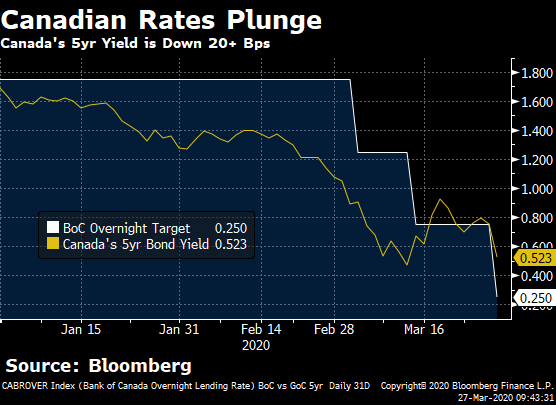

The Bank of Canada has slashed its key rate for the third time this month, using what many think are its last rounds of monetary policy ammunition.

- Rate Announcement: 50-bps emergency cut

- Overnight rate: Now 0.25%

- Prime Rate: Currently 2.95%; pending change to potentially 2.45% (see Prime Rate)

- Market Rate Forecast: No further change in 2020

- BoC’s Headline Quote: “This unscheduled rate decision brings the policy rate to its effective lower bound…”

- BoC on the Economy: “The spread of COVID-19 is having serious consequences for Canadians and for the economy, as is the abrupt decline in world oil prices.”

- BoC’s Full Statement: Click here

- Next Rate Meeting: April 15, 2020

The Spy’s Take

The bond market is now pricing in a possibility of another rate cut this year. It’s anyone’s guess if that happens, but if it does it could take Canada’s key interest rate down to 0%, a never-before-seen level.

The Bank also announced today that it will buy government bonds until “the economic recovery is well underway.” That could eventually push fixed mortgage rates lower given their link to the bond market. (Added bond buying pushes up bond prices and pushes down bond yields.)

Poloz on Negative Rates

“Interest rates below zero are in the monetary policy tooltkit,” Poloz confirmed. He added that negative 50 bps (-0.50%) is the widely accepted theoretical lower bound.

But Poloz was clear that the “negative effects for the financial system are pretty significant” with sub-zero rates. Moreover, monetary policy is having very little effect with the economy shut down. So, at this stage it would be “not sensible” to consider a move to negative rates, he said, adding, it’s “not one we’re contemplating” at this time.

What’s Next?

The BoC said rates will stay this low until the economic recovery is “well underway.” No one knows how long that is but it generally takes at least a year and a half for unemployment to top out during severe recessions.

With Alberta oil now cheaper than a Starbucks latte (it’s now trading at a record-low $5.03), and with short-term unemployment becoming long-term unemployment for some, this won’t be a quick “V-shaped” recovery.

Floating Rate Cuts

The mortgage market is now waiting to see if banks pass through the full cut to prime rate. The expectation is that they will, given public statements from the BoC and Finance Department about how important that is for the economy.

Those in an adjustable-rate borrowers will see their payments fall roughly $24 a month for every $100,000 of mortgage balance. Variable-rate borrowers with fixed payments will see more of their payments go to principal each month.

Prospective variable-rate shoppers may not enjoy the full benefit of today’s cut, however. That’s because banks may choose to cut floating-rate discounts.

Existing floaters with big fat discounts will fare best. On March 10 we suggested variable rates for most well-qualified risk-tolerant borrowers. At that time, you could still fetch variable discounts as hot as prime – 1.32%. But that window was short. Now, if you can find prime – 0.30%, you’re lucky.

Fixed Rate Outlook

Five-year swap rates, a rough proxy for a bank’s basic 5-year fixed funding costs, plunged 25 bps after today’s BoC’s move. Normally that would be positive for fixed mortgage rates. Unfortunately, credit spreads are surging, with banks’ 5-year funding costs climbing in the bond market by a similar amount.

We’ll need to see a reduction in the risk/liquidity premiums that investors are demanding from banks before fixed rates come down materially. That could take weeks or many months. It’s impossible to say.

log in

log in

9 Comments

Thank you for all of the work you do here, it is a great source of information.

As a holder of a variable rate mortgage, I have seen my interest costs fall dramatically in the past 4 weeks.

I know that when the mortgage is set up the banks lock in hedges (or use other tools) to protect themselves from increases or decreases in interest rates.

My questions is who in the mortgage equation is getting hammered in this?

Obviously it is the groups that take the other side of the position from the bank.

Who are these groups (pension funds?) and will we see some of them going under/sold if they lose too much money from the investment positions they took over the past five years?

Are the contracts traded on an exchange like the CME and is it at risk due to the fact that it acts as an intermediary on contracts?

I know the in depth answer to these types of questions are worthy of a couple of University courses, but I am trying to look ahead and see where the water stops running down hill.

Thanks

Thanks Ray, It’s an complex topic but here’s an example to illustrate (apologies in advance for the jargon).

When banks sell a 5-year fixed mortgage, they commonly use interest rate swaps to hedge — that is, protect themselves from the risk that rates might increase before the mortgage closes.

Hedging means that the bank pays a swap investor a fixed rate of interest (at the “swap rate,” e.g., 0.92% today) in exchange for that investor paying the bank a floating rate of interest (typically based on a rate like 3-month CDOR, e.g., 1.27% today).

Interest rate swaps are used for many other purposes besides hedging mortgages and they trade “over the counter” (OTC) on electronic systems. Swap counter-parties are generally well-capitalized institutional investors like banks, pension funds, insurance companies, etc. There’s a very small degree of counterparty risk in each transaction. But with vanilla interest rate swaps, it’s not the type of concentrated systemic risk that would bring down the entire system. It’s very different, for example, than the risk we saw in 2008 with the near-failure of AIG, the single largest counterparty for most collateralized debt obligations (CDOs).

Shopping to renew my mortgage. I thought that the 5 year fixed rate would go down today but instead my bank told me that it went from 2.54 to 2.89 today. Should I lock in now or wait a little? My renewal date is in a little over a month.

Hi Mark, Rates are in an uptrend. For that reason and because of extreme delays in application processing and closing, it would be unwise to wait for better rates with so close of a closing date. I’d check the rates available today and if I didn’t see a materially better rate for a better product from a better lender, I’d renew with my existing lender.

Excellent info as always!

@Mark Cabana, my guess is it’ll drop .50points, but banks are prices things in. so if you booked it in yesterday it was @ 2.54, tomorrow or next week it’ll be 2.89-0.5=2.39. But again thats just a guess

My God, another cut from the BOC and the banks will in turn increase their rates again and give some bull crap excuse as to why. Let’s see what they do to fatten their pockets this time. Corporate Greed. It should be on condition that there is a minimum/full cut passed down to the consumer when it gets this bad.

Thanks also for your great work. Is borrowing for an RRSP or TFSA similar to a mortgage or is it a different vehicle ? Thank you.

Hi Paul, Lots of differences including the fact that RRSP loans are most often unsecured (vs. a mortgage that’s secured by the property), have higher rates, are less expensive to set up and have an easier approval and funding process for qualified borrowers.