When it comes to rate predictions, the bond market outwits us all. It incorporates every known economic variable to arrive at today’s level of interest rates and estimate future rates.

Right now, the bond market is flashing two vivid signals:

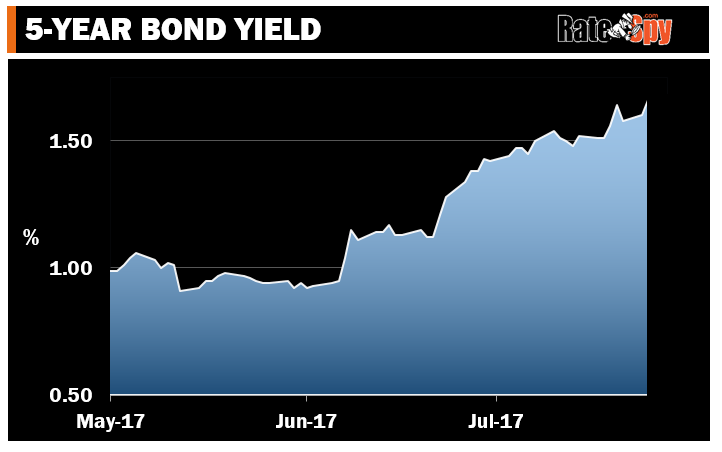

- Rates are on the upswing

- Bond yields, which guide fixed mortgage rates, are nearing a 3-year high and they seem poised to go higher

- The recipe for surging rates is simple. You take one part Trump effect, one part rising global yields and add one part Bank of Canada hawkish guidance and two parts rebounding economy (GDP is on fire).

- The risk of out-of-control inflation and numerous rate hikes is still small

- Despite the pop in yields, rate bears have little reason to hibernate. Consider that:

- Canada’s oil sands accounted for half of the latest spike in GDP, says BMO. Yet oil supply is rising and demand is falling. Canada can’t rely on oil forever.

- OSFI’s coming rule changes, if implemented as proposed, will act as air brakes for housing, and the economy really depends on housing

- Inflation is near 17-year lows, well below the BoC’s 2% target (e-commerce, weak commodity prices and demographics are just some of the reasons keeping inflation down, and those reasons still aren’t going away).

OK, So What Do I Do?

If you’re inclined to side with the bond market, that means you’re inclined not to panic about potential runaway rate increases. The market is telling us we face a small number of rate hikes before the Bank of Canada pauses to assess its damage.

And that pause may last awhile. It could even end in a rate cut, which is exactly what happened the last time the BoC hiked 75 basis points.

That takes us to the question du jour: Which mortgage terms make the most sense now?

Mind the Spread

The average Big 6 bank 5-year fixed rate (~2.84% to 2.94%) hasn’t been this high since January 2015. It’s hitched to the 5-year government yield, which has rocketed 70 basis points in the last 7 weeks, and over a point since last fall.

As a result, you’re not getting a ton of value in 5-year terms right now, unless you:

- truly need the interest rate security of a 5-year fixed

- can live with the more painful penalties (if you break the mortgage early)

- can find a 5-year fixed for less than ~65 bps above what you’d pay for a variable or shorter fixed term

To clarify that last point, suppose you’re a well-qualified borrower considering two options:

- A 5-year fixed rate at 2.75%

- A 5-year variable rate at 2.10% (prime – 0.85%)

The spread between these two rates is 65 bps. Even if the Bank of Canada hiked three more times (which may be a lot given the reasons above), you’d still be ahead in that 2.10% floating rate—based on interest cost alone.

Here’s the takeaway for today. If you can stomach a year or two of scary rising rate headlines, and you have fallback savings, any rate near 2% is still a decent bet. Lower the better.

*********

Sidebar: Most variable rates have jumped 25 bps since the Bank of Canada hike on July 12. That’s helped banks’ net interest margins on floating rate loans. That’s partly why we’re seeing a slight improvement in variable discounts of late. Barring some kind of credit panic or global risk event, we’ll probably see variable-rate discounts improve a touch further in the next six months.

log in

log in

When it comes to rate predictions, the bond market outwits us all. It incorporates every known economic variable to arrive at today’s level of interest rates and estimate future rates.

When it comes to rate predictions, the bond market outwits us all. It incorporates every known economic variable to arrive at today’s level of interest rates and estimate future rates.

2 Comments

I see just 1 or 2 hikes in the next year. Not enough inflation for more. If the dollar holds at 80c, inflation will go down, not up.

Agreed that the variable rate option is the better value choice right now. Whether or not most people have the nerves hold onto a variable rate through a few more rate hikes, as you mentioned, is another question. A lot of homeowners with renewals coming up are going to have to think long and hard about what to do.