—The Mortgage Report: Aug. 16—

HSBC Cuts

HSBC slashed a bunch of key rates going into the weekend, setting record lows on a variety of terms. That included reductions to these special fixed rates:

- 3yr: 2.19% to 1.99%

- Canada’s lowest-ever 3yr refi rate

- 5yr: 2.09% to 1.96%

- Canada’s lowest-ever 5yr refi rate

- 5yr (high ratio): 1.89% to 1.76%

- Canada’s lowest-ever widely advertised 5yr refi rate

The bank also trimmed the following special variable rates:

- 5yr: 1.99% to 1.89% (prime – 0.56%)

- 5yr (high ratio): 1.69% (prime – 0.76%, a brand new offer)

- The lowest lender-advertised variable rate

BMO Cuts

The Bank of Montreal trimmed these special fixed rates:

- 3yr: 2.39% to 2.19%

- 5yr Smart Fixed: 2.49% to 2.24%

- 5yr Smart Fixed (high ratio): 2.37% to 2.07%

- This move matches TD and CIBC for the lowest widely advertised 5-year fixed from a Big-6 bank.

Scotia Cuts

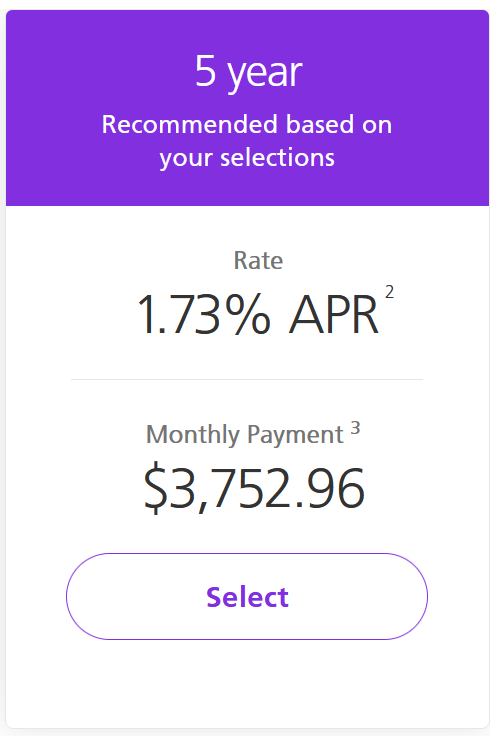

Scotia’s eHOME site has all the majors beat on default-insured purchases, with rates as low as:

- 1.73% on a 5-year fixed

- 1.71% on a 5-year variable (prime – 0.74%)

Insured 5yr Fixed, Aug. 16, 2020

Factoid

- Someone buying a home with 5% equity (i.e., a 5% down payment) and taking out the lowest 10-year fixed rate will have built up 33% total equity by the end of their term, even if home prices don’t even rise $1 for a decade.

(Reminder: Given the penalties, steer clear of 10-year rates if there’s any chance you’ll refinance or break your mortgage before the fifth anniversary.)

log in

log in

6 Comments

I am seeing all of these insured rates for 40 BPS below uninsured rates (i.e. butler mortgage rate, where the max you can have down is 19.99%)… Taking a look at a 675K mortgage to get be below the 20% threshold vs the 600K mortgage I was planning on taking, it appears that over 5 years even with the higher payment (variance coming out of the additional 75K + paying for the insurance cost I would have 40-50K in free money based on the insurance savings)…. Am I missing something here, or would it make sense to put down sub 20% and capitalize on the lower insured rated…

“Someone buying a home with 5% equity (i.e., a 5% down payment) and taking out the lowest 10-year fixed rate will have built up 33% total equity by the end of their term, even if home prices don’t even rise $1 for a decade.”

This is precisely why there should be no stress test for 10 year mortgages. There is basically no risk of rates rising so much by renewal that borrowers can’t afford their mortgage. Their income would be growing for 10 years while their mortgage payment stays the same. If rates did skyrocket, these people would easily be able to refinance or have plenty of time to sell.

Hi Gandalf, Certain policymakers believe it’s a good idea to apply inflated qualifying rates to long-term mortgages to limit people’s debt, regardless of the fact that such borrowers are not default risks and regardless of other considerations (rising rental costs, lost equity accumulation for homebuyers, etc.). As you can imagine, it’s an intensely debated topic, both in the industry and in general economic circles.

I have been getting your emails and they are

Great But they are mostly for for new mortgage s

There is no option to do a refinance for rates or

To use a mortgage calculator for refinance

Whish you had that option

Thanks David,

For a refi calculator try this: https://rates.ca/mortgage-calculators/mortgage-refinance?

For refi rates, check the box “Available for Refinances” on the left side of any rate table on the site.

Good luck

eHome not available in Quebec… boo Scotiabank!