Weekend Bulletins

- Approvals Revoked: We’re seeing and hearing from multiple customers and mortgage brokers that approvals are being overturned by lenders due to coronavirus layoffs. One of them just made the news. It’s essential to remember that most mortgage approvals are based on continued employment. If you’re facing a potential layoff, and your lender finds out (don’t bet they won’t), your completed approval could be voided. If you can’t get financing in time to close an unconditional home purchase, you could lose your deposit and potentially be liable for the seller’s losses. Remember that if you’re out there buying in this market. There’s no question that home purchases will start falling through for this very reason.

- Payment Deferrals: Here are links to the mortgage payment deferral announcements from top lenders.

- Another Bank Hikes: Scotiabank lifted its internal discounted rates today, according to its eHOME website. All terms went up, some by over 1/4 point. Here’s the latest big bank rate summary.

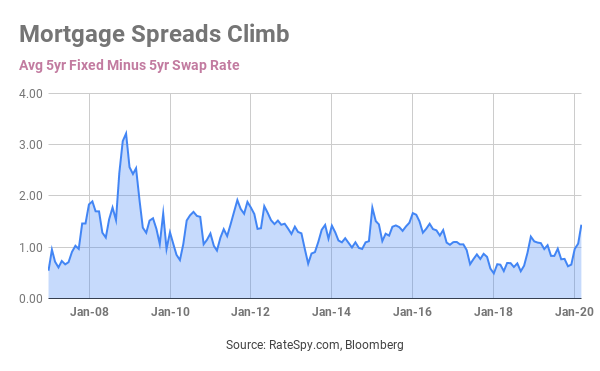

- When’s the End?: Everyone wants to know when this surprise mortgage rate uptrend will end. It could be a while. Economic crises can push mortgage rates higher due to constraints on lenders’ liquidity and elevated credit risk, among other things. In the 2008 experience, rate premiums faded after eight months, getting back near normal when the recession ended. After the 2020 recession peaks (note: we’re not officially in a recession but we’ll assume we will be, like everyone else), rates should slowly drift lower. Two exceptions are the following:

(A) if investors get concerned about the government’s ability to repay bondholders (due to all the debt Canada’s taking on and its deteriorating fiscal picture), and/or

(B) if we get an unexpected spike in inflation (i.e., if the plunging loonie and/or goods shortages offset the massive drop in demand).

Both such events could potentially drive up interest rates. Mind you, these are both low probability events. If they did occur, they’d last for a while but not forever.

Jargon Buster: Banks use interest rate swaps to hedge 5-year fixed mortgage rates. Swap rates can therefore be thought of as a very rough approximation of a bank’s base cost to fund a 5-year fixed mortgage.

- Floating Rate Alert: You’ll still find a few prime – 1.00% variable rates out there but they’re going fast. We’re down to just two lenders in the broker channel with 1.95% variables.

- Broker Frustration: The timing couldn’t be worse. With rates shooting higher, the mortgage brokerage industry’s most-used application submission software (Expert) is still down. Thousands of brokers are unable to submit to lenders despite record/near-record application volumes.

- Rate Mirages: Friendly reminder: If you see a rate and it’s not available when you apply, it’s likely not because someone is trying to cheat you. It’s probably because rates are moving so fast that it’s hard for lenders, brokers and rate aggregators to keep you up to date!

log in

log in

22 Comments

Any idea when MCAP will drop their bank prime? Been 6 days now since the last drop, not a peep out of them yet…

Hi Jim, April 1 reportedly.

Im a first home buyer from Winnipeg. Is it the right time to buy.

There was 2 rate drops from the bank of Canada already and my variable First National mortgage didn’t drop at all.

I’m sure if it would be an increase it would happen by next day.

Tom. Payment amount does not change until your existing term matures. What happens it that more if you payment is allocated to principal repayment and less to interest. This means your are paying your mortgage off faster.

Jeremy that makes no sense.

My mortgage #1 was 2.71%. when bank of Canada dropped rate by .5% my 2.71 dropped to 2.21

My mortgage #2 2.85% did not drop even tho bank of Canada dropped by not only .5 but .5 times twice.

MCAP #1

First National # 2

First National has dropped the full 1% on their prime rate. It takes effect on April 1st.

Reuben

Thx for the update

With 500,000 applying for EI and many more out of a job, there has to be an increase in homes hitting the market. After chatting with a few agents, they don’t seem to realize how many businesses will close and jobs be lost.

@Tom, @Jeremy,

Don’t forget guys – some variable rate mortgages have fixed payments (vrm), even as bank prime fluctuates. In this case, the balance of interest and principal inversely adjust. But, there are also adjustable mortgages (arm), where payments DO fluctuate with bank prime. It pays to know what type you have (scotiabank, for instance offers you the choice of both types).

Given everything rapidly occuring, and all things being equal… bottom line… if you were renewing your mortgage right now, today, and still have these options available to you… what would you choose over a 5 year term?

A.) Fixed @ 2.29% OR

B.) Variable @ Prime – 1.1%

Ask yourself what would cause variable rates to average 0.5% higher than they are today? If you can’t come up with a good answer and have sufficient savings, lean variable.

Is it best to switch to a fixed mortgage given current situation and interest rates? I’m with 5 years prime -.85 variable rate and 30 more months to go. What’s best with forecast?

Hi Hithen, Virtually no one can forecast interest rates with consistent accuracy. Please see this for more tips: https://www.ratespy.com/fixed-or-variable-rate-the-decision-checklist-02223752

@The Spy: any news for RFA…when are they dropping rates?

Hi Ani, Do you mean RFA’s prime rate? It’s currently 3.45% and I suspect it’ll drop to 2.95% in April.

If you mean rates other than prime, your guess is as good as mine. The trend is currently up.

My mortgage is approved. Notary is 7 April 2020. Right now I don’t want to buy the house because I’m scared right now. No job. Been laid off. Can I cancel the mortgage? Please tell me. Thank u

Hi Mannan,

Very sorry to hear about your job. Hopefully the layoff ends soon.

An applicant is generally not bound to close a mortgage until they’ve completed the signing process with a lawyer.

Unconditional purchase agreements are generally iron-clad, however, and usually cannot be cancelled.

That said, we can’t advise you on legal matters unfortunately. Please consult your lawyer for proper advice pertaining to your case.

Wishing you the best.

@The Spy, yes I meant Prime Rate. I currently have variable rate with them, and waiting for prime to drop. RFA still need to respond after BoC’s 2nd rate drop…

My mortgage matures on April 1st! Worst timing ever. TD is offering the following renewal rates:

5 YR Fixed – 3.07%

5 YR Variable – 2.53% (prime – 0.07%)

What to do?? (my current rate is 2.74%)

I have to renew my mortgage in 3 months. Can I change my lender if I’m in EI? How does being on EI effect my mortgage renewal?

Hi Jenny, Finding a lender with better terms is difficult (to say the least) for a borrower who is unemployed.

Assuming:

(A) the borrower can readily pay all his/her bills

(B) it still makes sense to carry the mortgage and remain in the home, and

(C) there’s nothing in the mortgage contract that requires the borrower to notify the lender of an employment interruption

…then, some borrowers would probably just print out the best rates from this site and use them as leverage to negotiate a better deal with their lender — leaving out the part about being laid off. One’s existing lender will seldom require re-qualification (make the borrower prove employment again) unless it’s a refinance.