—The Mortgage Report: July 21—

- A Seldom-used Strategy: Usually, it doesn’t make sense to buy default insurance on your mortgage if you have a big down payment. But there are exceptions, like when you have 35% equity and the difference between insured and insurable mortgage rates is 15 basis points or more. In those infrequent cases, you end up saving more by paying a default insurance premium—even though you technically don’t need to. (The premium is 0.60% of the mortgage amount — plus provincial sales tax in some provinces, like Ontario.) Doing so can qualify you for cheaper insured mortgage rates if your home purchase is under $1 million. And there’s an added bonus. When you come up for renewal, you can carry that insurance over to your next mortgage—even to a new lender, assuming you haven’t refinanced after getting the mortgage. Maintaining active insurance is valuable because it lets you keep qualifying for the lowest mortgage rates in the market, which are usually “high-ratio” insured rates. If bond yields drop further this year, there’s a chance the insured-insurable spread will widen to 15+ bps and this rare strategy will come into play. The reason being, some lenders have a disproportionately bigger appetite for insured mortgages and may price them a tad more aggressively, relative to mortgages at 65% loan-to-value. If this all sounds confusing and you have 35% down, simply ask your mortgage advisor to run the math and see if buying default insurance makes sense.

- Burning Through Mortgages Quicker: 18 months ago, people were paying 3.50% for a 5-year fixed. Today, the lowest rates are at least 1.50 percentage points less. How fantastic is that? Well, if you voluntarily made the same payment as you would have 18 months ago, that higher payment would pay off a standard 25-year mortgage in just 20 years, 4 months. That’s the power of falling rates. It works in reverse too, of course.

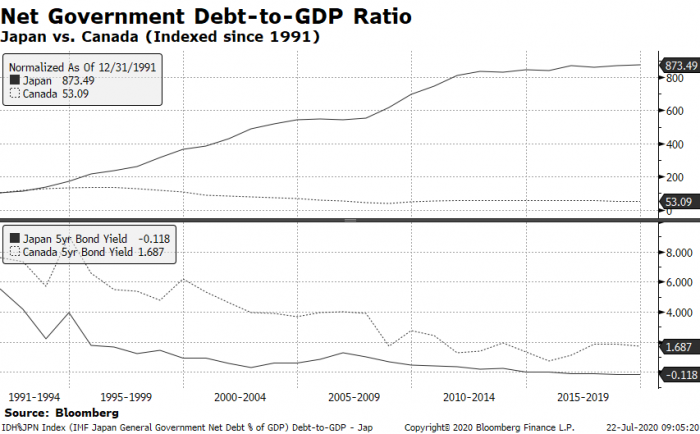

- Government Debt Alerts: Prepare for warning after warning (like this) about how our government’s debt issuance will boost bond yields and consumer borrowing costs. (Rising yields lift fixed mortgage rates.) Whether that happens to any significant degree is debatable, given all the other macro-economic pressures weighing down inflation and interest rates, including lingering unemployment and structural disinflation. You only have to look to Japan’s massive debt increase (see chart below), which unintuitively led to negative interest rates, to conclude that Ottawa’s debt spike isn’t a near-term threat. On top of the bond issuance concern, however, is the fact that the Bank of Canada will presumably sell some of its bond holdings…someday. Extra selling pressure also drives up yields and fixed rates, other things equal. This is probably a far-in-the-future problem, though. To date, “We have not sold any of the Government of Canada bonds that we have purchased [since the pandemic],” a Bank of Canada spokesperson said on Monday. And it probably won’t for several quarters.

Yet, its interest rates sank below zero.

- Quotable: “Even in cases where a homeowner simply can’t make their mortgage payments anymore — as long as they have equity in their homes and the housing market is relatively stable — there’s always the option to simply sell…”—Bank of Canada director of financial stability Mikael Khan, commenting about the coming end of mortgage deferrals. (via Advisor’s Edge)

log in

log in

7 Comments

@Spy how does one go out and buy default insurance. I tried to a few years ago. I asked the big bank I was with this as well as a few mortgage brokers and they all told me I could not as I had more than 20% down. I was thinking just like your article said as rates were more than 15 bps difference a few years ago. Luckily I didn’t as I refinanced to put more money into the stock market in March (Locked in Prime – 1.01%)

Hi Tyler, Your lender has to request it from the insurer (at your request). Some lenders either won’t facilitate low-ratio transactional insurance or won’t discount their low-ratio rates further, even with insurance.

Most mortgage finance companies, which often have the best insurable rates, are happy to let you pay for default insurance — given it benefits them.

Just weird, Talked to Butler, Canwise and Royalbank and all three said no we cannot do that. Forget which ones said which…one said no, only available from CMHC, if you are paying less than 20%. Another one said its not something you can request to be added on. The third just kinda ignored/shrugged off my question when I brought it up.

Could be just me, and my bad luck talking to 3 agent/specialist, but I don’t think lenders understand you can request it. When 2 mortgage brokers tell me this I just assume this is true and move on.

A mortgage broker should be like “Hey you are putting 32% down”, put another 3% down and get default issurance..then you can save XXX in the long run with a lower rates

This should be common knowledge for any experienced broker. At the moment the rates don’t justify paying a premium at 65% LTV. Maybe that is why they are not recommending it.

As for a bank like RBC it doesn’t offer insurable rates at 65% LTV so of course it will not offer this solution.

I thought it is still worth it. So on a 1 million dlllar home you will pay 6480 in Ontario. 0.15% on 650,000 is 975 the amount you save over 5 years is Just under 5,000. However when you renew, chances are youll get the 0.15 again, so in approximate in 6.5 years you break even. Then you have another 18.5 year to save another 8-9 grand (every year you pay less interest as the amount you owe decreases).

If you mortgage is 500k then you premium is 3240. Still takes 6.5 year to break even and you save 4-5k over 18.5 years.

As you stated, if the spread is bigger then you save even more. An extra 5bps saves you an additional 33%.

You only lose money if you break your mortgage within the first 6.5 years.

How is this preferable to the rate you get if your loan is simply eligible for bulk insurance? Insurable normally means a better rate for a conventional mortgage and the lender is paying the premium. It’s the same eligibility rules whether you pay or the lender pays. Most lenders already take into account insurability in making their best rate offer on a low ratio loan, no?

Hey David, Lenders with low-ratio insurable rates always factor in insurability, but every now and then there’s a pricing inefficiency that can be exploited between the best high-ratio rate in the market and the best 65% loan-to-value rate in the market. In other words, occasionally high-ratio insured rates (with borrower-paid “transactional” insurance) are sufficiently lower than low-ratio insurable rates (with lender-paid “portfolio” insurance).

Also, if you’ve got no plans to refinance for more than five years, sometimes it makes sense to pay the insurance even if the rate is *slightly* higher. That gets you a better deal at renewal.