The rate market just witnessed a rarity. The U.S. Federal Reserve has suddenly slashed its key interest rate by 50 bps.

The last such “emergency rate cut” happened in 2008 during one of the worst recessions of all time.

This pretty much cements a Bank of Canada rate cut by tomorrow.

This pretty much cements a Bank of Canada rate cut by tomorrow.

“With markets now pricing in a full 25 bps worth of easing, the cost of disappointing the market may be too high for the BoC to maintain its very cautious approach,” TD Securities chief Canadian strategist told Bloomberg News.

The surprise cut drops the U.S. fed funds target down to 1.25%. And the market currently expects two to three more reductions by year-end.

Most economists expect the Bank of Canada to cut 25 bps, but the bond market is now pricing in greater odds of a 50-bps cut. The market anticipates the BoC waiting until tomorrow and not acting today, but nothing is out of the question.

Further out, the market now expects Canada’s overnight (policy) rate to drop 75-100 bps total in 2020. If that happened, it could theoretically drive down prime rate by anywhere from 45-100 bps.

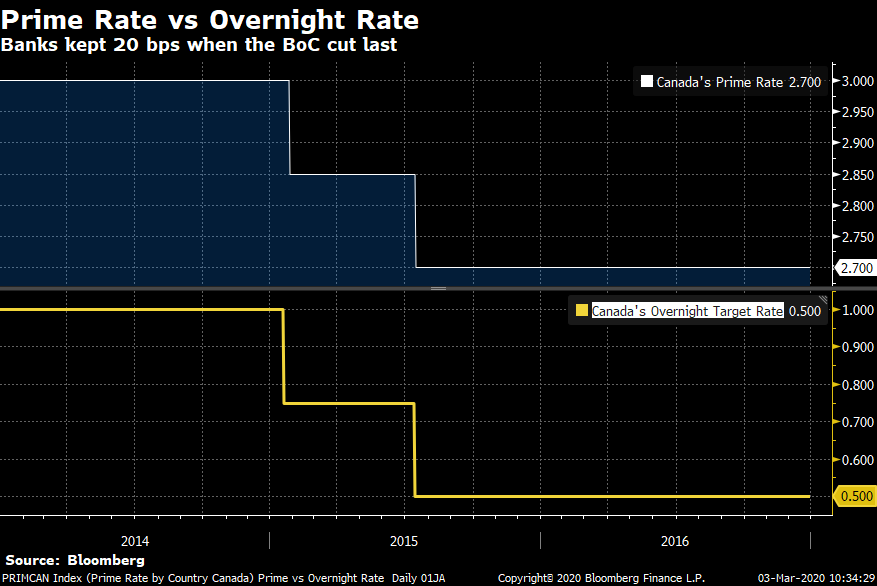

Rate watchers widely expect banks to not pass along some of the BoC’s cuts to consumers. Banks retained 20 bps of the last 50 bps in cuts in 2015. In other words, prime rate dropped from 3.00% to 2.70% when it normally would have fallen to 2.50%.

Either way, variable-rate holders should benefit after watching rates rise or go flat for four-and-a-half years. Just keep in mind that the lower rates go, the less likely banks are to pass through BoC cuts in full, or even partially (if things get bad enough economically and in the rate markets).

Variable-rate mortgagors aren’t the only ones who will see lower rates. Canada’s most-watched fixed-rate indicator, the 5-year bond yield, just broke yesterday’s panic low. Once this manic volatility calms down, lenders will bring fixed rates lower — until and unless credit risk surges and/or they’re forced to pay big risk premiums to fund their mortgages.

log in

log in

10 Comments

Wow, we live in interesting times.

Worst part of the bank’s not passing on the full cut back in 2015 is that they have never given it back to their customers.

They have moved lockstep up 25 bps at a time since then, but are still sitting on an extra 20 bps margin.

If the banks try this again, someone either the Gov or the Finance Minister needs to pick up a phone (do they still have landlines?) and work a little bit of the moral suasion .

Banks will never give those 20 bps back. They have to increase dividends each year or their stock prices tank.

I hope FinMin Morneau told the banks to pass on the ENTIRE cut(s) to consumers. If this is an emergency measure by BOC then all Canadians should get the full benefit of the cut(s). the big 6 should not take some for themselves. Lord knows the rates they pay on client deposits will drop by the exact amount of the rate cut.

Sad state of affairs right now, but this variable-rate holder is happy at the prospect of my interest rate finally falling in line with where fixed rates are at. As others have mentioned, however, I don’t have much faith that the banks are going to pass along the full savings. Still, I’ll take what I can get.

Despite the pandemic, the real estate market in the GTA is on fire. Lower rates will only fan the flames. Prices are going to surge.

Agreed. I can see Toronto condo prices rising over 20% this year.

Actually, the banks should *not* pass the rate cut on to mortgage borrowers. The cut is to stimulate borrowing that expands the economy, i.e businesses. Canadians are up to their eyeballs in housing debt and BoC/GoC needs to find a way to stimulate the economy without driving household debt up further.

People with variables must still pass the stress test no matter how low prime goes so your stimulus argument doesn’t hold much water. What you’re mainly doing by not passing along lower prime rates is hurting people who already have mortgages and LOCs

SPY,

Can you let us know when the banks cut their prime rate and more importantly what they cut it too?

You always seem to be ahead of the curve on getting information out.

Thanks

You bet, Ray. Watching and waiting.