Despite rates being less than a point from their all-time lows, borrowers are growing increasingly dissatisfied with shrinking mortgage discounts.

In the last month, typical 5-year fixed rates have surged 45+ basis points and variable discounts (from prime rate) have decreased by 75+ bps. That’s due mainly to temporary “risk premiums.”

In other words, lenders are charging borrowers more because nervous investors are forcing them to pay up for mortgage capital.

Over time, there is almost a 100% probability that these risk premiums will shrink and mortgage discounts will revert to “normal.” The question is, how long that will take?

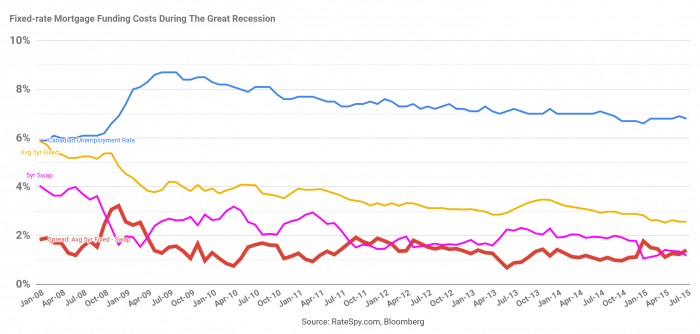

The chart above shows how risk/liquidity premiums spiked more than 170 basis points over a four-month period in 2008. So far in this crisis, they’ve risen about 70 bps. Hence, lenders we talk to think mortgage rates will keep climbing.

Definition: In this context, “risk premium” refers to the lowest nationally available 5-year fixed rate, as tracked by RateSpy.com, minus the 5-year swap rate, which is a rough proxy for a big bank’s base cost on a 5-year fixed mortgage. Base cost does not include personnel, overhead, marketing or other expenses.

Traversing the Canyon

We’re hearing from folks who don’t want to commit to long terms because they think discounts will improve in the future.

Their idea: bridge today’s rate turmoil by taking a short-term rate or HELOC today, and reset to lower rates when discounts normalize.

Here’s what we can say about that:

- Timing rates is risky business. No one but the most financially secure, well-qualified and risk tolerant should ever contemplate it.

- If you can find a fixed rate under 2.80%, you’re doing exceptionally well historically. 2.80% is the magic rate whereby someone with a 25-year amortization is paying more principal than interest with every payment.

- The coronavirus will ravage the economy like we’ve never seen. No one knows how long the damage (and risk premiums) will last. We will potentially see lingering unemployment, devastation in the oil industry, extraordinary corporate defaults and/or mass consumer insolvencies.

- That sounds bad, and it is. On the other hand, with governments committed to providing liquidity to markets and relief to consumers, the economy won’t completely derail. By the end of this year or next, history strongly suggests that mortgage risk premiums will be in decline.

- With a few inapplicable exceptions, elevated unemployment keeps inflation low. Low inflation generally keeps interest rates low. As Bruce Richards, CEO of Marathon Asset Management, told Bloomberg, “Whenever you have a crisis, a recession, the [central bank] will never tighten….(i.e., raise rates) in at least three years subsequent to that point. We know that in 2021, 2022 and 2023 with the highest level of confidence, rates are zero…”

The Bridge

That brings us to the above-mentioned strategy.

It helps to start with some basic assumptions, like:

- Sideways-moving rates for 2+ years

- 75 bps of BoC rate hikes in 2022 (similar to the 2010 experience)

- A resumption of normal funding spreads (i.e., how much extra lenders pay for mortgage capital) within two years

- A borrower with no need to sell or refinance early, and who is well qualified with:

- 20% to 35%+ equity

- Rock-solid employment with provable income

- A reasonable debt load

- Excellent credit

- A 25-year amortization

A quick simulation confirms that such a borrower would theoretically be better off:

(A) avoiding five-year fixed rates like 2.99%+, and

(B) taking a 2.80% or lower short-term or open rate, with the intention of resetting lower in 12-24 months.

RateSpy’s models show the above strategy saves this borrower roughly $2,300 of interest per $100,000 of mortgage over five years.

If rates surged three times as much in two years (+225 bps), the same borrower would pay just $860 more interest per $100,000 of mortgage, versus locking into a 2.99% five-year fixed.

Hence, the risk reward is reasonable indeed for those minority of borrowers who are ultra-risk-tolerant.

Should You Do It?

Again, one can’t stress enough how unknowable the future is. As one example of what could go wrong with this strategy, ballooning government balance sheets could increase sovereign credit risk premiums and an unwinding of quantitative easing (i.e., governments selling the bonds they bought during the crisis) could elevate yields, and hence mortgage rates. Few economists fear this outcome, but almost anything’s possible.

For reasons like that, the vast majority should simply lock in the lowest rate they can get for the term most suited to their 5-year plan, especially if it’s under 3%.

But for those willing and able to play the odds, they can build a bridge to lower rates by not locking in for five years. At the very least, do not lock into a mortgage with onerous prepayment penalties if you can help it — because you may find yourself wanting to refinance, sell or reset your rate sooner than expected.

Long story longer, taking a sub-3% short-term or open rate with the intention of resetting in a year or two (when mortgage pricing normalizes) is a rational calculated gamble for a limited subset of borrowers.

log in

log in

11 Comments

I have a HELOC at -035 and the LOC at prime +05 . My maturity date is Aug 2021.

I wonder if a Refinance to a 5 year fixed is the smart move now.

I am curious if there has been any talk about MCAP lowering their variable rates? We have yet to see the previous 50 basis points cut (March 13th) applied to our variable, and now there has been an additional 50 basis point cut (March 27th).

Hi Spy,

I have a commitment letter of 2.59% for 30 years Amortization. 15%/100% ( TDbank). 5 years fixed with 20% down. Just wanted to know if i should go for fix rate based on current and up-coming economic situation.

I wanted 25 year amortization, but things changed overnight and the lender said they will not commit to old rate. Is the above 30 year deal is good? I will be paying more interest though in the starting 5 years.

Thank you!

Hi Helder, Can’t tell you where rates are going or what term is right for your situation, but as of today, 2.59% is excellent for a 5yr fixed with 30yr amortization. Just beware that big bank penalties can be brutal if you need to break early or refinance elsewhere before maturity.

When does HSBC lower its prime rate? It is 2.95 currently and no updates.

Hi David64, HSBC drops its prime to 2.45% on Tuesday: https://finance.yahoo.com/news/hsbc-bank-canada-lowers-prime-160000672.html

@Kris

My broker told me MCAP is lowering its prime rate on April 1.

I have 2 offers

a 30yr fixed 3% mortgage rate for place I am keeping for the most 10 years. $750 credit towards closing cost.

B 3.25 intrest rate and $1800 at closing. All else is equal. What rate is better

Hi JR, Depends on the loan amount, among other things. Try this: https://www.ratespy.com/mortgage-rate-comparison-calculator

I was offered 5yr 2.42% by both Scotia and CIBC on March 10. Its a refinance deal as we are moving houses May 21. Our original mortgage was supposed to be up Sept 2020. Am I insanely greedy to take a smaller term for a potentially better rate in a few years or should I just take this and run

Hi Steve, There’s not enough info to tell you which is the best term for you, but it’s safe to say four things:

1) Both of those lenders have potentially brutal penalties if you need to break early, but at least Scotia’s STEP mortgage lets borrowers tack on more borrowing before maturity without affecting their existing rate and requiring a penalty

2) 2.42% is an outstanding 5-year fixed rate

3) No one knows where rates will be in a few years

4) There’s value in certainty