For more than  a year we’ve speculated that new rules will be adopted, making it tougher to qualify for a HELOC.

a year we’ve speculated that new rules will be adopted, making it tougher to qualify for a HELOC.

How could they not? The Bank of Canada, OSFI, CMHC and FCAC have all been warning about HELOC risk for months. And when multiple government agencies target a financial product, change is a’comin.

And now it’s here.

Banks are tightening rules significantly for those with a HELOC who are applying for a new mortgage (and not closing their existing HELOC).

But this time, it’s not a well-publicized government rule. It’s happening behind the scenes.

How people get approved today

Let’s assume you’re applying for a new mortgage on a second home, cottage or rental property.

Also assume you have a HELOC with a $200,000 limit.

Today, most lenders will make you prove you can afford the payment on the money you owe in that HELOC. If your HELOC has a zero balance, it’s of little consequence to your mortgage application.

If you do owe money in your HELOC, most lenders calculate your assumed payment based on:

- the HELOC balance owing

- the lender’s posted fixed rate (commonly the 5-year posted rate, or 5.34% today), and

- a 25-year amortization.

Here’s what’s changing

Take the exact same scenario as above, but now assume the lender makes you prove you can afford a payment based on your HELOC credit limit.

Even though you might have a zero balance, the bank assumes you might use all of your available credit. It therefore adds a hypothetical $1,334 a month payment to the debts on your mortgage application.

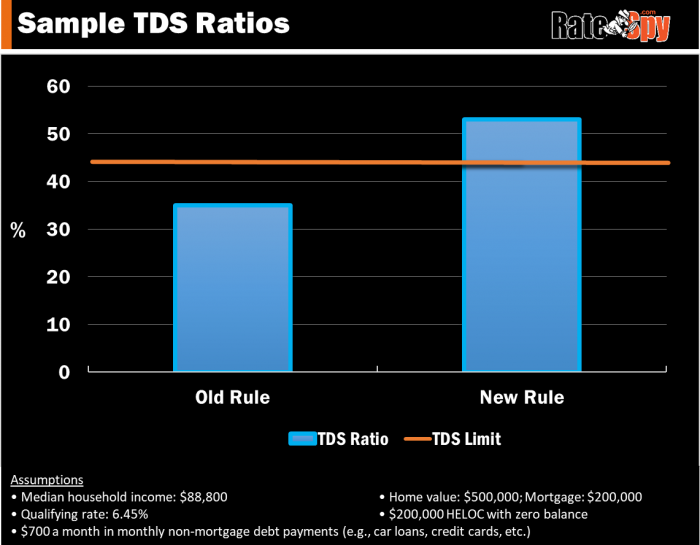

As this chart depicts, the impact is momentous:

This policy change would (will) push tens of thousands of borrowers over the maximum allowable debt-ratio limit, preventing them from getting the mortgage they seek (unless they make adjustments; see below).

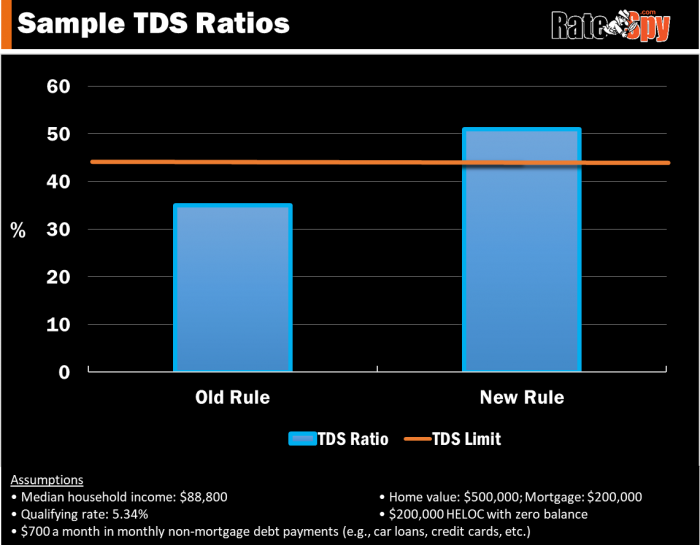

The above example is based on the $200,000 HELOC limit, a 25-year amortization and a stricter 6.45% qualifying rate for illustration purposes, given higher rates could eventually apply. Today, the most common rate lenders use to qualify existing HELOCs is 5.34%, much higher than the best HELOC rates. Using 5.34%, lenders would apply a $1,202 theoretical payment to the borrower’s mortgage application. That results in a still-offside 51% TDS ratio. Here’s how the chart looks with that assumption (still a huge impact on borrowers):

