The fun thing about running a rate site is that you see lots of interesting data, like the rates that consumers click on the most.

In reviewing hundreds of thousands of RateSpy clicks this past year, some noteworthy trends have emerged.

Here’s what our latest internal analytics reveal…

********

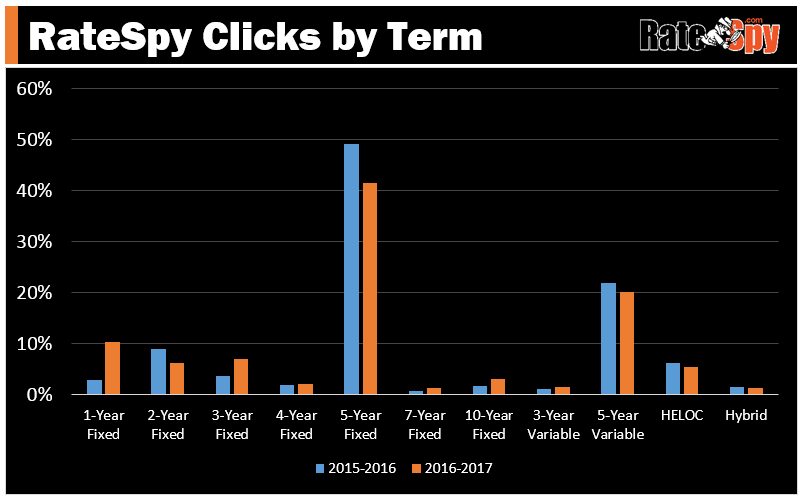

The 5-year fixed rate, typically a fan favourite, has lost lustre these past 12 months.

- Through February 2017, 5-fixeds have garnered 42% of the entire site’s rate clicks, down from 50% in the year prior.

5-year variable rates have also attracted less interest.

- Their share of total clicks has dipped to 20% in the latest 12 months, from 22% the previous year.

Eating Into 5-year Dominance

A good chunk of mortgage consumers (at least on the Spy) have shifted their attention to shorter terms.

Clicks on 1-year fixed rates have tripled from 3% of all clicks in the prior year (roughly in line with data from Mortgage Professionals Canada) to 10.5% in the last 12 months.

The share of 3-year fixed rates clicks doubled, while 4-year fixed rates saw a negligible bump in interest.

Behind the Trend

These results aren’t overly scientific, but they do suggest consumers are cozying up to shorter terms, at least more than they once did.

Various factors have driven this shift, including:

- More Education: Consumers are more mortgage savvy than ever. The more they research terms online, the more they realize that mortgage penalties aren’t fun. For folks who may refinance or move in a few years, and want the flexibility of choosing any lender, a 5-year term doesn’t make sense. Consumers are also learning how uncompetitive most lenders’ conversion rates are, which detracts from variables’ appeal.

- Variable benefits drying up: Ever since the Big 6 banks demonstrated they’re unwillingness to pass through Bank of Canada rate cuts in full, the biggest benefit of a variable rate is now in question. That’s made cheaper fixed rates comparatively more alluring.

- New Stress Test Rules: Effective November 2016, all insured borrowers must prove they can afford payments at the average 5-year posted rate (4.64% currently). There used to be a loophole around this if you chose a 5-year fixed term, but no more. With fewer people selecting 5-fixeds simply to qualify, shorter terms now make up a higher proportion of mortgages.

- Greater media attention: More people are writing about the benefits of short-terms (example, example). That’s generated a bit more consumer interest in 1- and 2-year options.

- Attractive Rates: Prior to November, short-term rates were relatively cheaper than variables and therefore made good variable substitutes. (This is no longer the case, due in part to recent government rules that make shorter terms costlier to fund for many lenders.)

Variables Not Down for the Count

Despite the recent appeal of short-term fixed rates, we’re not giving variables their last rites yet.

Heavy variable rate discounting has suddenly recaptured the interest of rate-sensitive borrowers. Looking at the current stable of 5-year variable rates, you’ll see offers as low as prime – 1.04% (that’s for insured loans; uninsured are 15 to 25 bps higher).

That’s widened the fixed-variable gap to as much as 60 bps on high-ratio mortgages, the most in several quarters. As that gap grows bigger, it means borrowers are paying relatively more for the “insurance” of fixed rates. And most people will only pay so much.

The Jokers in the Deck

As we all know, nothing is certain in the world of interest rates. The appeal of short terms could change on a dime if/when:

A) bond yields surge (people tend to lock in when rates shoot up….which could happen if The Donald’s fiscal stimulus looks to pass in Congress)

B) Oil collapses (perhaps because clean energy, electric cars, pipelines, OPEC and/or U.S. drilling permanently shift supply/demand)

C) Trump gets us into another war (perhaps because, well, Trump opens his mouth).

log in

log in

The fun thing about running a rate site is that you see lots of interesting data, like the rates that consumers click on the most.

The fun thing about running a rate site is that you see lots of interesting data, like the rates that consumers click on the most.

Variables Not Down for the Count

Variables Not Down for the Count The Jokers in the Deck

The Jokers in the Deck

6 Comments

Why do you think the 2yr fixed isn’t more popular? Over the last year, for <=80% LTV, the cheapest rates have usually been on the 2yr fixed. My primary residence and 2 rental properties are now on 2yr fixed terms. 5yr variable is usually the lowest, but the last couple years have been strange…

People actually get 10-year terms? Just one question…. why?!?

Tara, Most likely because they have a deep burning desire to enrich their lender.

That aside, 10-year terms have very limited application for certain income property financing scenarios, but not so much at today’s rates.

I have a mortgage due for renewal in Dec. 2017 ( rental property) One other ( principal residence) in may 2018. They are presently locked into a 5 yr variable 3.040 interest. I’d like to consolidate them as rental so I can claim the interest in my taxes. What would be the best term to choose in the waiting gap between Dec. 17 and may 18?

If we saw a sustained rise in bond yields, how long would it typically take for rates to start rising?

Hi F3 — When the 5-year bond yield jumps 0.15+ percentage points, the lowest 5-year fixed rates typically rise within a week or so.