—The Mortgage Report: Oct. 26—

- Canada’s original mortgage rate comparison site, RateSupermarket.ca, is now RATESDOTCA.

- RATESDOTCA and its affiliates (including this site) are Canada’s largest family of comparison sites serving over 8 million customers each year.

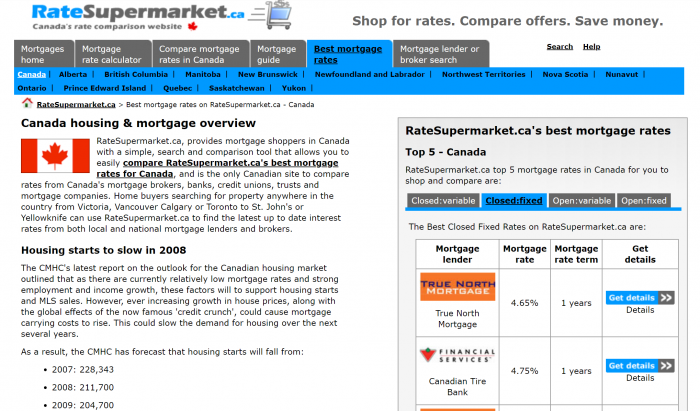

- Here’s a look at the original website that propelled Canada’s rate comparison movement, circa 2008.

The original RateSupermarket.ca website, 2008

Pessimistic Mortgagors

- 1 in 8 mortgage borrowers say it is “likely” or “somewhat likely” they will not be able to pay their mortgage in the next 12 months. Mind you, while that many people will surely not default, it is noteworthy how worried people are as they come off of mortgage payment deferrals. That story…

Lingering Unemployment

- 1.3 million Canadians have been unemployed for more than half a year. That’s a 107% increase, almost three times the peak increase during the 2008 financial crisis, according to the C.D. Howe Institute.

- Other things equal, it’s likely that the longer unemployment stays above average, the longer interest rates stay below average.

- Mortgage Rate Influence: Bearish

Quotable

- “I was quite worried that we would see a collapse in loan-volume growth in March, and that’s not what has occurred…The real estate market has stayed quite active on the residential side.”—National Bank of Canada CEO, Louis Vachon

log in

log in

1 Comment

To have a “collapse in loan-volume growth” you need a collapse in housing prices. If this shift to less populated areas keeps up and we get another recession dip while immigration is on hold, maybe it happens.