It’s been six whole days since RBC unexpectedly hiked mortgage rates, encouraging a herd of banks to follow its lead.

It’s been six whole days since RBC unexpectedly hiked mortgage rates, encouraging a herd of banks to follow its lead.

But my oh my, how things can change in just one week. Interest rates outside the mortgage market have plummeted and rates are about to change…again. That’s got many thinking RBC’s rate hikes were just a blip (at least for fixed rates).

If you’re a mortgage shopper, it’s as confusing as a drunken stupor. But you can successfully navigate this rate volatility, and here’s a few tips to help.

********

I’ve heard rates are climbing. Is it time to lock in?

Well, first off, fixed rates are no longer climbing, not for now. More on that in a moment.

That said, if your financial picture has seriously deteriorated and you have a lousy variable rate (e.g., prime – 0.25%), converting to a fixed mortgage could help you manage interest-rate risk. Just don’t rush to lock into an inflated fixed rate (e.g., 2.94%+), as those rates could very well drop.

If you’ve got a stable job, 3+ months of liquid savings, solid credit, a reasonable debt-load and a terrific variable rate (e.g., prime – 0.65% or better), don’t even think about long-term fixed rates.

For anyone else, professional mortgage advice may be in order.

An economic abyss

What we’re witnessing right now is a full-out commodity disaster. Canadian oil prices have nose-dived 82% in a mere 19 months.

But the price of oil isn’t the only thing plunging. So are housing starts, business investment, consumer confidence and hiring intentions.

Bank of Canada Governor Stephen Poloz predicts that weak oil prices could hurt Canada’s economy for years to come, and oil prices haven’t even bottomed yet. According to National Bank, “The persistence of low oil prices could indeed trigger defaults which may then spill over to financial markets and spread contagion to other markets, including housing.”

Will Poloz pull the trigger?

The BoC decides on rates next Wednesday and trader expectations for a rate cut have heightened significantly since November. “The consensus expects the BoC to stay on hold … but we don’t think the governor will wait,” Merrill Lynch economist Emanuella Enenajor told The Globe and Mail.

The chart below shows a 45% implied probability of a rate cut next week, as of this writing (source: Bloomberg). Look where we were in November.

Note: These odds are based on the prices of overnight index swaps, fancy financial instruments that track the market’s interest rate outlook. Since we went to press, the probability of a rate cut on January 20 is now over 50%.

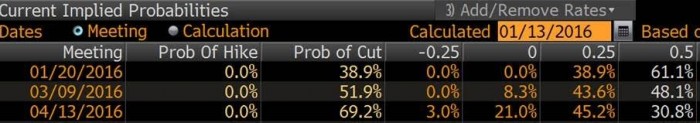

This table below shows the market pricing in a 70% probability of one or more rate cuts by April. In short, the rate market has undergone a radical shift in thinking.

How Low Can Mortgage Rates Go?

Canada’s overnight target rate, which drives prime rate, could drop to as low as -0.50%, according to the Bank of Canada. But, while the economy would have to get much worse for negative rates, a zero percent overnight rate is very possible.

In a zero-rate scenario, bond yields would also likely tumble. And fixed mortgage rates would go along for the ride—albeit, nowhere near proportionately (i.e., banks would keep much of those improving margins for themselves).

But What About U.S. Rate Hikes?

Sure, “..over the past 30 years, when U.S. 5-year bond yields rose, about three-quarters of the increase was reflected in Canadian 5-year bonds,” said Poloz in a recent speech. But higher yields would be counterproductive for an economic recovery. Absent strong growth, all they’d do is further increase the odds of BoC rate cut.

“Usually, you think of the Canadian economy following the U.S. economy fairly closely. This will be one of those [times] where it really doesn’t…There will be a divergence there. We’re already seeing it, and so you should expect a divergence in [rate] policy too,” Poloz has said.

But a discussion of higher U.S. rates may be academic because, despite economists calling for 2-4 more U.S. rate hikes in 2016, the bond market isn’t buying it—not yet anyway. U.S. yields are actually dropping. The reality is, “…Analysts have overestimated interest rates almost every year since 2000,” says BMO’s Douglas Porter. Why should this year be any different?

