After slashing rates three times in March and buying billions in bond market instruments to further suppress interest rates, the Bank of Canada pressed <Pause> today. Here’s what happened and how mortgagors should respond.

- Rate Announcement: No change

- Overnight rate: 0.25%

- Prime Rate: 2.45% (see Prime Rate)

- Market Rate Forecast: No change until at least 2022

- BoC’s Headline Quote: “The Bank’s Governing Council stands ready to adjust the scale or duration of its programs if necessary.”

- BoC on the Economy: “…The global economic recovery, when it comes, could be protracted and uneven.”

- BoC’s Full Statement: Click here

- Next Rate Meeting: June 3, 2020

The Spy’s Take

Reader Note: If you want to understand the logic behind the mortgage strategy that follows, read on. If econo-talk dulls your senses, skip to the bottom section.

Some quick points:

- Despite the Bank saying its key rate is already at its “effective lower bound,” the bond market continues to price in a roughly 1-in-3 chance of another rate cut before year-end.

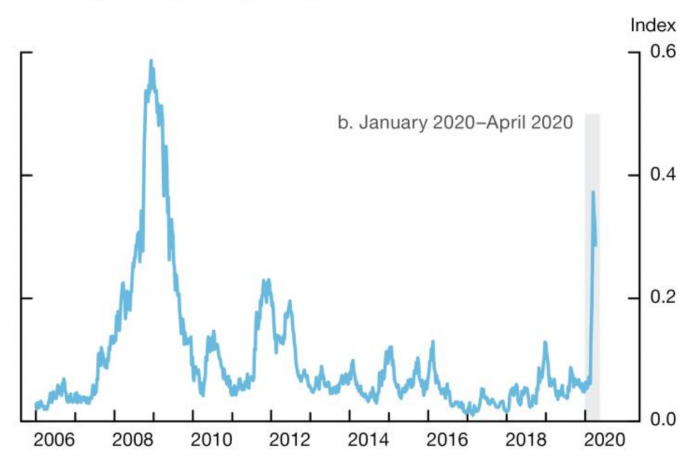

- Lending markets are functioning better than three weeks ago but “remain strained,” the BoC said, despite extraordinary government support.

(Source: Bank of Canada)

- Oil plunged to 21-year lows this morning on fears over demand destruction and a supply glut. That continues to threaten jobs in Canada’s oil industry and should further weigh on rates until crude prices (WTI) rebound well above $30.

- “CPI inflation is expected to be close to 0% in the second quarter…” the Bank said. That’s a sobering projection given inflation expectations are the #1 driver of mortgage rates and the fact that BoC’s minimum allowable inflation target is 1%.

- Consumers and businesses—many financially constrained, overindebted and fearful of the unknown—will continue under-spending for several quarters. As the BoC puts it, “…Uncertainty and scarring effects of the recession on confidence and production capacity could prolong the recovery substantially.”

- Persistent deflation could make it harder for Canadians to service debts, Governor Stephen Poloz said today. He suggested that outcome is unlikely, however.

- In a worst-case scenario, which the BoC deems less likely:

- Thousands more businesses and exporters than expected could “permanently close their doors.”

- Hundreds of thousands of workers could face “longer spells of unemployment.”

- Together, these factors could “cause structural damage to the economy that might not be undone for several years, if ever.”

- “…Credit markets may be impaired and slow to recover, despite central bank support.”

- And none of this even acknowledges the unquantifiable risk of a housing crash, which economists say is unlikely, but could potentially cause a depression if it occurred.

- On a related note, StatsCan previewed Q1 GDP today, suggesting economic growth was -10.5% annualized during the quarter. Numerous economists think Q2 GDP will drop an unprecedented 25%+, making it the worst recession since the Great Depression.

- “Canada’s large lenders are well-positioned to weather a severe economic and financial downturn,” the BoC reassured.

- Once COVID-19 is largely past us, pent-up demand and lagging supply could boost inflation (and interest rates) quicker than expected.

