If you’re a homeowner, you want your property value to escalate over time.

But market fundamentals—those economic factors that drive supply and demand—aren’t alone in determining your home’s worth.

There’s something else that can be just as important: what your neighbours and people you know think prices will do.

Price Expectations Matter (a lot)

Research from Marcato and Nanda (2014) confirmed that market sentiment is “important in explaining residential real estate price changes…” Indeed, the opinions of those in your neighbourhood are more meaningful than many think.

That’s why “…policy-makers concerned about boom-bust cycles in house prices should pay close attention to house price expectations, especially at longer horizons,” say Bank of Canada researchers.

CMHC concurs. The federal housing agency’s research finds that “fundamental drivers (interest rate changes, employment growth, population growth) are thought by homebuyers as having less impact on house prices than factors linked to perception.”

It adds, “The fact that those perceived factors, linked to speculation, have a greater influence on house prices can lead to higher house price growth expectations because it makes homebuyers more willing to pay higher for homes.”

Expectations of long-term price appreciation cannot be underestimated as a driver of home values. 88% of Canadians polled in the last year felt that “real estate is the best long-term investment, even better than financial investments.”

Driving Expectations

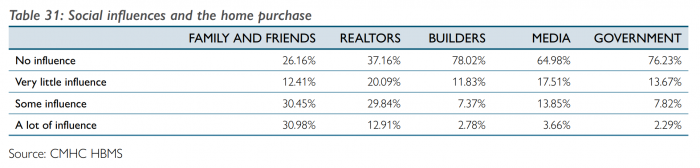

Our beliefs about home price direction and magnitude take shape in many ways. Not the least of which are influences from friends and family, and news reports of past price performance.

Out of friends/family, realtors, builders, media and government, friends and family have the greatest social influence over homebuyers…by far.

But your inner circle is likely subject to significant bias. For one thing, people are usually over-emotional. A 1985 study by Bondt and Thaler found that people tend to overvalue an investment when they were exposed to “good news” stories and undervalue it during “bad news” stories.

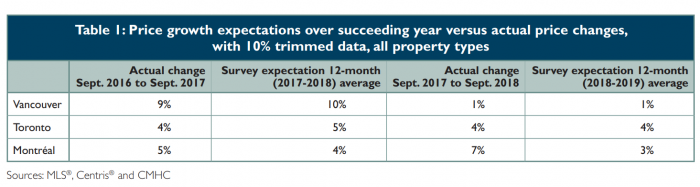

Research also suggests that people extrapolate their home price expectations largely from what prices did over the past 12 months. That’s why price sell-offs can become a self-fulfilling prophesy, as Case and Shiller (2010) found in their research.

When people read that home values are falling 6%, 7%, 8%, 9%, and that’s reinforced by opinions from friends and family…people get progressively more worried, and demand and housing liquidity drop. These backwards-looking price expectations can also make people slow to acknowledge market turns, CMHC writes.

The survey table below shows just how closely people’s expectations of future prices are linked to past appreciation.

For these and other reasons, keeping prices stable and avoiding downward spirals (or upward spirals for that matter) has been top of mind for policy-makers.

We Need Better Data

One way we can gain more insight into where prices may be headed is by soliciting longer-term views from the public. Five-year price expectations are quite telling, according to BoC researchers. “Extrapolation [of past prices] (particularly at long horizons) can lead to self-perpetuating increases in house prices that may not be supported by economic fundamentals.”

Such phenomena was likely behind the supersized price gains in Toronto and Vancouver this decade.

“Unfortunately, no such data for Canada have been readily available,” the BoC says. But that’s about to change. The bank is now regularly tracking 5-year price expectations for the very first time, on a quarterly basis. This essential data will be published by the BoC starting in 2020—giving home price analysts something to look forward to.

log in

log in

If you’re a homeowner, you want your property value to escalate over time.

If you’re a homeowner, you want your property value to escalate over time. CMHC concurs. The federal housing agency’s

CMHC concurs. The federal housing agency’s

1 Comment

Perception is that real estate prices grow to the sky. Wait until unemployment jumps 1/2%. We’ll see real estate sentiment sour mighty quick.