Why it matters

Roughly 3.1 million Canadians have HELOCs, according to CMHC. The number of people impacted will be a meaningful minority of that number.

Given the median homeowner household makes about $7,400 a month, adding a $1,334-a-month payment—almost 20% of gross income—to their debts (for mortgage qualification purposes) is big potatoes!

Take a typical borrower with an “average” total debt service (TDS) ratio of 35%, for example. If that person wishes to retain his or her $200,000 HELOC (whether they use it or not), suddenly their TDS ratio soars to over 50%.

The result: they no longer qualify for additional financing. (Note: 44% is the maximum TDS limit for prime HELOCs, but 40% or 42% is more common.)

This rule update is market-moving. And intuitively, its purpose sort of makes sense. But don’t be fooled, says broker Shawn Stillman of Mortgage Outlet. “It’s just chipping away further at borrowers’ options.”

Who’s doing it

So far, three of the six largest banks have moved to this debt-ratio calculation method.

Canada’s undisputed leader in HELOCs (TD Canada Trust) just made the change November 5.

TD explained its logic in this email to RateSpy:

The Debt Service Ratio change was made to ensure prudent underwriting guidelines, and reflects concerns around consumers’ abilities to manage debt – particularly in a fluctuating rate environment.

Before this change, a borrower’s capacity to service their entire authorized limit was not assessed, even though the borrower had access to those funds. This change helps ensure our customers make informed financial decisions by assessing their affordability on the available lines of credit they currently hold in addition to any credit they apply for.

…The change aligns with our existing prudent underwriting guidelines, with the impact being limited to a small number of customers that have an existing home equity line of credit and are applying for additional financing.

RBC, Canada’s second-biggest HELOC lender, is using a similar method and has been (since 2013, according to a spokesperson). Earlier today, it told us:

RBC reviews every mortgage based on a number of factors, including a client’s credit worthiness and history, and their ability to repay. When evaluating an applicant’s capacity to repay we need to understand their total financial picture. We are unable to see if a HELOC from another financial institution is secured or unsecured, so we assess the client on the assumption that they could draw on the available credit at any time rather than assuming the balance at the time of application will remain unchanged…

Who’s behind all this

“This came from somebody in the government,” Stillman says. “Banks never would have had a eureka moment and said, ‘We need to do this from a risk point of view.’ It’s not justified with delinquencies of 25 basis points.”

And here’s some more relevant stats: Homeowners with a HELOC (and no mortgage) have 81% equity on average, according to data from Mortgage Professionals Canada. The number of standalone HELOC holders who borrow more than 50% of their equity is just 7%.

Broker Ron Butler of Butler Mortgage agrees. “Let’s face it, TD is the biggest HELOC provider in Canada. Chances are, OSFI is trying to put a lid on [HELOC growth] because, factually, rates are guaranteed to rise 50 bps at least, 100 bps at worst, in 12 months. For a government who has a hard time not interfering in anything, it’s tough to leave that one alone.”

Indeed, this issue has been on policy-makers’ radars for a while.

A senior banker we spoke with yesterday, who didn’t want to be named for obvious reasons, told us that OSFI inspired this policy.

We asked OSFI to confirm that and the banking regulator told us:

When underwriting a new HELOC application, as per B-20 principles, OSFI expects federally regulated financial institutions (FRFIs) to ensure the borrower has the ability to expect full repayment over time, which means the Gross Debt Service Ratio (GDSR) for a HELOC application should be calculated based on the HELOC limit requested.

