Higher interest rates mean more homeowners will have difficulty affording their mortgage when it comes up for renewal.

2) Flat housing prices mean fewer opportunities for debt refinancing, even if the homeowner could qualify under the new rules. 10 years of steadily rising house prices has allowed imprudent homeowners to rack up consumer debt and then refi their mortgage to get out of it. Now many of those that won’t be able to refi any more will stop making payments on their mortgage and declare bankruptcy.

What we have today are overzealous regulators setting rules based on what a small fraction of imprudent homeowners MAY do. Meanwhile people who have proven their ability to manage debt have seen their financing options disappear in the process.

The liberal bureaucrats in Ottawa make it sound like this is the first time rates have ever gone up. Back when you could qualify for a mortgage using payments set at the 5 year fixed rate, rates shot up 2-3% multiple times. Debt service ratios weren’t far from where they are today and guess what, default rates were less than 0.65% at worst.

This 450% debt-to-income (DTI) threshold that CMHC and the Bank of Canada talk about is totally meaningless from a default standpoint. Some policy wonk read it in a book and now regulators think it’s gospel. What truly matters is the total debt service ratio because that is the real measure of your ability to make payments. TDS ratios are somewhat higher today than many years ago but they are still well below any danger zone.

Well Check, risk management is a complicated thing. Someone considered moderate risk last year may be considered higher risk this year even if their personal situation hasn’t changed. For example, the prospect of higher rates and a potential economic slow down may cause the underwriter to change their risk assessment. As Ralph said, a decade of rising home values and static interest rates provided an easy way for people to tap into their growing equity. That scenario does not exist at this time.

As for K.W.’s comments about prudent borrowers having their financing options disappear, that’s a fallacy. If someone was prudent with their debt management then they would have more financing options over time not less. In fact it’s those imprudent borrowers that constantly require refinancing to keep on top of their debt obligations that have had their options curtailed.

I’m sure the way you described how regulators come up with policy (“read it in a book”) is also inaccurate but hey, believe it if you like.

Higher rates and potential economic slowdown are already built into every single lending decision a Canadian bank has ever made. That is how underwriting works Yolo. Lenders incorporate a buffer for higher rates.

Someone who qualified last December should qualify this year, if it weren’t for the new and artificially high qualifying rate. There is no debating that this change has caused financing options to disappear. This is not fallacy. It’s reality. If you can no longer qualify due to an exaggerated stress test, then you no longer have the options you once did.

Labeling someone imprudent when they met OSFI’s rules 11 months ago is essentially calling OSFI imprudent for creating those rules in the first place. Just because they changed the rules doesn’t make the old rules invalid.

By the way, none of this has anything to do with constantly refinancing. Everyone should have the opportunity to refinance at least once to extricate themselves from a bad situation. Big brother has now eliminated this option for hundreds of thousands of people and I agree with this story, overall risk has increased as a result.