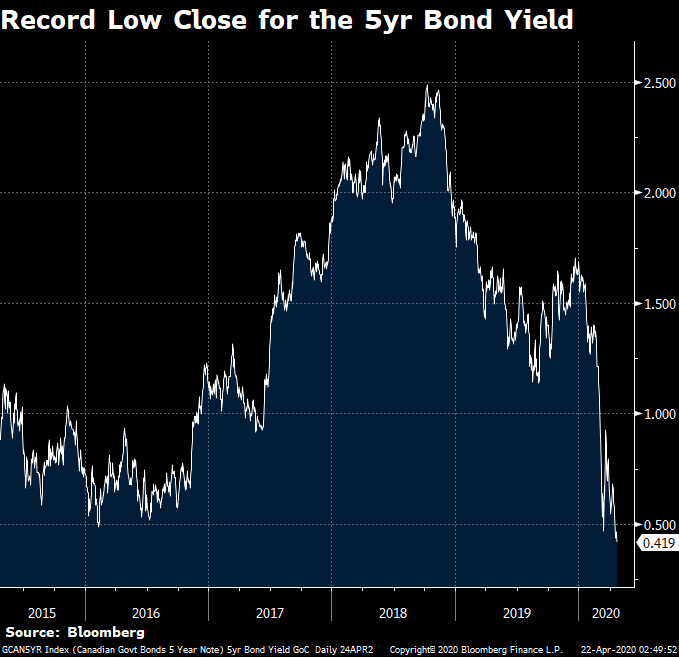

Never before has our government been able to borrow 5-year money so cheaply.

With oil in crisis mode, Canada’s benchmark 5-year bond closed at a record low yield of 0.419% on Thursday, according to Bloomberg.

Bond yields remain a driving force for fixed rates, even with all the risk and volatility in the market. The reason: numerous other mortgage benchmarks are linked to government yields, including swap rates, Canada Mortgage Bonds, covered bonds and other mortgage-backed securities.

It’s no surprise then that fixed mortgage rates are descending once again. Big bank 5-year fixed rates are down 1/4 point in the past three weeks to 2.79% or less. The lowest rates for default-insured mortgages are back in the 2.20% range in some provinces. By comparison, the cheapest variables (also for insured mortgages) are just below 2%.

With economic fundamentals (unemployment, consumer spending, business investment, exports, oil prices, etc.) all in the dumpster, there’s a good chance yields could venture further into uncharted territory. Some think Canada’s 5-year yield could even join France, Germany, Sweden, Netherlands, Switzerland and Japan and go negative this year.

In the meantime, lenders are enjoying healthy revenue margins on fixed mortgage rates. So even if yields stay flat-ish, fixed rates could drift lower.

log in

log in

7 Comments

Hey Spy! I’m getting a 4 yr fixed @ 2.64 for an upcoming renewal and am pretty keen on that however keep calculating my risk/reward scenario for the other option: 3 yr variable @ Prime – 0.2 (effectively 2.3 as per cibc) Figuring the next 6-12 months will be enjoying low interest rates and then the next 24 months lock in at whatever higher fixed rate is available — what are your thoughts?

Similar situation here – getting quotes for a 5-year in the 2.54% range from the major banks. My concerns around variable rates are around inflationary potential down the road given all the QE spend/helicopter money – hence why I feel locking into a 5 year may still be the “safest” option vs. flipping a variable in 6-12 months. Would love to hear others thoughts.

Hey Mike, Headline inflation could potentially spike temporarily as the economy recovers but for the next few years few analysts see anything that would significantly drive up *core* inflation (which is what the BoC cares most about). The recession will leave scars in terms of lingering unemployment, reduced spending by consumers and businesses, higher debt levels, etc. And helicopter money won’t make ends meet for millions of Canadains. This is all reflected in economist forecasts and interest rate forwards, for what those are worth.

Hi. Do you think Canada could ever see mortgage rates sub 1% like some parts of Europe have?

Hey Steven, A small number of variable-rate borrowers have effective rates below 1% already. Some brokers sold effective rates (which include cash rebates to the borrower) of prime – 1.46% last fall. But I’m not aware of anyone with a contract rate below 1%.

As for advertised rates below 1% in the future, it’s theoretically possible if:

a) the overnight drops to zero or less, and prime rate drops the same amount, and variable discounts get big enough once again

or

b) Canadian bond yields go sub-zero (e.g., -0.50%) and a few lenders get hyper-aggressive with short-term fixed-rate discounts.

I could be wrong but wouldn’t bet on either case playing out in this business cycle. Perhaps the next recession or the one thereafter.

What inflation? The QE is just trying to fill up the hole created by defaulting debt. Net net, it’s still highly deflationary.

Our Big-5 are “too big to fail” and we know it.