So regardless of what the U.S. does, Canada’s prime rate appears destined to stay at 2.70% or below…for months on end. If you’re a variable-rate mortgage holder who’s gainfully employed, toast your good fortune and put Canada’s near-free money to good use.

What Will Banks Do if the BoC Cuts?

If the BoC drops its key rate again, banks are widely expected to cut prime rate by just 15 bps, like they did last January and July. But some, like economist David Madani, suggest they won’t pass along any cut to borrowers.

That could be an outright PR disaster, with virtually every personal finance journalist crucifying the banks. If you’re a variable-rate borrower, the idea of banks not transmitting the full cut probably makes you sick. You’re being asked to take all the risk of higher rates, only to get partial reward when rates fall.

With $35 billion in 2015 profits, banks won’t get much sympathy for their plight. But the further rates fall, the worse it is for bank margins. So they can’t (in their minds) pass along a full 25 bps.

On the other hand, they’re averse to public backlash and are by no means losing money at today’s variable discounts. Hence, we’ll bet on a 10-15 bps reduction in prime rate when the BoC cuts next.

What About Fixed Rates? (Warning: This is a little technical)

Lenders have been pushing up fixed mortgage rates as of late. CIBC is the latest, saying it was just “responding to the market.”

Meanwhile, as this chart depicts, rates on 5-year swaps (a financial derivative that’s a proxy for fixed mortgage funding costs) just made a record low. Let’s hope CIBC and the other banks pay attention to that market.

But swaps are just one element of mortgage pricing. There are lots of other costs to consider, especially risk and liquidity premiums. Also known as funding spreads, these premiums are the extra yield that investors demand to lend to lenders. These latter two factors have made it increasingly expensive to raise capital for mortgages.

Check out the following chart, for example. Relative to government bonds, it is now 20 basis points more expensive to raise money with Canada Mortgage Bonds (CMBs) than it was in October. That’s significant because CMBs are virtually the cheapest way to fund a 5-year fixed mortgage. They’re relied upon by scores of lenders.

The Good News

Fortunately, falling yields should offset most of the increased costs for lenders, especially with fixed-rate mortgages.

Fortunately, falling yields should offset most of the increased costs for lenders, especially with fixed-rate mortgages.

More importantly, smaller lenders are lining up to give you a better deal on your mortgage. In the last 48 hours alone we’ve seen new rate sheets with five-year fixed rates of 2.59% to 2.54% or less. Compare that to discretionary rates at the Big 6 banks, which average around 2.89% according to RateSpy informants.

Don’t Panic on Pre-Approvals

RBC’s widely reported rate hike sent borrowers scurrying to lenders and brokers to lock in rates. Well, put away the hose because the fire is out.

There is no urgency at the moment. Rates have already risen so take your time and shop for a better deal. Barring a surprising rebound in government bond yields and swap rates, RBC’s hike may prove to be a short-term blip.

This line from National Bank best sums up the world we’re living in: “…The Bank of Canada seems to have thrown in the towel by signalling it may go negative on rates.” Imagine that. What a sea change given that a few short years ago the BoC suggested rates couldn’t drop below 0.25%. Despite temporarily higher funding spreads, nothing on the visible horizon supports steadily increasing Canadian rates.

Where’s the value?

Variable discounts have shrunk so much that the gap between 5-year fixed rates and variable rates is now a minuscule 38 basis points. At that spread, the risk-reward just isn’t worth it, for two reasons:

Variable discounts have shrunk so much that the gap between 5-year fixed rates and variable rates is now a minuscule 38 basis points. At that spread, the risk-reward just isn’t worth it, for two reasons:

- Relatively speaking, most variable rates are simply too high right now (assuming you don’t already have one); and

- Banks are no longer passing through the full BoC rate cuts.

So what are variable-lovers to do?

Try on one- and two-year fixed rates for size.

The best one-year fixed rates can be found on the Spy for 1.89% or less. (This rate may not last.)

The lowest two-year fixed rates can be had for 1.99% or less. (Probably the better bargain, if for nothing else but to avoid renewal headaches in 12 months.)

Either of these options are better than paying prime – 0.40%, (or worse) for five-plus years. Naturally, these short-term fixes will let you renew into a variable in one or two years, when hopefully discounts improve.