When underwriting any loan application where the borrower has an existing HELOC in place, FRFIs may use either the limit, or outstanding balance of the HELOC, to estimate an ‘assumed payment’ in calculating the Total Debt Service Ratio (TDSR) for this loan application. It is at their discretion, however OSFI expects that, given the revolving nature of a HELOC facility, FRFIs will take a longer term (and conservative) view of the borrower’s debt servicing requirements.

Borrower workarounds

If:

- you want a mortgage

- you have a HELOC that you want to keep

- your prospective lender stress tests you based on your HELOC limit

- you have higher-than-average debt ratios

…then here are some of your options:

- Find another lender

- As mentioned, only a handful of lenders use this policy now, but as Stillman notes, “This industry is all monkey see, monkey do.” Given OSFI’s priorities, we expect most big banks, if not all, to apply it by year-end, or next year at the latest.

- Many non-federally regulated lenders who get their funding from banks should also follow suit.

- Expect lenders who don’t apply this debt-ratio policy to charge higher rates for this “service” (just as credit unions do for borrowers who don’t pass the federal stress test).

- Lower your HELOC limit

- Banks that stress test you on your HELOC limit will try hard to retain your new mortgage business. Two ways they’ll do that is by recommending you:

- convert your HELOC debt to an amortizing fixed or variable-rate mortgage.

- lower your HELOC limit(s) so you qualify for new financing.

- Banks that stress test you on your HELOC limit will try hard to retain your new mortgage business. Two ways they’ll do that is by recommending you:

- Close your HELOC

- A minority of affected borrowers may choose to close their HELOCs altogether.

- Others may trade them in for an unsecured credit line (which are typically qualified based on 3% of the balance, at least for now).

- Get a co-borrower.

Who wins

- The economy, say policy-makers

- They argue that it’s economically beneficial because less risky HELOC borrowing (and accounting for what borrowers might borrow) makes the economy more stable.

- That’s apparently notwithstanding the fact that HELOC arrears are less than mortgage arrears and near an all-time low. Nor does it account for the economic and jobs benefit of greater HELOC liquidity (which has never been OSFI’s guiding consideration).

- Lenders that can convince existing borrowers to lock in HELOC debt to fixed rates (assuming those fixed rates are more profitable for the lender) and stay with them.

- Mortgage brokers—because they have lender solutions banks don’t—and they know which lenders aren’t applying the new policy.

Who loses

- Consumers

- HELOCs have countless prudent uses. Restricting them further reduces economic opportunities for investors and cuts fallback liquidity for Canadians who rely on HELOCs to weather economic shocks.

- Mortgage brokers (yes, they win and lose)

- If you say to a borrower, “You don’t qualify for a mortgage because of your HELOC,” the first thing they’ll do is go to their bank” and ask how to fix it, says Stillman.

- The bank will tell the borrower they’ll work with them to get them approved if they get their mortgage through the bank. And a good chunk of these borrowers will then stay with their bank.

Looking to the Future

The higher rates go, the harder it’ll become to qualify for a HELOC and/or a mortgage if you already have a HELOC.

“In a rising rate environment, at what point does it not make sense to add two points on the stress test anymore?” Stillman asks. If we get three more hikes, as the markets predict, the qualifying (“stress test”) rate on HELOCs could exceed 7%. Coupled with stricter debt-service policies, HELOC growth would collapse in this scenario. (Regulators’ end-game?)

“It’s going to hurt the upper end of the market, people with higher priced properties that have big HELOCs,” Stillman predicts. This will further slow real estate given many of those people rely on HELOCs to buy rental properties, cottages or second homes.

With every new lending rule comes higher costs for prudent consumers and increased risk for borrowers who gravitate to more costly (higher risk) lenders. This one will be no different.

Rightly or wrongly, there’s an obsession in Ottawa with borrower risk. It makes you wonder how far they’ll go to stamp it all out. Next thing you know, lenders will be asked to assign a hypothetical payment to people’s credit card limits. (We say that only half jokingly.)

log in

log in

19 Comments

So which is the third bank that is using this methodology? You’ve mentioned TD and RBC as two of the three…did I miss it in your article?

Hey Dave, Awaiting the bank’s official confirmation before mentioning.

