Not So Fast…

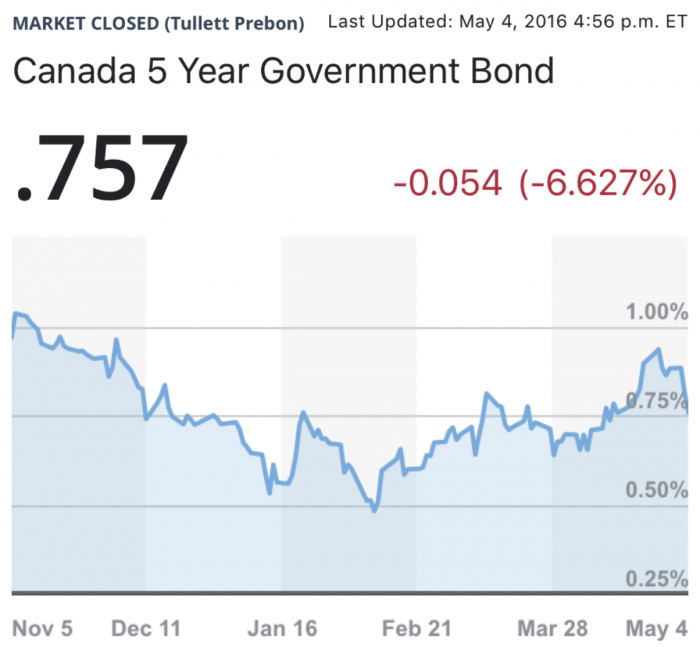

A slew of lenders have hoisted fixed mortgage rates in the last few weeks. Their motivation was the recent spike in government bond yields, which hit multi-month highs and (temporarily) boosted banks’ funding costs.

Meanwhile, numerous lenders simply absorbed those higher yields and kept their rates as-is. For mortgage providers, staying price-competitive is not optional in the March through June stretch, which accounts for almost half of the year’s revenue for some lenders.

As for bonds, they’re as fickle as a feather in the wind. Following downbeat economic news, yields have again U-turned lower—taking funding costs with them. As a result, we’re now seeing lenders that raised rates a week ago do a 180 and take them back down.

All of this has set a new high water mark, with respect to how high bond rates can go before triggering fixed rate hikes. It looks like 5-year yield may need to pierce 1.00% before we see another flood of fixed-rate increases. (Today it closed at 0.757%).

Here’s the takeaway: If you’re fixed-rate shopping, the urgency to secure a rate hold has subsided. But if you see the 5-year bond yield make a new high for the year, get a rate guarantee and protect yourself.

Fancying the Shorter Term

There is new anecdotal evidence from TD that one in four Canadian mortgage borrowers are now renewing every year. It used to be closer to 1 in 5.

The reason? Apparently more people are choosing shorter terms like a 1-year fixed or a 2-year fixed, instead of the old-hat 5-year fixed and 5-year variable.

And who can blame them? Short rates have been tantalizing in Canada’s low-rate environment. Plus, with a petite term you’re not bound to your lender so long. That lowers the odds you’ll:

a) pay a pound of flesh (a.k.a. penalty) to exit your mortgage early, or

b) get stuck with a shabby rate when refinancing before maturity (if your lender knows you have to pay to leave, it’ll be less competitive on your rate).

New Regulations Could Lift Rates

Ottawa wants safer banks. Nothing wrong with that.

Ottawa wants safer banks. Nothing wrong with that.

Well, wait. If banks are safe enough already, it is possible that the price of more safety may be too high…for consumers, that is.

The government is forcing banks to sock away more capital for every mortgage they lend on as a safety net if home prices crash. The problem is, capital isn’t free. Once this rule takes effect, borrowers get stuck with the extra cost.

The new regs officially kick in November 1, but banks may start pricing in these costs early. Preliminary estimates from analysts are that the impact on rates will be less than five basis points, but every basis point is dollars out of your pocket. Prudence has a price.

log in

log in

There is new anecdotal

There is new anecdotal

2 Comments

Enough with the new rules and regulations already! Canada has proven that its sound financial system and existing mortgage regulations are effective against shocks to the system (the 2007 financial crisis). Our housing market didn’t nosedive like they saw in the U.S. If anything, any future rule changes should be directly aimed at Toronto and Vancouver, the only two markets in Canada that truly show any risk of a bubble. Why should the rest of us pay more to protect banks from buyers of overpriced homes in Toronto and Vancouver?

Ottawa has layered regulation on top of regulation ever since the financial crisis. Consumers would be shocked to know how much more they’re paying lenders because of it. And now, here’s more regulation destined to hike borrowing costs again: http://www.canadianmortgagetrends.com/canadian_mortgage_trends/2016/05/mortgage-costs-about-to-rise.html