On Monday night we’ll find out which “housing affordability” plan Canada gets, be it from the Conservatives, Liberals or NDP.

All three parties are promising to put homes more within reach, particularly for first-time buyers. Some of their proposals are merely vote bait; some are genuinely productive.

After listening to the rhetoric for weeks on end, we’ve formulated three observations. Here are our predictions in each case as to how things play out post-election:

- Observation #1: All three parties want to boost the purchasing power of young buyers. The Conservatives and NDP would do it mainly by extending insured amortizations to 30 years. The Liberals would do it by increasing the income and leverage limits of their First-time Home Buyer Incentive.

- Prediction: Any of these plans would (will) help first-time borrowers qualify for bigger mortgages in 2020, 2021 and perhaps 2022. A 30-year amortization with 5% down boosts buying power 7-8%. By somewhere around 2022 to 2023, home prices should adjust to this credit easing, leaving future first-time buyers with little additional buying power relative to today.

Observation #2: The Conservatives propose easing the federal mortgage stress tests.

Observation #2: The Conservatives propose easing the federal mortgage stress tests.

- Prediction: Assuming they form a government, the Tories will make the stress test easier for certain insured mortgages (rule changes on insured mortgages are the domain of the Department of Finance). As for the uninsured stress test, politicians can’t just flip a switch and force changes. OSFI, the professedly independent regulator who brought us the uninsured stress test, won’t give in (much). It’s more likely the Conservatives will convince OSFI to make less risky tweaks. One will be exempting straight switches from the stress test, a much-overdue policy improvement.

- Observation #3: Amid Canada’s debt risk, “It is hardly an encouraging sign for financial stability that the main political parties want to start reversing [the credit tightening] process,” says Capital Economics analyst Stephen Brown.

- Prediction: Politicians will start realizing this and shift their focus on permanent supply-side solutions to the housing crisis. Eventually, the government will be successful in balancing demand with more homes. They’ll do it with developer incentives, land grants, high-speed transit investments, red tape reduction, tax policy and more. That’ll slow home prices for multiple years thereafter, but it will take time. Indeed, at some point well down the road, such measures will create more supply than the growing population can readily absorb. It might even coincide with other macro drags, like depressed oil prices. That’s when we’ll see home prices really struggle, barring a major recession first.

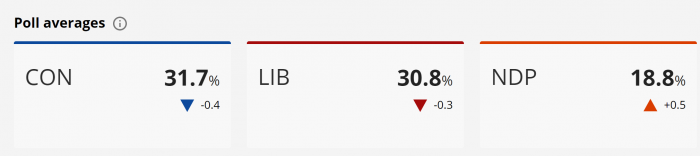

By the way, if the polls are right and we get a minority government, that doesn’t mean the ruling party will be thwarted in enacting its proposals. As Capital Economics points out, “The last blitz of looser lending restrictions, when the maximum term on insured mortgages was raised from 25 to 30, to 35 and then to 40 years within just nine months, occurred within the first 10 months of Canada’s smallest ever minority government in 2006.”

log in

log in

2 Comments

Great news im a first time homebuyer looking at an insured mortgage this 30 year amortization

proposal interests me hopefully its implemented

early next year as thats when im projecting to buy

I am wondering why are these politicians not talking about focusing on supply alone. Why is there suggested policy not along the lines of some of the suggestions in this article. I am sure they know what the root cause of the problem of housing affordability is……..