Someday you’ll be getting mortgage advice from an online robot.

Someday you’ll be getting mortgage advice from an online robot.

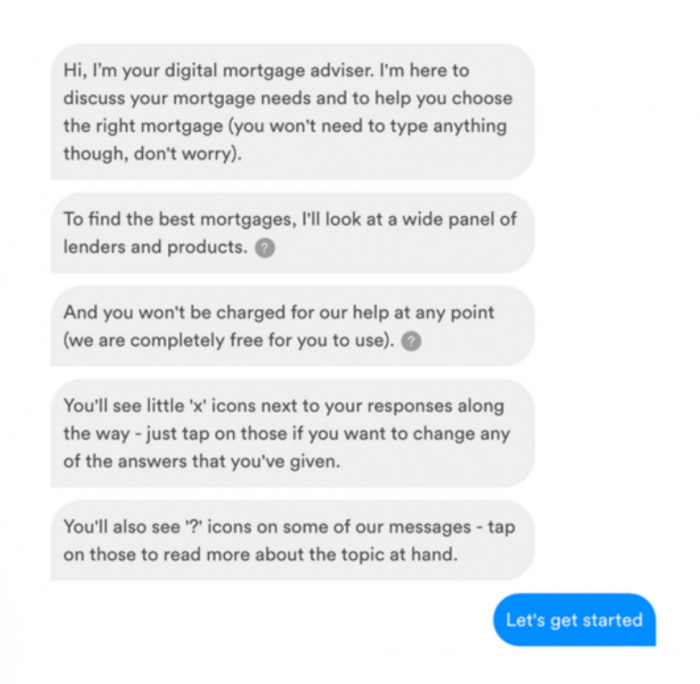

This “chatbot” will ask you questions to determine your needs. It’ll then recommend the most suitable mortgage based on your answers and its programming.

Today, of course, people use human mortgage advisors for this very same thing. But robo-advisors are different. They don’t:

- Sleep (They’re available anytime you are, 24/7/365)

- Keep you waiting (Their answers are instant)

- Rush you (They’ll walk you through an entire mortgage application without ever making you feel you’re taking their time)

- Ask for personal information (and if they do—you can make something up without feeling bad about lying to a robot)

- Make you feel guilty when you take their advice and go elsewhere to get your mortgage.

Programmed correctly, robo-mortgage advisors can provide high-quality, in-depth mortgage advice with no need for small talk and no need for you to drive anywhere. All of this is quite appealing to Canada’s growing “instant-gratification” demographic.

The best part is, once they’re programmed, bots are cheap to maintain. After the initial investment, lenders can save up to 1/2% to 1% of every mortgage they originate in commissions, plus call centre costs.

Lenders could someday use that savings to shave off another 1/10th per cent (+/-) from your interest rate. On a $250,000 mortgage, that’s $1,180 back in your pocket over five years.

Is a thousand bucks enough to forgo human advice? That’s a question mortgage shoppers will increasingly ask themselves in three or four years. And it will heavily depend on how good bots become.

The Future is Near

As much as the mortgage industry doesn’t want to admit it, humans can be replaced by machines…for some tasks, for some customers.

As much as the mortgage industry doesn’t want to admit it, humans can be replaced by machines…for some tasks, for some customers.

Mind you, it is very early days. Today’s mortgage chatbots are essentially just glorified FAQs machines. They’re not good at negotiating with customers, closing sales, or probing to confirm product suitability—something skilled humans are good at. And bots are also not good at advising on more complex cases like borrowers with multiple rental properties.

Nonetheless, the next iterations will leverage far more powerful artificial intelligence. They’ll be conversational, they’ll ask questions about your finances and mortgage needs, they’ll remember what you told them, and then they’ll query their massive database to recommend the optimal mortgage and rate…

…all with zero obligation from you.

Banks Have the Edge. Or Do They?

Banks are all over this technology. In 2018, tech spending at RBC, for example, will hit ~$3.2 billion, up from $2.9 billion in 2017 and $2.6 billion in 2015. Tens of millions of that will go into artificial intelligence and bots.

When it comes to mortgage tech, our big banks can outspend almost anyone in the Canadian mortgage market. No question.

But one thing they can’t do is be objective. You’ll likely never see RBC promoting a Scotiabank mortgage, for example, even if the rate and terms are better.

That’s why the leading mortgage bots of the future will be independent. They’ll give you the advice you’d expect from someone who: A) truly cares about minimizing your borrowing costs to the greatest extent possible, and B) tracks all mortgages in the market objectively.

If you’re an advisor who makes commissions from selling mortgages to well-qualified applicants on owner-occupied properties, beware. Chatbots are game-changing tech and they’re coming…faster than many might think.

log in

log in

5 Comments

I have a background in tech, and found the banking and finance sector to be one of the least efficient on IT spending.

A web-facing database of detailed financial information will be a target for black-hats, so obviously security will be a top priority. CIBC and BMO can survive a hack, but an upstart robo-mortgage company likely cannot.

While I agree the robo-advisors will come, 5 years from now I doubt they will take more than 5% of the market.

Most top lenders will roll out robo-mortgage advice within five years, so the percentage of borrowers closing with lenders offering this tech will be multiples of 5 per cent.

When it comes to fintech robo-advisors, however, your guess is as good as ours, Ralph. Five per cent certainly doesn’t sound like an unreasonable guess, 60 months out.

Mind you, it’s amazing how receptive the younger generation is to automation. Deloitte found that in the UK, 38% would pay for “automated advice to find a mortgage”: http://prntscr.com/jwfkd2

Some might find that hard to believe, but paying $250 to save $1000+ isn’t so far fetched. Sadly, provincial broker regulations (FSCO’s and FICOM’s for example) ban or seriously limit fee-based mortgage advice. That prevents Canadians from enjoying such technology-based cost savings. This is something people need to be emailing their members of provincial parliament about as it will cost families thousands over time.

Here’s Deloitte’s study in full, in which they conclude “Traditional mortgage brokers will be hardest hit”: https://www2.deloitte.com/content/dam/Deloitte/uk/Documents/financial-services/deloitte-uk-updated-robo-advice-new-horizons-layout-mww8.pdf

This was a conversation I was having with our team today. We run a real estate team. How long will it take for blockchain to disrupt the real estate transaction?

Great question Rich. The potential savings to the industry and mortgage consumers could easily top $1 billion a year in Canada alone. But getting all mainstream lenders and land titles on the chain could take years. My wild stab in the dark would be 5+ years minimum. (Hope I’m wrong!)

I’ve been mining BTC and ETH for 3yrs, and writing mining software.

https://github.com/nerdralph/ethminer-nr

I’ll double-down on Rob’s 5yr bet and go with at least 10 years. Key recovery is a necessity before blockchain can go mainstream. Already millions of dollars with of BTC has been lost due to lost passwords, so nobody will risk loosing real estate.