It’s fashionable to be negative these days.

It’s fashionable to be negative these days.

To have a negative yield, that is.

Since 2012, it’s been increasingly common for government bonds to have interest rates (yields) below zero. Not only are investors in those bonds earning no return, they’re actually paying to save—i.e., paying for governments to hold their money safely.

Mortgage Implications

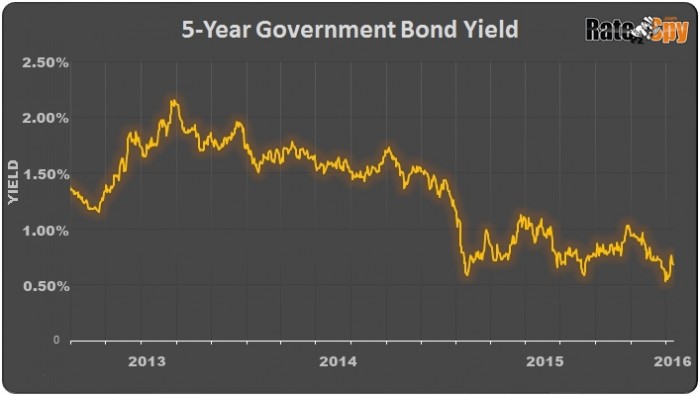

Global yields matter in a mortgage context because fixed rates are closely linked to bond yields. Thirteen days ago our 5-year bond yield plunged to a record 0.49%. That seems unfathomably low for a five-year investment, that is, until you compare Canada to our friends across the Atlantic.

Switzerland has a 5-year yield of minus 0.77%, followed by Germany (-0.26%), Netherlands (-0.20%) and Austria (-0.18%). France too has negative yields, while Japan and Ireland are just a few basis points away from being sub-zero.

Numerous industrialized nations now have negative rates. (Table source: Bloomberg)

In more normal times, competitive 5-year fixed mortgages have been priced about 1.70 percentage points (pp) above the 5-year Canadian yield. Unfortunately, this “spread,” as traders call it, has inflated in the last year to about 2.00 today. That’s pushed up the cost of a new 5-year fixed mortgage by almost $2,500.1

Will Canadian Yields Go Lower?

Notice that our 5-year yield is still about 0.70 pp above our euro cousins. What makes us so special?

The answer: not much at the moment. (Here’s more on what’s driving negative yields if you like the technical stuff.)

With our economy teetering precariously close to recession, rates could stay depressed for multiple quarters, if not years. The potentially higher return of our bonds, Canada’s AAA credit rating and controlled inflation make Canuck bonds appealing, relative to those across the pond. That’s notwithstanding our crumbling currency, which tends to freak out foreign investors.

Regardless, more international demand for Canuck bonds could eventually result in lower interest rates, other things equal. If this demand, and weak economic data, push our 5-year yield below half a per cent for a week or two, fixed mortgage rates could easily drop further.

If you look at the chart below, the 0.50% to 0.55% area is key psychological support. Bond traders have probed this area three times and the more that rates touch a support level, the more likely they are to break it.

For now it’s a matter of watching and waiting. If yields and fixed rates do fall, don’t count on major discounting near-term. Lenders are doing everything in their power to maintain above-normal profit margins going into the all-important spring market. The point here is simply that there’s no dire rush to lock in.

But if the 5-year yield does trade below 0.50% for a while, we could see some mortgage providers advertising 5-year fixeds at 2.29% or less. That ain’t too shabby, albeit, it’s only 0.10 to 0.20 pp below today’s lowest rates.

1 Based on the average Canadian mortgage balance of $175,000 amortized over 25 years.

log in

log in

7 Comments

Another great post. It’s quite refreshing to read reasoned and logical financial information when so many “experts” are prone to drama and protecting their ego.

Thank you sir. One thing you learn as a trader, where you lose more than you win, is that ego tends to stand in the way of profitability.

Great, it looks like the only way to make money on bonds anymore is speculation.

Negatives rates is pure desperation. Nothing good will come of this (except for temporarily lower mortgage rates, perhaps). But in the end, if yields are negative it’s because things have gone from bad to worse for the economy, and slightly cheaper mortgage payments may be of little solace.

@Jane. Point well taken. To the extent that negative rates would follow another economic breakdown, no one should want to see that.

It seems most banks are using the 4.64% qualifying rate on all fixed rate terms below 5yr. Do you know which banks don’t?

Try a credit union. They often use the 3 year rate for qualification on uninsured mortgages.