Comparing mortgage rates is more worthwhile today than it was two years ago, for multiple reasons.

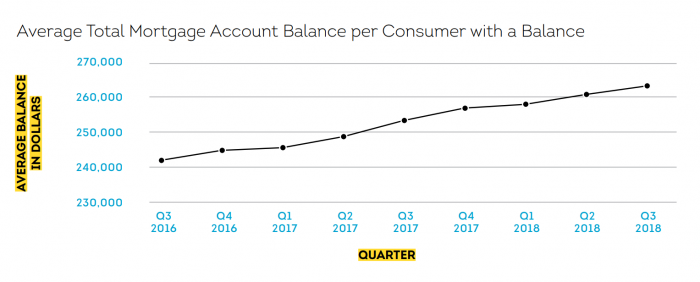

For one thing, Canada’s average mortgage balance is now up to $263,657, according to TransUnion.

This number has been rising for years, and it’s risen another 4.23% in the 12 months ending Sept. 30, 2018 (the latest data available).

The bigger your mortgage, the mortgage interest you pay at a given rate and amortization, the greater your savings from every additional basis point of rate discount.

Adding to that, the lowest 5-year fixed rate rose 119 basis points in that same timeframe. And, no surprise, the higher rates go, the more interest a mortgagor pays, and the greater the savings from every additional basis point of rate discount.

And then there’s greater lender choice. There are more providers advertising deep discount rates online than ever before. And to get noticed (given that few people click beyond the best five rates for a given term), providers are undercutting each other more than ever.

For all these reasons, it’s been increasingly profitable for consumers to compare mortgage rates over the past few years.

Two years ago, for example, (when the lowest 5-year fixed rates were 119 cheaper and the average mortgage was $22,360 less) slicing 10 basis points off one’s rate would have saved the average borrower about $1,125 over a five-year term.

Today, negotiating that 10 bps off saves the typical borrower $1,247, or $122 more. (That’s not including the effects of greater discounting.)

No one’s going to get rich because they saved an extra $122, but why leave any money on the table?

Past research has shown that the average Canadian gets fewer than two quotes when shopping for a mortgage. Assuming you’re well qualified and get one quote from one lender, the odds are overwhelming that you’ll find another lender selling for less on a rate site.

And, the bigger mortgages get and the higher rates go, the more that research is worth your time.

log in

log in

1 Comment

So glad to have rate comparison sites like yours around! I can’t tell you how helpful it was to be able to compare our bank’s offer with what the other big banks are offering. That helped us in the negotiation process and save us some $$$ at the end of the day!