- Interestingly, the BoC was supposed to announce its new neutral rate estimate today. Instead, it deferred it till October 2020, citing a “high degree of uncertainty” in its outlook. “Neutral” is the theoretical rate that neither stimulates nor restrains inflation. Needless to say, the Bank’s current neutral rate estimate of 2.75% seems way out of whack.

How to Play It?

- As COVID-19 treatments and vaccines eventually roll out, mortgage rates should revert somewhat higher. The key message for now is that hundreds of thousands of Canadians will never get their jobs back post-pandemic. For that reason, among others, a full economic recovery could take years, plural.

- Today’s BoC meeting therefore does not change the mortgage playbook for most well-qualified, risk-tolerant borrowers. For them, leaning towards the lowest mortgage rate they can find, regardless of term, makes sense — so long as:

- The mortgage features and term length match one’s 5-year plan

- i.e., portability, refinance and prepayment options all meet their needs

- households with employment or budgetary risk, for example, may be better suited to a deep discount, full-featured portable 5-year fixed rate

- The penalty is reasonable

- if there’s any chance of changes to the mortgage before maturity

- don’t ignore this point if there’s a chance you’ll need to sell your home before your mortgage matures

- The advice and service of the mortgage provider are adequate

- To the extent one is willing to pay more for this, and less-experienced mortgage shoppers often should

- The mortgage features and term length match one’s 5-year plan

- Basic funding costs dropped today in the mortgage market (as measured by Canada’s 5-year swap rate, which reflects a bank’s base cost to fund a fixed-rate mortgage).

- Counteracting this are slightly widening credit spreads (meaning lenders must pay a bigger premium above their base costs to procure mortgage capital).

- Net-net, current market action implies flat to slightly lower fixed rates near-term, minimal short-term changes to variable rates and heavily suppressed rates (overall) through at least 2021.

log in

log in

10 Comments

Ratespy: Do you think there will be very high inflation or hyperinflation that soon follows the current period of deflation? (Due to all the money printing). Most of your recent articles seem to warn us rates might go up. What do you really think?

Hi Biff,

Hyperinflation is highly unlikely. Above-target inflation is likely…eventually. But it may be well down the road.

By definition, inflation expectations generally exceed the Bank of Canada’s 2% target as the economy recovers and rate tightening cycles begin.

If supply lags post-COVID and pent-up demand creates temporary shortages of goods and services, it could potentially fuel price increases and create expectations of higher inflation.

In general, however, economists don’t expect high inflation anytime soon (nor do we). Commentary about this is mainly just a reminder that anything’s possible if enough time passes. It’s not a signal for most people to lock in for 5+ years, although some will anyway, for “peace of mind.”

i have 390k mortgage, i want to refinance my home and get a heloc. home value aprx. 700k.

if im to leave my current bank im looking at 3k in penality (mortgage ends jan 2021)

what is best for me on the refinance fixed for 5 years, or variable.

for the heloc, what the best banks are giving. Prime – what ???

Hi Latch,

We unfortunately can’t give term recommendations to individuals in this forum because suitability assessments require more information on the borrower.

As for HELOC rates, most big banks are at prime + 0.50% for well qualified borrowers. Occasionally you can negotiate better. Here’s the latest HELOC rates we’re aware of: https://www.ratespy.com/best-heloc-rates

The Bank of Canada may not lower prime rate any more but its 5 year bond purchases will definitely lower 5 year fixed rates.

Hi BaySt, The BoC’s pledge to buy bonds has played a role in falling yields of late. That said, Poloz hinted yesterday that 5yr government bonds at 0.60% or less require little further intervention from the BoC.

Does anyone have any prior experience with HSBC mortgage? How good are they beyond rates? How responsive are they too? Will appreciate any input at this point.

Hi KT, HSBC has some solid mortgage features (love that its variable is open after three years, for example). Beware of their big bank style penalties on fixed-rate mortgages, however. Also, turnaround times may be longer than usual in some cases, given its competitive rates. But confirm that with your local branch.

What happened to HSBC High Ratio Mortgage for 3 years @1.99%

Hey Cal, They pulled it.