Canada’s rate-setter left its key rate untouched today while striking a less-than-cheery chord on the country’s outlook.

Here’s a quick take on this morning’s Bank of Canada rate decision:

- Rate Announcement: No change

- Overnight rate: Remains at 1.75%

- Prime Rate: Remains at 3.95% (see Prime Rate)

- Market Rate Forecast: One rate cut in 2020

- BoC’s Headline Quote: “…Governing Council will be watching closely to see if the recent slowdown in growth is more persistent than forecast.”

- BoC on the Economy: “…the Bank now forecasts real GDP will grow by 1.6% this year and 2% in 2021…”

- BoC’s Full Statement: Click here

- Next Rate Meeting: March 4, 2020

The Spy’s Take

When the market woke up this morning, odds of a rate cut in 2020 were almost a coin-flip.

After the BoC’s statement, the bond market quickly priced in a full rate cut by year end.

Economists—those guys who get paid big bucks to be wrong roughly half the time—already had a rate cut bias to their forecasts. Nine of 17 major economists polled by Bloomberg expect a cut by June.

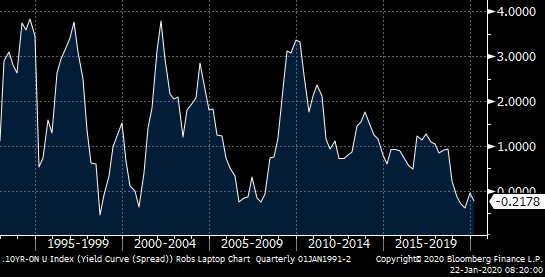

Canada’s yield curve (10-yr gov’t yield – BoC rate)

But that alone doesn’t tell us much because all it takes are a few blockbuster economic reports to change all the thinking.

Indicators we’d rather lean on are things like:

- Unemployment, which is low but looks bottomy at 5.6%

- The yield curve, which is eerily still negative, auguring a slowdown

- Weakening GDP (it was -0.1% in Oct and the BoC now projects just 1.3% in Q1 and 1.6% in 2020, which is completely inconsistent with rate hikes)

- Falling exports

Yet, indicators remain “mixed” overall, the Bank says — i.e., they’re not great, but not bad enough (yet) as to warrant a cut, especially given Canada’s housing resurgence and inflation that’s (slightly) above the BoC’s mid-point 2% target.

All kinds of wildcards remain, and they’re mostly rate bearish. For example, “geopolitical tensions have re-emerged, with tragic consequences,” the Bank said today. That epitomized the somewhat dreary theme of today’s report.

In recent meetings, the BoC hasn’t been overly hawkish or dovish. Today’s messaging had a clearly more dovish tinge. The bond market agreed, with the 5-year yield falling big time, and below 1.50% for the first time since Dec. 3.

How to Play It

Even if the BoC keeps its finger off the rate button, lenders will keep their finger on the discount button.

We expect it to be a very competitive spring for mortgage discounts with online players running a full-court press, housing demand high and bank funding costs at long-term lows.

Bank funding costs (Avg 5yr bank yield vs. 5yr Govt yield)

With the BoC’s messaging implying minimal risk of meaningfully higher rates, with variable rates comparatively overpriced, and with the risk of banks pocketing a portion of BoC rate cuts (reducing the appeal of variable rates), well-qualified borrowers may look for any rate advantage they can get on shorter fixed terms.

The deals in that area are currently in the three-year space. You can snag a 3-year fixed rate for as low as 2.54% to 2.69%. The benefits of a 3-year include:

- upfront rate savings versus most 5-year fixed rates

- the ability to reset sooner than a 5-year (if rates drop)

- free switches (most lenders pay your legal and appraisal fees if you’re switching a standard mortgage into a new 3-year term, which is often not the case if you’re getting a 1- or 2-year term)

- less penalty risk (given most borrowers refinance or break after 3.7 years, give or take).

We also wouldn’t be surprised to see attractive rate specials on terms below 3-years, once we get closer to spring.

log in

log in

4 Comments

I’m thinking they’re going to keep delaying any rate cut until after Poloz steps down. They wouldn’t want to be blamed for fanning the flames of the hot spring housing market and increasing Canadians’ debt loads after all the finger-wagging they’ve been doing over the years.

I think the Bank of Canada is behind the curve and underestimates recession risk. The only way I’d get a 5-year fixed is if the rate was close to 2%.

BUT BUT BUT the economists told us a rate cut was a sure thing by the end of 2019. Do they just keep changing their forecasts until they’re right?

I don’t remember economists predicting a rate cut this year. Where did you hear that?