Breaking news (only to you): the entire globe is obsessed with mortgage and housing related vulnerabilities and risk. Why? mounting and mounting evidence and research about the toxic combination of too much debt and out of control house prices. If I were in your shoes, I would worry a lot more about the consequences (not just for your business, but for your investments, your RRSPs etc) of the crisis that we will never be able to prove was avoided. Buy a smaller second home; smaller cottage; or maybe borrow less and stop complaining at a time when rates are still at close to historic lows. boo freaking hoo.

Back in the wonderful world of reality, when the country’s biggest HELOC seller dramatically tightens its qualification rules, it’s breaking news to every single affected borrower. 3.1 million people have HELOCs in this country.

It’s smart to limit excessive risk. No one is arguing otherwise. But the key word is “excessive,” and that is what’s being debated.

It is simply economically short-sighted to over-restrict risk-taking. Real families with average TDS ratios who invest with their HELOCs and add tangible economic value (e.g., jobs and housing liquidity) for all Canadians, will be hamstrung by these rules. These existing rules, by the way, have been on the books for years and proven their effectiveness through multiple economic cycles. Debt levels are higher today, but debt service levels are not higher overall.

That’s not to say banks shouldn’t test any existing HELOCs at the limit. It’s to say that some borrowers who’ve proven they’re responsible (based on quantifiable underwriting criteria) should get a pass. There is ample buffer built into the system already when it comes to existing HELOCs.

As for the “business” bias of the author, we welcome your evidence that we don’t have our reader’s best interests at heart…always. Full stop.

BS RBC I just saw someone with a $50,000 unsecured line of credit with a part time job. Prudent my behind.

I heard from a mortgage specialist that RBC’s policy applies to HELOCs over $50,000 but I haven’t had time to confirm that.

Informative article, thanks Spy.

If banks are going to assess someone’s ability to debt service the limit of their HELOC, at least base the test on realistic numbers. No lender requires HELOC holders to make amortizing payments, at least no lender I know of. TD and RBC should have used interest only payments based on OSFI’s interest rate. That would have served the purpose while not over-tightening.

So….once again “prudent” government policy will produce the unintended consequence of driving more business to unregulated private lenders where less information will thus be available for analysis and the development of prudent, evidence-based government regulations. Sounds about right.

you cant look at HELOC delinquencies and say there’s no problem bc a HELOC is the only instrument you can borrow from to pay back (a ponzu scheme in the extreme) and people will do just about anything not to lose their homes

question guy,

Look up the definition of “delinquency” because I think you’re confused.

Let me help you. It means “a debt on which payment of interest or principal is in arrears.”

Debt ratio testing is meant to ensure people can make their payments. If you are making payments you are not delinquent. If someone has to use their HELOC to pay their borrowing costs, it may be unfortunate but it’s not new. Borrowing from Peter to pay Paul is what a small percentage of people do every day. Government can never prevent some people from getting in over their heads and borrowing to make payments is always better than not making payments.

Great article Rate Spy,

So more HELCO borrowers will be pinched out of the investment market … inevitably means fewer Canadians with the means to invest (real estate, stocks, business ventures) or to spend on consumer goods (cars, appliances, stuff). All points to a slower economy. Lucky the foreign buyer/investor with a little cash. Canada will be for sale at bargain prices. Canadians will become bystanders in their own economy. But they will be good tax paying daily grind wage Warner’s. Sounds like the 1960’s.

It’s a little disingenuous to point at the stability of HELOC borrowing over past economic cycles to deduce that the same underwriting standards are effective today. The growth and use HELOCs in the past decade, a period of time when interest rates have been at emergency levels and home equity has been growing, has been exponential. It’s easy for consumers to keep up payments when all they have to do is tap the growing equity in their homes. The banks are all too aware of what happens when the cycle turns to rising interest rates and receding home equity values.

It’s also naive to think that OFSI implemented these rules (including B20) without first consulting the big 6. The banks have decided collectively, as Canada’s banking oligopoly always does, to reduce credit availability. Having equity in a home does not entitle a borrower to credit.

To Yolo:

It is just as disingenuous to discount the stability of HELOC borrowing over past economic cycles and deduce that the same underwriting standards are not effective today.

