—The Mortgage Report: Sept. 30—

- The costs you’re expected bear to carry a new mortgage have never been higher—at least based on how lenders assess you as a mortgage applicant.

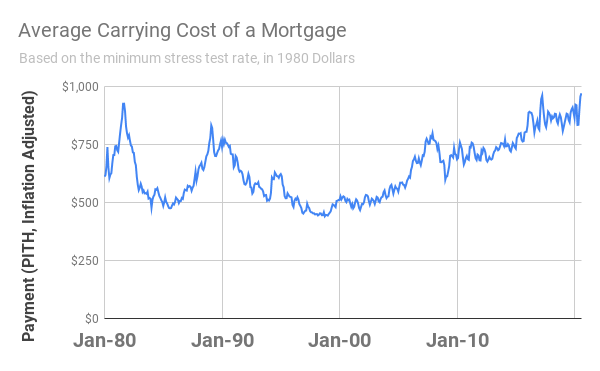

- Rocketing home prices and a stubbornly high “stress test rate” have pushed the basic inflation-adjusted cost to carry a home (i.e., average mortgage payment + heat + property taxes) to an all-time high.

- Other things equal, if your income growth hasn’t kept pace, that means it’s gotten relatively harder to win that mortgage approval.

- Nominal carrying costs, based on the stress test rate, are also at an all-time high, according to RateSpy calculations. Such theoretical costs are what lenders use to calculate borrower debt ratios. That tells them, in part, if someone is likely to pay them back.

- It’s most interesting, however, to view theoretical mortgage carrying costs after the effects of inflation are stripped out. By doing this, you uncover the real growth in costs. As the chart below shows, those “real” costs have doubled this millennium according to RateSpy data.

- Expect this surge in Canada’s “typical” minimum stress test payment to boost demand for credit union mortgages qualified on 5-year contract rates. One credit union we’re aware of uses a qualifying rate of just 2.69% when approving borrowers with 20% down payments. Compared to the official minimum stress test rate of 4.79%, that credit union’s lower qualifying rate boosts buying power 20.7% (almost $80,000 given an $80,000 household income and assuming no other debt).

- Note: Such “non-OSFI-compliant” products are uncommon. Moreover, they’re not available in most provinces. But we know of a few lenders offering this flexibility in Ontario and B.C. Speak with a broker for more details as we can’t promote them by name here.

- Despite national average home prices at a record, up 18.5% in one year, average nominal mortgage payments are still below the all-time high. We could potentially break that April 2017 peak as soon as October, however. For more on this, see: Mortgage Payments Near Record High

A New Low for 5-year Rates

- Canadian 5-year fixed rates have cracked the 1.50% floor for the first time ever, at least in Ontario.

- Default-insured borrowers in the province can now access rates as low as 1.45% for a full-featured mortgage. That’s a point below where they were eight months ago and half of what they were 19 months ago. Here are the latest 5-year fixed rates.

“Will you shut up, man?”

- Apparently, that’s how people talk to each other in today’s ‘un’-presidential debates. Insults overtook facts in Tuesday night’s Trump-Biden showdown, and rate markets barely cared. One day later, Canada’s 5-year bond yield has barely budged, up 1 basis point.

Rush Closes Get Higher Rates

- Some of the lowest-rate lenders are taking 10+ business days just to look at an application plus another 10+ business days to review documents. So-called “quick close” lenders are becoming an endangered species — if your criteria is the lowest possible rate.

log in

log in

13 Comments

Hey Spy – Do you see similar 5 year fixed rates coming to BC?

Thanks

Hey Will, It’s very possible. BC is less than 10 bps away already.

Really doesn’t make sense to call it carrying cost and take the stress test into account. Yes it’s a qualifying hurdle but it has nothing to do with carrying cost

Leo, We differ on this point. Remember, affordability in this context means qualification ability. “Basic carrying costs” are the key expenses required to maintain a mortgage. Principal, interest, property taxes and heat are the key expenses required to maintain a mortgage. Hence, the label. Lenders of course factor all four of these carrying costs in their debt ratio calculations. As for the stress test rate, using it in the time series portrays qualification ability over time. RBC economists use the same rate in their affordability reports. What the trend also shows is that lenders are increasing their expectations of the carrying costs a borrower must handle.

Good morning, Do you think we will see a drop in carrying costs anytime soon? Thanks for your opinion on this.

Hi Kimb, Hopefully yes, but it may not be significant.

I do think the minimum qualifying rate (i.e., “stress test rate”) will fall again in the not too distant future. That’ll reduce the theoretical carrying costs lenders use to assess borrowers — thus making it easier to get approved, other things equal.

Lower discounted rates are helping too — with *real-life* affordability that is.

And of course, weakening home prices would also lower carrying costs. That’s the biggest wildcard of all going into 2021.

Where is the best bank to ask about a 30 year mortgage? Thank you

Hi Shirley, If you’re asking who has the lowest rates on a mortgage with a 30-year amortization, here’s a ranked list assuming you’re well qualified (change the inputs to match your situation): https://www.ratespy.com/best-mortgage-rates/500000/400000/30/any/+29/yes/5-year/fixed

Hey Spy, if we get a fixed mortgage now, what will be the IRD penalty for big banks in the future? Are we expecting very low penalty for fixed mortgage under low interest rate?

Hi nbf2008: https://www.ratespy.com/prepayment-envy-092816026#comment-127416

The stress test was introduced to make sure borrowers can still afford their mortgage if rates climb. With the BOC forecasting minimal rate increases for the next years, what are the chances of the stress test going away or being tweaked to increase borrowing power?

Do you see a deregulation move similar to what is happening in Australia happening in Canada?

I am lucky enough to not have any debt but find myself limited in terms of lender options with good rates due to the stress test.

Hi Millenialbot,

We might need a new government for significant mortgage deregulation in this country. And they’d have to be careful until the supply imbalance is balanced.

Like you say, Australia is in loosening mode because the government realized that over-regulation cut off vital credit flow and hurt the economy. I just don’t see that sort of movement happening here to the same degree, but who knows where regulation goes?

The Liberals are proposing to boost buying power somewhat under version 2.0 of the First-time Homebuyer Incentive, but only in a few big cities (if implemented as proposed). That, and possibly rolling out their new stress test calculation in the next year, are probably as adventurous as policymakers are going to get for a while.

It is so stupid that they chose banks’ 5 yr posted rates to qualify people in my opinion

Let people who get 10 yr mortgages qualify at the true 10 yr rates

By the time they renew, their income and equity will be so much greater that it won’t matter if rates are 4% higher