It didn’t take the government long to propose changes to the First-Time Home Buyer Incentive (FTHBI). Just 10 days after the program launched, and following criticism that the Liberals’ new program didn’t address housing needs in high-priced markets, the Libs have tweaked it.

Effective as soon as November, if you live in one of three high-cost regions, qualifying for the program may get easier. Specifically, the government is proposing to raise the FTHBI limit on:

- how much income you can earn, and

- how much of a home you can buy with that income (the “leverage factor”).

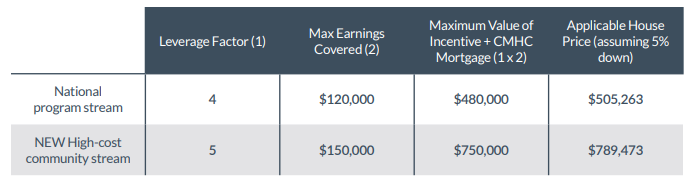

Previously, the FTHBI’s maximum “leverage ratio” of 4:1 meant a first-time buyer’s mortgage + CMHC incentive couldn’t exceed four times their income. And total household income was capped at $120,000. That made it almost worthless to a broad swath of big-city buyers facing average home prices in the high six digits.

Now, buyers in greater Toronto, Vancouver or Victoria (sorry Montreal, Calgary, Edmonton and Ottawa) will be able to qualify with incomes up to $150,000, and mortgages+incentives up to five times their income.

Here’s a summary of the “NEW” policy:

The Practical Impact

The Liberals say the changes would help another 20,000 Canadians benefit from the program, or 120,000 in total. That assumes, for one thing, that they win the election next month and can continue the program.

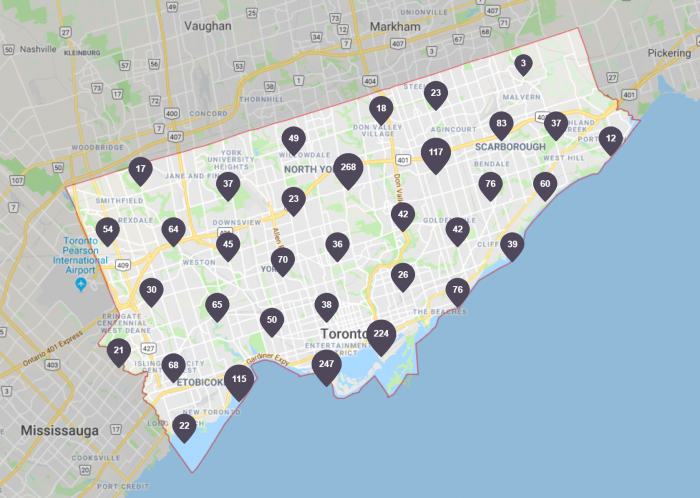

In Toronto, for example, these tweaks raise the number of potential FTHBI-compatible homes by 241%, based on Realtor.ca data.

Here’s how many one+ bedroom Toronto properties a FTHBI user earning $120,000 with 5% down had to choose from before (652 in total):

Here’s how many they can access now (2,227, or 242% more):

The revamped program would no longer constrain buying power either, at least for well-qualified borrowers in greater Toronto, Vancouver and Victoria.

Under the old scheme, many FTHBI users could buy a more expensive home if they opted for a regular old insured mortgage. Now, FTHBI users could qualify for just as much as non-FTHBI users, often more. In fact, a couple with the minimum down and making $150,000 with no other debt could now afford roughly $40,000 more home by using the FTHBI.

If they bought a new-build, where the government incentive is doubled (i.e., 10% of the purchase price), borrowers could afford an even higher-priced home.

For these reasons, we believe there’s now a decent chance that FTHBI demand could meet the government’s expected target of 120,000 users.

Critics Complain

The FTHBI is basically a social program that takes tax revenue and gives it to first-time homebuyers in the way of interest and default insurance savings. Whether that tax revenue will ever be recouped is debatable.

“The costs associated with enhancing the First-Time Home Buyer Incentive would be paid for within the existing profit of the Canada Mortgage and Housing Corporation (CMHC),” according to a Liberal handout. As a crown corporation, that’s profit that otherwise would have been paid to taxpayers via a dividend.

There’s also the question of its ongoing existence. These changes will likely only take effect if the Liberals gain a foothold in the government following the October 21 election. A Conservative government would potentially dismantle the program in favour of alternative first-time buyer initiatives it deems more effective.

