It turns out home equity lines of credit (HELOCs) aren’t growing as fast as previous government reports suggest.

It turns out home equity lines of credit (HELOCs) aren’t growing as fast as previous government reports suggest.

Prior regulatory filings showed HELOC balances increasingly at roughly double the pace of mortgages.

Now, a new report from the Bank of Canada confirms the opposite. “The total balance of HELOCs contracted by 1% year-over-year…” in the fourth quarter of 2018, it says.

“…The total outstanding balance of HELOCs has contracted over the past year, which is consistent with rising interest rates and a slowdown in the growth of household consumption.”

Mortgages, by comparison, grew 3.8%, the BoC reports. (This number includes both stand-alone mortgages and the amortizing component of readvanceable mortgages.)

The New Growth Leader

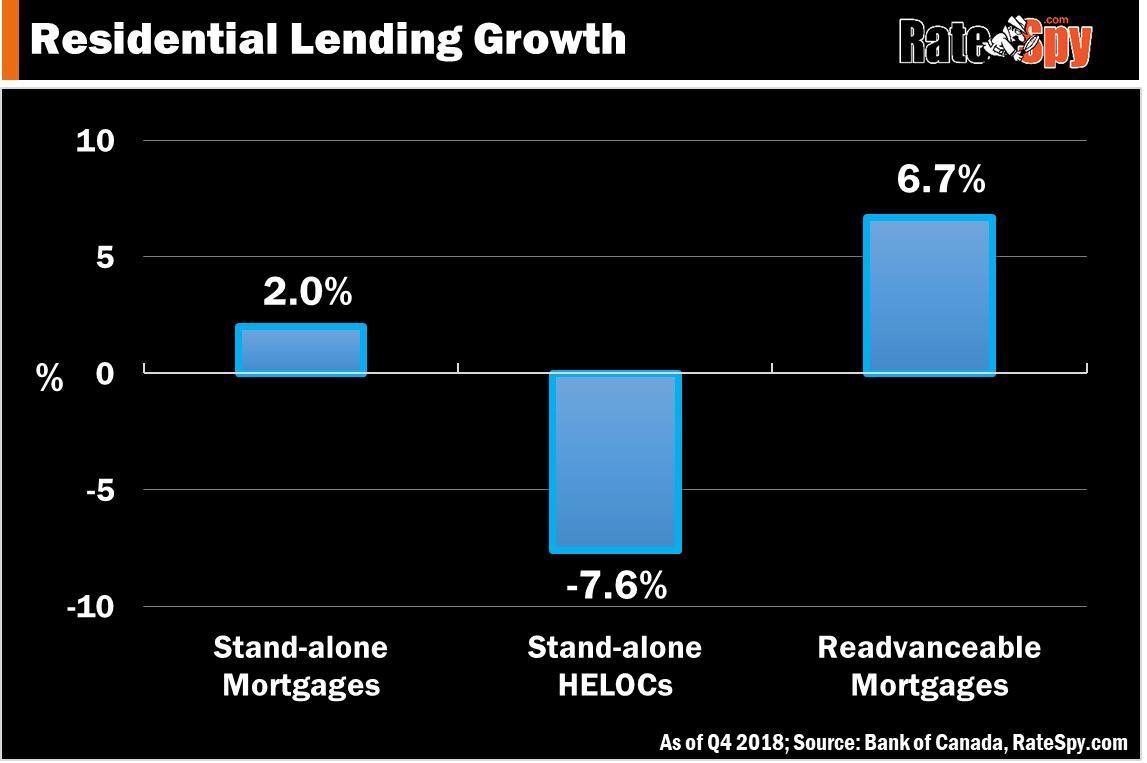

The BoC’s new data also confirms strong growth in mortgage/HELOC combinations. These products, also known as “readvanceable mortgages,” grew 6.7% year-over-year. They now account for almost “40% of outstanding residential credit on the books of chartered banks,” BoC data shows.

In fact, readvanceables “appear to be taking market share from the traditional stand-alone mortgages and HELOCs,” BoC researchers say. And that’s no surprise. Banks love to sell these products because:

- customers like the ability to re-borrow from their HELOC as they pay down their mortgage

- additional borrowing is more profitable for banks (believe it, or not)

- readvanceable mortgages make customers more “sticky” (because these products are collateral charges that make it harder and/or more expensive to switch lenders in most cases)

- readvanceable mortgage rates are often higher than the best mortgage rates on non-readvanceable mortgages, which again makes them more profitable for banks, and

- readvanceable mortgage customers tend to have more non-mortgage products with the bank.

Meanwhile, stand-alone mortgages grew by a measly 2.0% and stand-alone HELOCs actually fell 7.6%.

BoC Researchers are Concerned

HELOCs are a potential source of financial system risk, the report authors maintain. They write: “…Borrowers accumulating large amounts of debt secured by housing may find themselves with minimal (or even negative) housing equity if the value of their house falls.”

That would take quite a sell-off, of course, given borrowers need 20% equity minimum to qualify for a HELOC. The revolving portion of a HELOC cannot exceed 65% loan-to-value.

BoC staff add that, “Home equity extraction may also be concealing emerging financial distress if borrowers are taking equity out of their homes to manage other debt obligations or to finance their daily expenses because they lack other sources of funds.”

What the BoC proposes in this case is unclear. Taking HELOCs away from homeowners who are making their payments as agreed would be just as risky given its potential to exacerbate recessions or housing corrections. Indeed, as BoC chief Stephen Poloz noted, HELOCs let “people make major purchases and smooth their consumption over time,” something that helps the country ride out downturns.

What the BoC proposes in this case is unclear. Taking HELOCs away from homeowners who are making their payments as agreed would be just as risky given its potential to exacerbate recessions or housing corrections. Indeed, as BoC chief Stephen Poloz noted, HELOCs let “people make major purchases and smooth their consumption over time,” something that helps the country ride out downturns.

The authors conclude: “These considerations warrant continuous monitoring and assessment of stand-alone HELOCs and combined plans (readvanceable mortgages).”

With all the focus on this product, we continue to expect regulators to clamp down in some way on HELOCs and/or readvanceable mortgages. What that looks like and when it’ll happen, we don’t know.

Sidebar: The above data are for Canadian chartered banks only, says the BoC. It comes from a new regulatory filing that banks must submit, which is meant to standardize reporting on HELOCs (it’s about time!). Banks hold roughly 4 out of 5 outstanding residential mortgages. Hence, actual HELOC credit is even higher because the above numbers don’t include credit unions and other non-bank lenders.

log in

log in

5 Comments

Hello, Does anyone know why the previous government data was so wrong?

Hi Lynn,

The govt’s prior data relied on regulatory filings whereby some banks were reporting the amortizing mortgage component of their readvanceable mortgages as HELOCs. This skewed the HELOC estimates upwards. Now, all banks must report non-amortizing HELOCs the same way — the right way.

Glad to see there’s not the runaway growth in HELOCS that we were led to believe.

Not to say there aren’t still risks, as the BoC staff rightly point out. Let’s not forget FCAC’s findings earlier this year that nearly a third of HELOC holders are only paying the interest each month. This will definitely be a segment to monitor closely.

Rob, do you think the new filing requirements will mean banks will start correctly reporting to the credit bureaus as well?

I’m referring to banks like BMO that report their ReadiLine as one secured line of credit rather than as a mortgage and a LoC.

Hey Ralph, I’m guessing this new regulatory filing won’t change the data mechanism banks use to report to the bureaus. But I’ll look into it.