Mortgage growth in Canada is like King Kong—it’s hard to kill.

You can riddle it with bullets (mortgage rules), but it just keeps beating its chest and roaring on.

More than 60 mortgage rule tightenings later (including insurance and securitization fee increases) the question is, has Canada’s mortgage market finally been shot down?

Nationally, average home prices are already down 14% from the 2017 highs. In Toronto, they’re off 20%.

The mortgage market, however, is still chugging along at 5.5% growth (the latest number from December). But now, more than a few observers are wondering whether OSFI’s radical mortgage stress test will drive that number to decade lows.

Anecdotal reports suggest that some OSFI-regulated lenders are now seeing 5-10% slower volumes year-to-date. That’s not catastrophically slower, but it’s not insignificantly slower either. Hard data will probably come out in a week or two as big banks provide earnings guidance.

Ultimately, if you want to confirm whether policy-makers have succeeded in their quest to slay the mortgage beast, there’s one indicator to watch…

Mortgage Growth

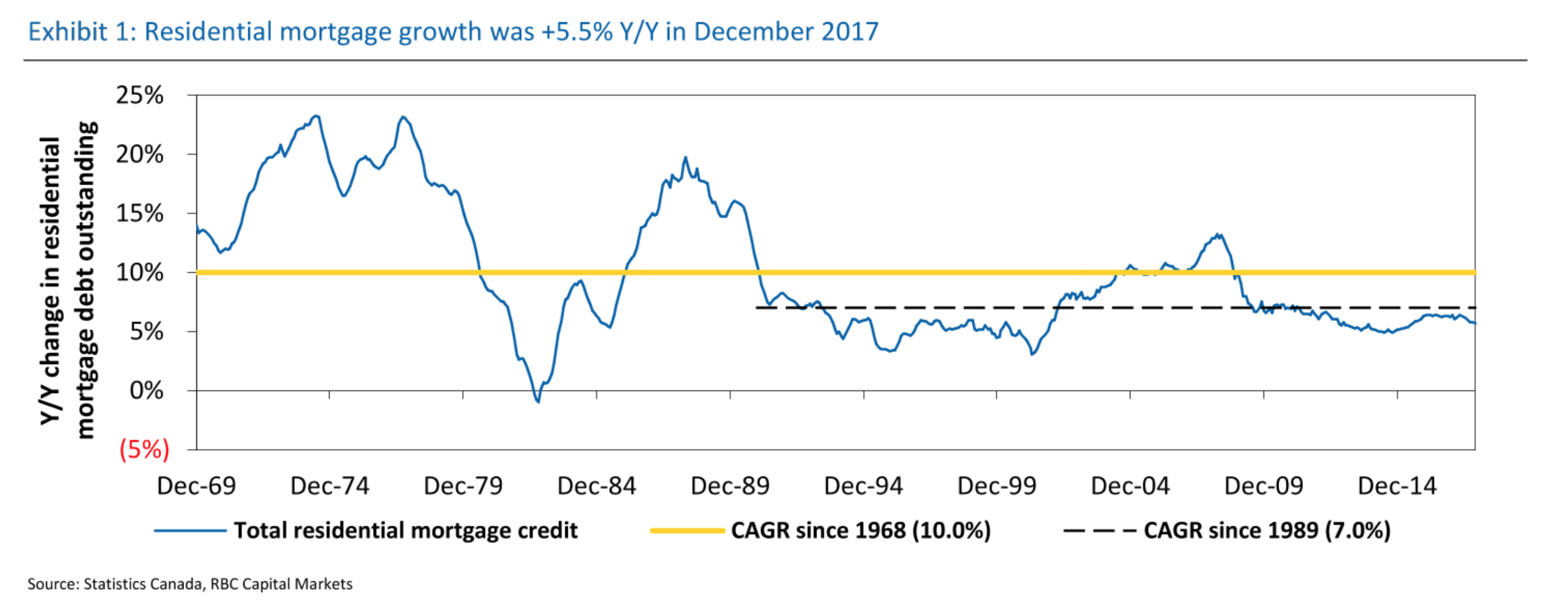

The below chart from RBC Capital Markets shows year-over-year mortgage growth in Canada over the last five decades.

Its message is that things have to get a lot uglier before the mortgage market flatlines.

Notice how resilient annual mortgage growth has been over the years.

There was just one dip below 0%, going all the way back to the late sixties. Not even the Great Recession could make mortgage growth negative.

Forces like non-stop immigration, organic population growth, supply shortages, urbanization, robust employment and new construction are all hot air that keeps mortgage growth inflated.

That said, government rule tinkering, rising rates, fewer single-family dwellings (relative to cheaper multi-unit dwellings) and ever-rising indebtedness make it harder than ever for Kong to keep climbing.

There’s a real chance we could now see mortgage growth slide to new millennium lows. We’re talking sub-3% growth, a conspicuous drop from the long-term average. (Negative growth would be unlikely and potentially a harbinger of, if not the result of, economic recession. Not even risk-obsessed regulators want to see that extreme.)

In any case, until you actually see growth approach zero, don’t count the mortgage market out. Because as seven Kong movie sequels have established, the big fella just keeps coming back.

log in

log in

Mortgage growth in Canada is like King Kong—it’s hard to kill.

Mortgage growth in Canada is like King Kong—it’s hard to kill.

1 Comment

The good news is that everyone needs a place to live, and for the most part people are resourceful enough to find ways to achieve their objective of buying a house. The new stress test may delay that dream for many people, but it may also be what’s needed for the long-term health of the housing market.

To me it looks like Kong taking a little breather before continuing his climb.