Housing critics will also find something to crow about with today’s news. That’s because the buying power increase would almost certainly stoke home prices more than the old program. CMHC head Evan Siddall was previously vocal about designing the FTHBI to be a “marginal program” that didn’t have “an inflationary effect” on home prices.

“…We don’t want to be sending a signal that prices are going up…” he told BNN Bloomberg’s Amanda Lang in May. Well, with today’s announcement of buying power enhancements, consider that signal sent.

We asked CMHC how the program’s uptake has been so far, and how these changes might affect home prices. A spokesperson responded: “…Given we are inside the caretaker period, we are not in a position to provide further comment and won’t be providing comment on party platforms or proposed policies.” Well isn’t that convenient?

There’s More

Attacking foreign buyers is in fashion politically, so the government wants a piece of it. “We need to send a strong signal that Canada is no place for those who wish to purely speculate in the housing market,” a Liberal memo said today.

“We will tackle this problem head on by…applying a 1% annual vacancy and speculation tax on applicable residential properties owned by non-resident, non-Canadians.” It will be on top of any regional taxes, like B.C.’s speculation and vacancy tax.

“Canadians who live abroad, as well as non-Canadians who live in Canada, will not be affected in any way,” the statement said.

It’s debatable how much the move will help since only 9,386 properties are affected by B.C.’s existing speculation tax. At the very least, however, it will dampen market sentiment further. And we all know how important market psychology is to home values.

log in

log in

The FTHBI is basically a social program that takes tax revenue and gives it to first-time homebuyers in the way of interest and

The FTHBI is basically a social program that takes tax revenue and gives it to first-time homebuyers in the way of interest and

14 Comments

Good analysis!

In regards to 2nd point, something has to be done…

Hi, is there any minimum amount of time you must own your house to avail yourself of the first time buyers incentive?

Maybe if the all-knowing government bothered to consult industry before formulating such a half-cocked plan they would have figured out the original version was worthless to the people who need it most.

Mr. Spy

In your opinion how would this revamped shared equity mortgage, if it happens, compare to simply bringing back a 30 year amortization for insured mortgages?

@P: Thanks

@Sandra: No.

@Django: I’m guessing they didn’t do much consulting in the planning stages because this thing was rushed out so fast before the March budget announcement. That, and policymakers often seem to “forget” to get outside feedback. Case in point: The disruptive insured mortgage changes of 2016 that were ushered in with no public consultation.

@BillN: Compared to this new “Turbo FTHBI,” a 30-year amortization would get you a few more percentage points of buying power and be available to all, not just those in the GTA, GVA and Victoria. (i.e., it would create a more inflationary impact on home prices.)

When housing values drop 20% and all these 5% down people are underwater, how much do taxpayers lose in this shared inequity program?

Great strategizing by the Libs! What’s new? Now, before election week, Libs can add 30-35 amortization and rake in some more voters! With 5year fixed at 2.69percent (sept 13. And heading lower!), that’s even better for Ftb! I suggest tweaking the payback terms, with payback at par option, if said payback occurs within 5 years (at the 5yr term mortgage renewal anniversary. And, further consulting with relevant industry *Now*! For max tweaking of the fthbi!

I am curious re what consulting was done by the Libs policy analysts involving reps from the real estate brokers and Mortgage brokers industry? These are frontline folks who have their pulse on affordability of Ftb folks! We see daily how e.g. Cmhc rules, default insurance rates, mortgage underwriting rules ,qualifying thresholds, and income type, denial of real rental income of a sublet or basement income, denial or weighting of a guarantor’s net worth, and a host of other ‘common-sense’ lending factors in a grossly impotent and ‘non-personalized’ static risk assessment model! Time for major tweaking of systemic factors that impede especially ftb affordability ! (Like x2 land transfer tax of Toronto!)

Is it possible to even get to 5x leverage on an insured mortgage?

Yes if the person gets a 10% incentive.

My son is in the market for his first house and is considering this program. Would all brokers be equally educated on helping a first-time buyer decide whether this program is right for them? I’m concerned it’s so new that many wouldn’t know how to properly run the calculations. Thanks.

Most brokers and bankers have no clue how to do the math to see if it’s worthwhile. You have to figure it out yourself. About the best most can do is quote maximum amounts and projected savings from this calculator:

https://www.placetocallhome.ca/fthbi/eligibility-savings-calculator

So I just called the FTHBI hotline and they dont know anything about this proposed change. Is this not happening after all?

It’s a proposal at this stage. The Liberals have to win government first.