One more option

A few lenders have decent 3-year fixed and 3-year variable deals. A shorter-term fixed or variable can be worth a look—for the same reasons as above. It also gives you flexibility to renegotiate or lock into the best long-term rates sooner, if locking in floats your boat.

Three-year variable rates can be found on the Spy for as low as prime – 0.61% (2.09%). But you’ll still likely need two BoC rate cuts to get a lower borrowing cost than a 1- or 2-year rate.

Quick tips on short-term fixed rates:

- Don’t pay needless fees — If you’re renewing, look for lenders or brokers with “free-switch” offers on 1- and 2-year terms. That means you don’t have to pay appraisal, legal and title insurance fees.

- Beware the renewal offer — Lenders who offer great short-term rates bank on you taking whatever rate they dish out at renewal. If your lender’s renewal rate sucks, plan on having to move that mortgage again in 12-24 months. That takes a few hours of your life and costs you at least the lender’s discharge fee. But it can be worth it if you have a $200,000+ mortgage.

- Avoid collateral charge mortgages — That is, unless you anticipate having to borrow more money in 12-24 months. A collateral mortgage lets you refinance without legal fees, which is a perk, but far less useful in a 1- or 2-year term. The biggest downside of collateral charges is the need to pay refinance fees to change lenders. That’s a problem if you want to leave in 12 to 24 months because your lender stuck you with a cruddy renewal rate.

Parting Thoughts

The odds of significant rate hikes are now far less than they have been historically, thanks to anti-inflationary trends like:

The odds of significant rate hikes are now far less than they have been historically, thanks to anti-inflationary trends like:

- Plunging commodity prices

- A Bank of Canada that’s hyper-vigilant on inflation

- An aging population

- Outsourcing

- Wider trade deficits

- Online shopping (hey, even online mortgage shopping is dampening inflation!)

Inflation is the all-important determinant of Canadian interest rates, and the above trends should contain it, if not conspire to cause disinflation.

So if you’re a financially stable borrower deciding between fixed and variable rates, or long and short terms, you can likely afford to take more rate risk today than in times past. (Just be sure to run your numbers through a mortgage stress test calculator so you’re prepared if inflation miraculously surges and brings rates up with it.)

If you can save one-third of a point on a 3-year term versus a 5-year term, or on a 1-year fixed versus a variable, that’s a solid bet in this market. You’re guaranteed to pay a lot less interest up front, with manageable renewal risk. Take those interest savings and invest them, or pay down principal on highest interest debt. That’s how you beat the banks at their own game.

log in

log in

8 Comments

Great analysis of the current situation! Agreed that the variable rate risk in now outweighing the reward – watch people move out of them in droves for the safety of fixed as this volatility continues

Your site give clear answers to mortgage issues. Thanks for providing real possibilities in an easy to understand format!

One year fixed are the the best of what I see right now. Scotia is doing 2.04% on 1yr fixed as of Jan 2016.

@Internationalist & @Chris,

Much appreciated…

@Ralph,

Scotia had a great deal going but we’re hearing it ended recently. Fortunately there are still brokers offering sub-2% 1yr rates from at least four other lenders (that we know of).

It’s refreshing to see that shorter term fixed rates are being considered as viable alternatives to variables. Especially when variable rate holders keep getting stiffed by the Big Banks refusing to pass along the full extent of rate cut savings. Why would you choose to leave your payments to the mercy of the banksters?

2 year fix at @2.19 or 5 year fix at 2.64?

Good problem to have, but can anyone help?

@Donovam1

If rates spiked 2% by the time you renewed in 24 months, how would that affect you? Not saying it will happen, but you must be equipped for the possibility. That’s step #1.

Secondly, are you well qualified (provable income, stable job, reasonable debt load, excellent credit, etc.)? If not, there’s potentially some renewal and budgetary risk.

And do you envision any possibility of having to renegotiate your mortgage in the next five years? A five year fixed usually ties you to a particular lender for that timeframe, unless you pay a breakage penalty of course (which can be extreme in some cases).

These are some of the questions that guide optimal term selection.

@ The Spy.

I’m thinking my break even point is about 3.5% in two years. Actually, it would only be 18-20 months before I could lock something in. I’m well qualified and really just gambling a couple thousand against our economy… but your points are well received, so thank you.

Good points – thanks.