“It’s different this time” are the costliest four words in the finance industry. It’s not different this time. Lending is lending. Every single bank in the country stress tested years before OSFI even announced B-20. Banks already underwrite more conservatively today than they every have. They draw from past experience just like you said. “The banks are all too aware of what happens when the cycle turns.” Yes, and they incorporate that knowledge into every lending decision they make.

You make Canadian banks sound like amateurs. Do you really think they systematically assume excess HELOC risk with OSFI and investors breathing down their necks every single day? You don’t make $1-3 billion a quarter by making stupid lending decisions. Banks have over a century of lending experience in different cycles and yes history matters. Rising rates and receding home values are nothing new.

The Finance Department is just killing the consumer who is 60% of GDP. They’re doing it one domineering lending rule at a time. When the banks meet with OSFI and OSFI says, “Jump,” they say “How high?” Consultation? Get real.

People are borrowing more from HELOCs mainly because the Bank of Canada cut rates. What did you expect to happen with a 0.25-1.75% overnight rate? Adding fuel to the fire is Ottawa’s weak agenda for boosting jobs and incomes and negligent government policies that open the immigration floodgates but don’t ensure enough housing supply. When GDP grinds to a halt thanks to constricting credit, the Liberal government will have only itself to blame.

Rate Spy,

I’m interested in your view on what Richard Werner’s take on this would be. Richard Werner (USouthhampton, UK) is the creator of quantitative easing.

First let us distinguish between the following:

1. price of money. Largely influenced by interest rates set by the Bank of Canada which is independent of the government.

2. quantity of money. i.e. the money supply

3. access to money, which is largely controlled by the banks through their lending practices and government regulations, the latter of which is the subject of Spy Rate’s article above.

Not withstanding the responsibility of most individual borrowers, my understanding is that Richard Werner would argue that:

1. any bank loans/mortgages/HELOCs/etc. increase the national money supply because they are literally “created out of thin air” based solely on the borrow’s credit. When a customer signs a loan agreement with a bank, this is entered as an asset on the bank’s balance sheet, which then allows that bank to “create” a deposit of equivalent value in the customer’s account. Contrary to popular belief these loans are not finance through deposits, bonds, or even fractional reserve banking.

2. bank loans used for financial transactions and asset purchases often do not lead to GDP growth (as no value added good or services are created) and because the loans increase the money supply these activities are ultimately inflationary and lead to asset bubbles.

This highlights the distinction between the benefits (and risks) of the banking system to individual vs the overall economy. While “smart” investors may use their HELOC for investment purposes, no value added goods or services are created and there is no growth in GDP. However, the risks to the economy are an increase in the money supply, which leads to asset inflation and bubbles.

That’s not to say that responsible people should not be allowed to borrow to purchase real estate and/or invest in the stock market, but these activities should be financed from existing money that is already in the economy; not through bank loans which are SPECIAL because they involve the creation of new money.

Of course, the corollary is that over 95% of our money supply is created by private banks, not the Bank of Canada.

Any thoughts?

I don’t think using a HELOC for the down payment on an investment property makes that much sense in the first place. With most HELOCs at prime +0.5% or higher, it’s a lot cheaper just to refi your mortgage.

HELOCs are important for anyone who invests because they let you act quickly on fleeting opportunities. You don’t have to wait to get approved and miss out on real estate deals that often times don’t even hit MLS. They’re perfect for bridging purchases until you can get a mortgage, down payments on new condos, flips and for renovations. The rate doesn’t matter because they are fully open and you can write off all the interest.

@Dave, if it is used for short-term I could see the benefit.

Where I live in NS, single-family homes sell for around $250K and big HELOCs aren’t very common. That still hasn’t stopped my wife and I from moving quickly on opportunities like bank foreclosure sales despite below-average employment income. It takes some extra preparation figuring out which banks can do the deal, since none of them seem to use the same formula for TDS.

Tighter rules for HELOCs may inconvenience some investors, but when an opportunity for profit presents itself, people have a way of making it work.

can we get an update on which banks have changed over to this policy now? Are there any banks that still dont do this?

Thank you

Hi Dave, Most banks still don’t do it. I don’t have a current list unfortunately.